The self-proclaimed cypherpunk and CEO of Blockstream, a leading blockchain technology company, Back has a track record of making accurate forecasting about market trends and developments in the cryptocurrency space, his latest prediction, a bet that Bitcoin will surpass $100,000 before the halving of 2024, has sparked excitement and debate among investors and enthusiasts.

Over the weekend Back made the challenge on Twitter, publicly announcing his bet:

“The bet is on: I’m betting that Bitcoin will reach or exceed $100k between now and halving (March 31, 2024).”

Summary

Adam Back’s forecasting of Bitcoin: price will soar in the pre-halving period

This bold statement was not made in isolation. Back backed up his belief with a tangible bet, agreeing to wager 1 million satoshi (0.01 BTC) with the Twitter pseudonym user “Vikingo.”

The stakes are high, but Back’s reputation and knowledge of the market suggest that he does not make such bets lightly.

Back made this prediction in June and his position has not changed. His timing is strategic, aiming for the prediction to come true about a month before the halving scheduled for late March 2024 or early April.

To reach this monumental price milestone, Bitcoin would have to appreciate by an incredible 243% over the next eight months or so.

For skeptics, it is important to note that Back does not just make wild guesses. He relies on historical patterns to come up with his predictions.

In the eight months leading up to the last halving in May 2020, the price of BTC remained relatively stagnant, with no significant gains.

However, the six months following the halving saw the cryptocurrency’s value embark on a parabolic journey, marking the beginning of a bullish market.

This is not the first time Adam Back has offered bold predictions to the public

When someone questioned the feasibility of his prediction, Back attributed the previous undershoot to a confluence of factors.

He pointed to the impact of the COVID-19 pandemic, quantitative easing measures, economic disruptions, and cryptocurrency-specific events such as the cascading liquidations of DeFi (Decentralized Finance) and the failure of industry players such as 3AC, Celsius, Blockfi, and Genesis.

These factors, he speculated, may have led to miscalculation in previous projections.

Back did not shy away from elaborating on his bullish position. He theorized that positive adoption by the mainstream financial sector, combined with an increase in Bitcoin holders and miners’ reflexivity, could contribute to a delayed upward correction.

This “bulltard” scenario, as he called it, suggests that despite past discrepancies, a convergence of favorable factors could push the value of Bitcoin upward.

His sentiment is mirrored by fellow Bitcoin enthusiast Samson Mow, who predicts that the cryptocurrency could reach a new all-time high before halving, rather than after.

Lending credence to Back’s prediction is his analysis of the mining sector. Miners, who play a key role in transaction validation and network security, have a substantial influence on Bitcoin prices.

Back pointed out that for miners to remain profitable after halving, Bitcoin prices would have to reach about $98,000, according to a report by Seeking Alpha.

This suggests that miners’ need to cover their costs could act as a price ceiling, potentially pushing the cryptocurrency’s value upward.

It is worth noting that this is not the first time Back has predicted a six-figure Bitcoin price. He made a similar prediction for the end of 2021, although the timing turned out to be too optimistic.

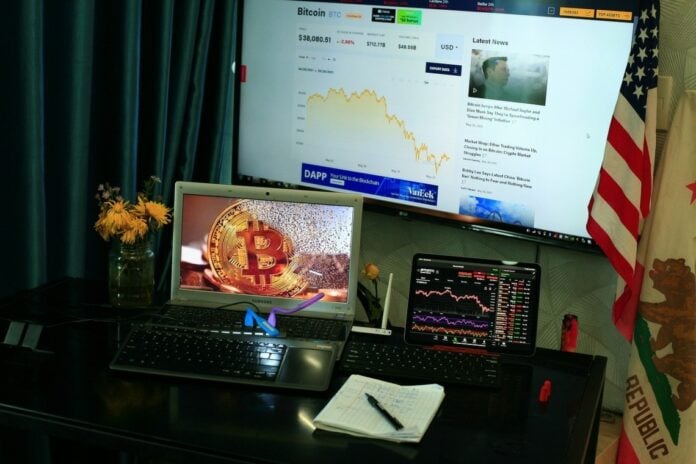

While Back’s prediction impacts the crypto community, the current state of Bitcoin remains relatively stable.

Hovering around the $29,100 mark, the cryptocurrency is consolidating its gains after a period of intense volatility. Altcoins, on the other hand, continue to experience a gradual decline, contributing to a marginal decline in total cryptocurrency market capitalization.

To conclude

In conclusion, the cryptocurrency world anxiously awaits the outcome of Adam Back’s bold bet on Bitcoin’s trajectory.

Back’s track record as a visionary cypherpunk and his central role in Blockstream have earned him the respect of the community.

Although predicting market movements is inherently uncertain, Back’s analysis is based on historical patterns and a nuanced understanding of the factors driving the cryptocurrency market.

As the clock approaches the 2024 halving point, all eyes will be on the Bitcoin price chart, waiting to see if Back’s bet becomes a reality.