Revolut, the financial super app, has announced that it has added bonds to its trading offering for customers in Italy. From now on, users can also invest in corporate and government bonds.

Summary

Revolut app and the addition of bonds to its trading offer

Revolut, the super financial app, has announced that it has added bonds (obligations) to its trading offer, for customers in Italy and the European Economic Area (EEA).

The idea originates from a survey conducted by Dynata, according to which 29% of Italians indicate a low propensity for risk, which leads them to seek safer investment options.

Precisely for this reason, Revolut is expanding its investment offering, including bonds, both for their stability and as an opportunity to diversify the portfolio and learn to invest.

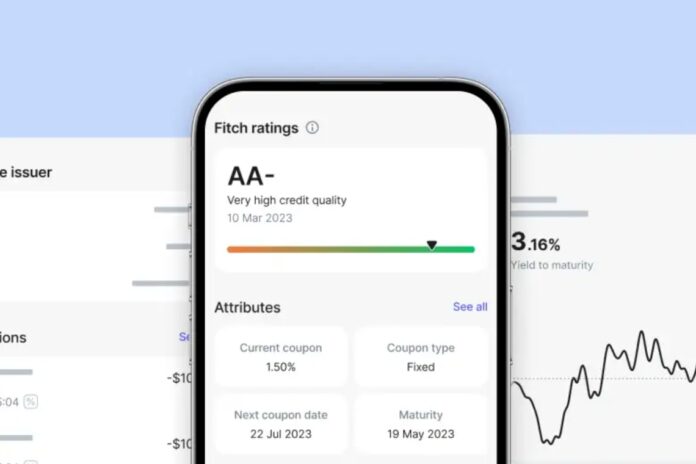

From now on, Revolut customers in Italy and the European Economic Area can invest in corporate and government bonds and receive regular fixed-rate payments – up to 5.5% per year (gross).

Such investment services for the entire EEA area are provided by Revolut Securities Europe UAB (Revolut).

Revolut app and bonds as a new trading offer for Italian customers

Revolut already offers investment products in the EEA with over 3,000 assets available in the app, including US and EU stocks, ETFs, and now bonds.

In general, bonds tend to be more stable assets compared to stocks and other assets. Not only that, good credit ratings and protection against inflation further contribute to their appeal, especially for investors seeking stability and potentially reliable returns.

Bonds are used by both governments and companies as a means to raise capital, offering investors the opportunity to effectively lend money in exchange for periodic interest payments and the eventual repayment of the principal amount.

There are different types of bonds, with different risk and return profiles. In this regard, Revolut aspires to expand the list of corporate and government bonds in the coming months.

On the financial super app, the minimum amount to start investing in bonds is USD/EUR 100, with a fixed commission of 0.25% per transaction (min USD/EUR 1).

Rolandas Juteika, Head of Wealth and Trading (EEA), said:

“We continue to expand Revolut’s investment offerings with bonds, a great way to diversify the investment portfolio, protect against uncertainty, and generate fixed income. With potentially higher returns and diversification benefits, bonds offer an interesting alternative for investors looking to create wealth and preserve capital.”

The largest neobank in Italy

At the beginning of this month, Revolut revealed that it has become the largest neobank in Italy in the month of May, after reaching 2 million customers in the country.

It is exactly double the number of customers that the financial super app had about a year and a half ago, now becoming the most downloaded financial and banking app in Italy.

This milestone is the result of continuous product innovation, supported by increasing investments in the market.