The latest news is about the “Japan Blockchain” association and its urging Tokyo for a crypto-related tax reform that can invite investors to enter the market without fear of high capital gains taxation.

The government will now have to review its tax plan and decide whether to comply with the demands of the well-known Japanese association.

In the meantime, the cryptocurrency exchange Binance plans to re-enter the country during August, after suffering a warning from the regulator 2 years ago.

Full details below.

Summary

Tokyo: “Japan Blockchain” call to reform crypto tax system

On Thursday, 27 July, the “Japan Blockchain” association (JBA) submitted a call to the Tokyo government for tax reform for the cryptocurrency sector.

Its members argue that current regulations are an obstacle to the growth of the web3 industry, with potential damage to the country’s technological future.

In particular, high tax impositions discourage taxpayers from holding and using cryptocurrencies, which are already subject to high volatility and not insignificant operational risks.

Going into specifics, the JBA’s request is for the elimination of taxation on latent end-of-term capital gains on companies that hold cryptocurrencies issued by third parties.

Also petitioned is the introduction of separate self-taxation and the possibility of deducting losses as capital losses as well as the complete elimination of taxation during cryptocurrency trades

The “Japan Blockchain” association led by the well-known Yuzo Kano, who serves as the CEO of the Bitflyer exchange, has made its vision explicit in relation to a change in the Japanese tax system that could attract many domestic companies to enter the blockchain sector.

Last month. Japan’s National Tax Agency (NTA) changed part of the rules on this sensitive issue, helping companies relieve themselves from taxation on year-end unrealized gains from tokens they issued themselves.

The Japanese association now also wants unrealized gains from crypto assets issued by third-party companies to be exempt from taxation.

In Tokyo, the JBA presented its thinking, explaining that a review of taxation along these lines could break down some barriers to entry, benefiting the country’s economy.

These are his words in a letter:

“If the end-of-term unrealized gain tax is abolished, companies will no longer need to sell the tokens they hold for tax purposes… Under the current tax system, selling tokens to pay taxes could cause the price of the tokens to fall, which could hinder the growth of the token-based economy.”

According to data from the Japan Crypto Asset Trading Association, the number of people opening cryptocurrency trading accounts in the Japanese market is growing steadily, with a number of 6.8 million users as of April 2023 alone.

44% of those surveyed by the association reported that they would double their investments if Tokyo switched to separate taxation for self-assessment.

If the Japanese government complied with the JBA’s request on the capital gains issue and allowed capital losses to be deducted, it could face a surge in new members.

Binance prepares to make a return to Japan with its platform

As the “Japan Blockchain” association visits Tokyo with a call on crypto tax reform, cryptocurrency exchange Binance is preparing to return to Japanese soil with its services.

Two years ago, the Financial Services Agency (FSA) notified the leading crypto exchange platform that it was operating in Japan without their permission.

Now the FSA’s warning no longer seems to be an issue, thanks to the exchange’s compliance with Japanese regulations.

In detail The return of Binance, set by the end of August, will be made possible by the acquisition of crypto service provider Sakura Exchange BitCoin (SEBC) in November 2022.

SEBC’s platform will be replaced under the provisional name “Binance Japan,” which will offer all the investment solutions of the global platform.

Announcing the glorious return to Tokyo was Changpeng Zhao, CEO of Binance as well as crypto billionaire, who last week disclosed his company’s intentions.

Meanwhile, Japanese Prime Minister Fumio Kishida explained his optimistic view regarding the country’s crypto future, emphasizing the potential of technology that could transform online environments. These are his words:

“I hope the Web3 industry will regain attention and vitality and several new projects will be born.”

Hence, Japan could become one of the main hubs of the crypto industry in the coming years, going on to attract new investors and new companies.

After all, what to expect given that the nickname of the founding father of the Bitcoin protocol “Satoshi Nakamoto” comes from a Japanese name?

We stand by to see what the government’s next moves will be and to have an exact date for the reappearance of Binance in Tokyo and its vicinity.

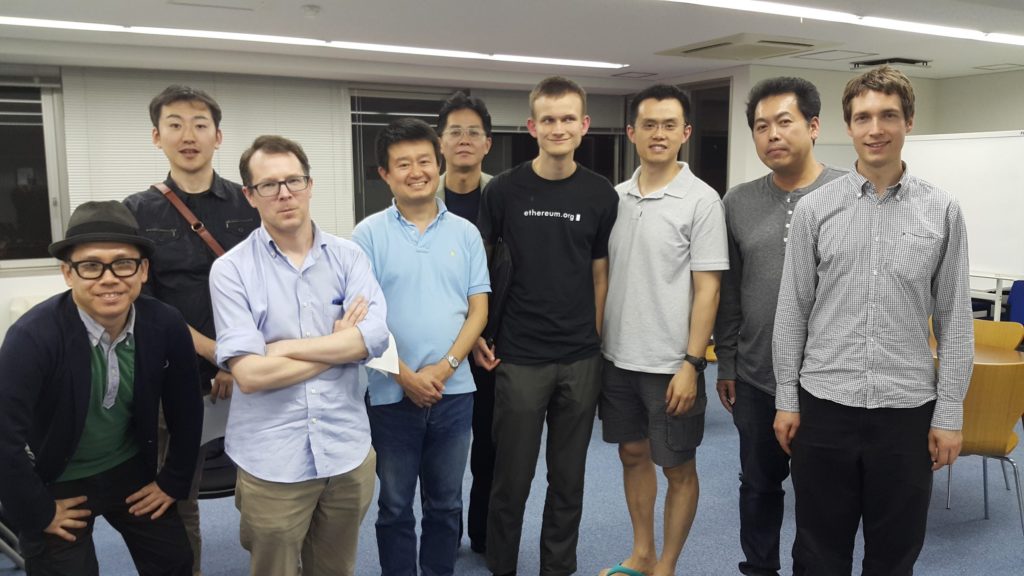

In conclusion, it is deemed interesting to show this photo from 2015 depicting the Changpengh Zhao and Vitalik Buterin together precisely in Tokyo, where they were discussing Ethereum and its imminent launch to the markets.

CZ said that although he knew about the project from its early days, he did not buy ETH during his ICO and bitterly regretted it a few years later.