Avalanche and software development platform Ava Labs have presented a “crypto report” on real-world asset tokenization, in which the topic is explored in depth.

After the recent “Avalanche Vista” initiative, it seems that the team behind the development of Layer 1 wants to steadfastly pursue the path of tokenization of off-chain assets (OCA) and become an industry leader.

However, behind the ambitious goals there remains an underlying problem: how to bring real-world data inside the blockchain?

Let’s take a look at all the details together.

Summary

OCA tokenization: the crypto report by Avalanche and Ava Labs

Avalanche and its foundation Ava Labs have shown that they are seriously interested in dominating the world of tokenization of real-world assets, which are significantly more capitalized than crypto coins.

They recently launched a $50 million fund called “Avalanche Vista” dedicated to developing and funding this sector within the crypto network ecosystem, which is seeing increasing interest from financial players.

In addition, the company Securitize recently tokenized equity in a Spanish real estate investment fund on Avalanche, opening the door to this type of secondary trading.

Just a few days later, a new initiative has arrived that aims to explore this niche even more, with the publication of a report in which the topic of tokenization of “off-chain assets” (OCA) is discussed.

In particular, the report discusses the advantages and obstacles of this practice, while delving into the most innovative projects and protocols of the moment.

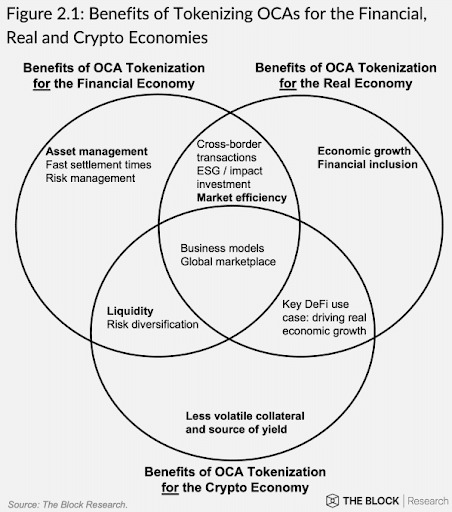

Among the most important benefits to mention are improvements in asset management and administration, market efficiency and liquidity, and risk diversification.

OCA tokenization according to Avalanche and Ava Labs will provide these kinds of benefits for both the financial economy and the real economy, as well as of course for the crypto market.

Despite these potential benefits, there are hurdles to overcome for this technological innovation to reach its full potential: first and foremost is the problem of national regulations.

Indeed, in order for OCA tokenization to be adopted on a global scale, it is necessary for the regulations of a multitude of governments to come into contact to find a common agreement.

Knowledge barriers are also a small obstacle to be addressed, and in this regard interdisciplinary collaboration between specific figures from multiple sectors (insurance, commercial finance, smart contract development experts, blockchain entrepreneurs, etc.) will be increasingly required.

In any case, the development of this sector now seems to be marked, especially after the entry of Avalanche and the Ava Labs Foundation, which have shown that they are serious about it.

The strong interest on the part of these entities is motivated by the enormous value that could be brought on-chain and the different categories of real-world assets involved in this revolution. According to Bank of America, this market could be worth $16 trillion by 2030.

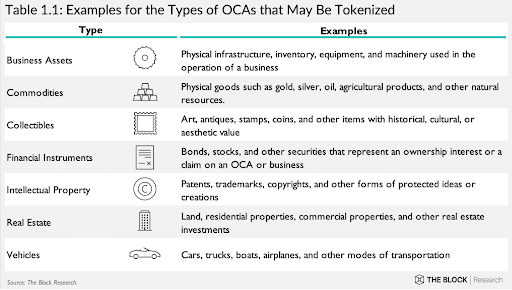

Some of the asset classes that are seeing their future increasingly tokenized include physical infrastructure, commodities, assets from collections, bonds, stocks, securities, intellectual property, real estate and vehicles.

In the face of this broad scope the following question arises: What will NOT be tokenized in the future?

The role of oracles in moving data from the real world to the on-chain world

The commitment of Avalanche and Ava Labs to exploring the best solutions for bringing real-world assets within the crypto world is evident and seems to be growing more and more in the recent period.

Despite the good intentions, however, no one has come to terms with an extremely important detail that is often overlooked when it comes to tokenization: what will be the source of trust?

Obviously transporting information from the real world to the crypto world is no small task, and it must be coupled with an entity (decentralized or centralized) that can verify the process without making mistakes.

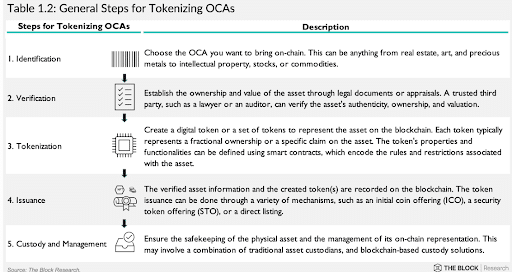

Avalanche and its development team have planned to rely on a third-party entity (as yet unknown), whose role will be to verify the authenticity, ownership, and value of off-chain assets.

This is clearly visible in item 2 of the report’s table showing all the steps required for OCA tokenization.

Although there is inherently nothing wrong with relying on a third-party company to verify this kind of information, there is still the question of the reliability of this source.

Moreover, this choice runs counter to the underlying philosophy of cryptocurrencies, which sees the absence of financial intermediaries and the creation of a free market as the main factor.

The most ardent advocates of decentralization wonder why Avalanche and Ava Labs did not choose a decentralized partner to carry out this process.

For example, Chainlink‘s oracles are perfect for transporting information from real-world to on-chain environments without ever relying on a single point of failure.

In general, technology is a better source of trust than human presence, which is potentially corruptible or fallacious.

A few days ago Chainlink itself announced that it had integrated its PoR services with the Matrixport project to help in the minting process of US Treasury bonds.

To conclude, there is much praise to be given to Avalanche for the work they are doing to bring OCA tokenization to noteworthy levels, but at the same time there is some reprimand to be given for what they are doing in terms of their choice of trust sources and the way they handle off-chain data.