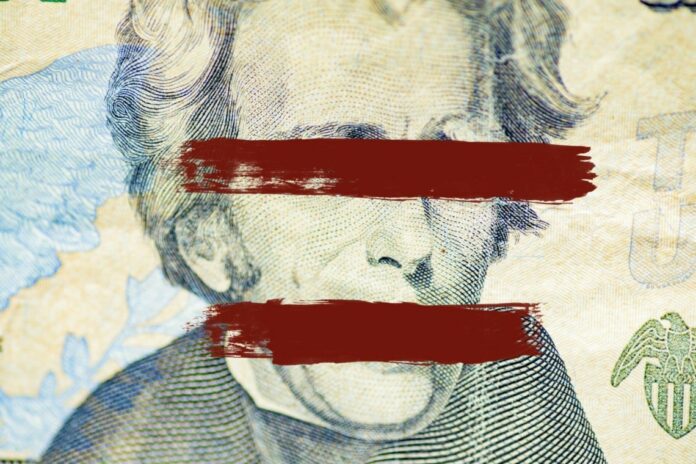

In a financial development of staggering proportions, the US has added a staggering $275 billion to its national debt in just 24 hours, more than half the market capitalisation of bitcoin.

The total value now stands at an all-time high of $33.44 trillion. This exponential increase has caused concern and reflection on the nation’s fiscal path.

Summary

Alarming surge: US adds more than half the market value of bitcoin to its debt in a single day

In a staggering turn of events, the US added a colossal $275 billion to its national debt in a single day, catapulting the nation’s total debt to an unprecedented $33.44 trillion.

To put things in perspective, this astronomical daily increase in US debt was more than half of the entire market capitalisation of bitcoin, a sum equivalent to around 10 million BTC.

This remarkable development underlines the continuing expansion of the US debt mountain, with billions of dollars being added to it every day.

Astonishingly, this daily accumulation of debt exceeds the total market capitalisation of most cryptocurrencies. In this article we look at the implications and ramifications of this fiscal phenomenon.

US debt: half of bitcoin’s market capitalisation in debt

On 4 October, renowned Bitcoin pioneer Samson Mow astutely compared the monumental increase in US debt to the market capitalisation of bitcoin.

The result was astonishing to say the least: the increase in debt exceeded half of bitcoin’s market capitalisation of around $267 billion.

To put this figure into perspective, it is equivalent to around 10 million BTCs, a staggering sum that makes one ponder the relative value of $27,000 as a potential purchase price.

Furthermore, the increase in debt has surpassed the entire market capitalisation of Ethereum, which currently stands at just under $200 billion.

In essence, this daily debt escalation represents a quarter of the total market capitalisation of cryptocurrencies, which is seamlessly integrated into the burgeoning national debt.

Notably, this surge in US debt came just two weeks after the $33 trillion threshold was crossed, reflecting the exponential growth of US financial obligations.

To provide further context, this means that the US is adding $32 billion of debt every day, a pace that could potentially result in $1 trillion of debt maturing in a single month. This is double the previous rate of $14 billion per day.

Rising US debt servicing costs

Goldman Sachs analysts have predicted that the cost of servicing the US’s colossal debt load will hit a new record by 2025.

The rise in borrowing costs over the past year, largely due to the Federal Reserve’s interest rate hikes, has put upward pressure on the cost of managing the gigantic national debt.

In 2022 alone, the US government will spend as much as $476 billion, or about 2% of national GDP, on servicing interest on the debt. However, interest payments are projected to rise to 3% of GDP by 2024, with an alarming projection of 4% of GDP by 2030.

The Peter G. Peterson Foundation has estimated that the US will have to spend the colossal sum of $10.6 trillion on interest payments on the national debt over the next decade.

In addition, other estimates have predicted an accelerated rate of growth in the debt-to-GDP ratio. According to a projection by the Congressional Budget Office, the federal debt could reach a staggering 181% of national GDP by 2053.

Debt ceiling unlimited until 2025

Finally, it is important to note that the debt ceiling, which limits the amount of debt the US can accumulate, will remain suspended until January 2025.

As a result, the staggering numbers associated with this surge in US debt will become the new normal, raising critical questions about the nation’s long-term fiscal sustainability.

The dramatic rise in US debt, which in a single day exceeded half the market capitalisation of bitcoin, is a financial phenomenon that demands attention and scrutiny.

The implications of this continued fiscal expansion go far beyond the cryptocurrency space and have profound implications for the US economy, interest rates and the country’s long-term financial stability.

As the United States continues to accumulate debt at an unprecedented rate, policymakers, economists and investors must grapple with the complex challenges and uncertainties this poses for the nation’s fiscal future.