Important crypto news and price and performance updates on Stellar (XLM), Litecoin (LTC) and Mina (MINA).

Summary

Focus on the crypto assets Stellar, Litecoin and Mina

It is worth recalling that Stellar is an open source currency exchange protocol founded in early 2014.

Litecoin is a peer-to-peer cryptocurrency and an open source software project.

Finally, Mina is a “minimal blockchain” built to reduce computational requirements in order to run dApps more efficiently.

Stellar (XLM) crypto shows a bearish trend: significantly worse than the trend of Litecoin and Mina

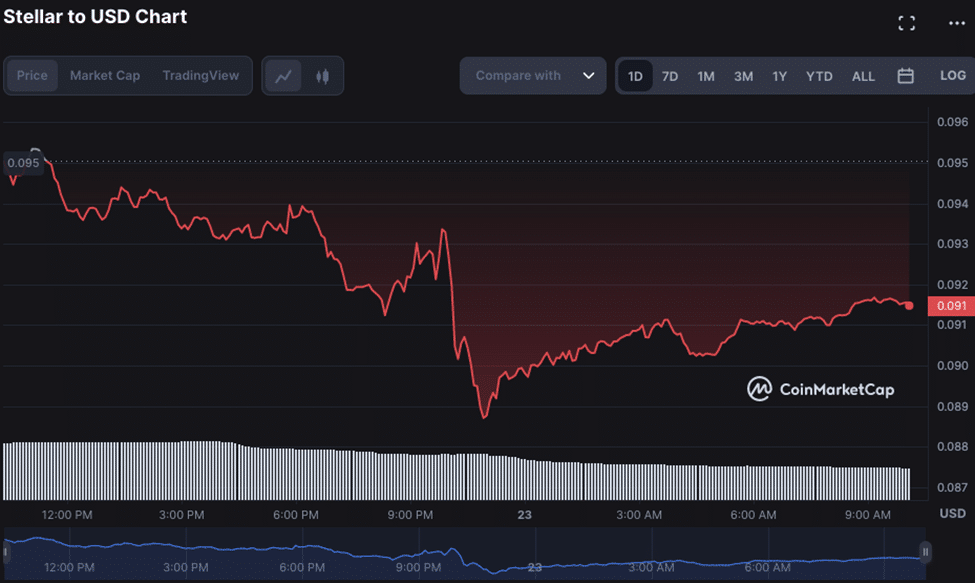

The price analysis of Stellar (XLM) shows that the bearish momentum has taken over the market. Selling pressure is increasing on the XLM market and prices are falling to lower levels.

In fact, the Stellar token is trading near $0.0914 and has lost 3.26% in the last 24 hours. The past few days have been supportive for bullish traders after the price of XLM rose to highs near $0.095 and tested resistance at $0.09536 when buyers pushed the price higher.

However, today the bears took over and the price of XLM fell below the $0.095 level. If this bearish pressure continues, we may see a deeper correction that will bring the XLM/USD pair closer to the $0.08871 support level.

On the upside, on the other hand, if the bulls manage to push prices higher and break through the current resistance at $0.09536, then we could see a further rise in price with the possibility of testing the next resistance at $0.10 levels once again.

In addition, 24-hour trading volume for XLM/USD has dropped to $129 million and is still far below previous levels, indicating that investors are reluctant to trade due to bearish market sentiment.

The market capitalization of the XLM token has also dropped to $2.47 billion, down more than 3% in the past 24 hours, placing it 28th on CoinMarketCap. Not only that, daily technical indicators for the XLM/USD pair remain bearish and indicate further downward momentum.

The stochastic RSI indicator is in neutral territory and stands at 57.82. However, if the bearishness persists, we may see the stochastic RSI move toward oversold territory. The MACD is in bearish mode and has crossed the signal line, indicating further downward momentum.

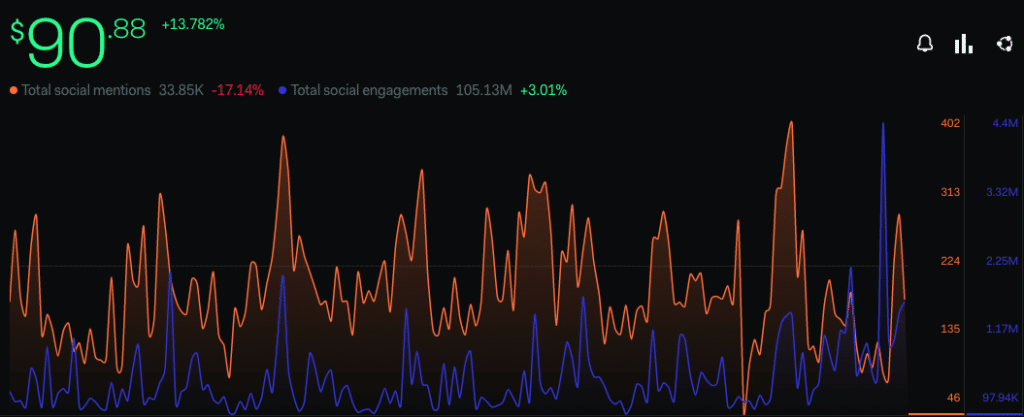

Litecoin outperforms Bitcoin and leaps to the top of social rankings

Litecoin (LTC) separated itself from the broader market decline after the Fed’s decision ended in an interest rate hike.

The decision may have negatively affected Bitcoin (BTC) and many others instead, but LTC was able to identify a 13.78% increase as its own repercussion.

Normally, a circumstance like this would have been the result of significant development around a project. However, this was not the case with the cryptocurrency’s native low-cost blockchain payment network.

Indeed, regardless of its silence with updates, LunarCrush signaled that no other coin matched LTC in terms of social and market activity. Currently, social engagements peaked at 29,819,175 while mentions were 4,467.

Hence, being at the top of the ranking means that LTC enjoyed an excellent status in terms of its financial, community, and market metrics. It is also inferred that investors considered the currency promising in the short term.

While LTC may have gained investor confidence and outperformed BTC, the next course of action may be to pay attention. This was because of the condition on the chain as shown by market value to realized value (MVRV).

The metric functions as an outstanding indicator for identifying market cycle highs and lows halved and also indicates when an asset is undervalued or not. At press time, the 365-day MVRV ratio was 25.95%.

Long-term holders could be considerably unperturbed by this position, as LTC’s price was down 82.56% from its ATH.

However, the increase in the metric might not be the same for investors looking for quick gains, as it implied that LTC might be overvalued.

Also, the long/short MVRV difference seemed to agree with the position of the ratio. Currently, the metric was 19.85%. Since it was not on the negative axis, it means that short-term realized gains may sink soon.

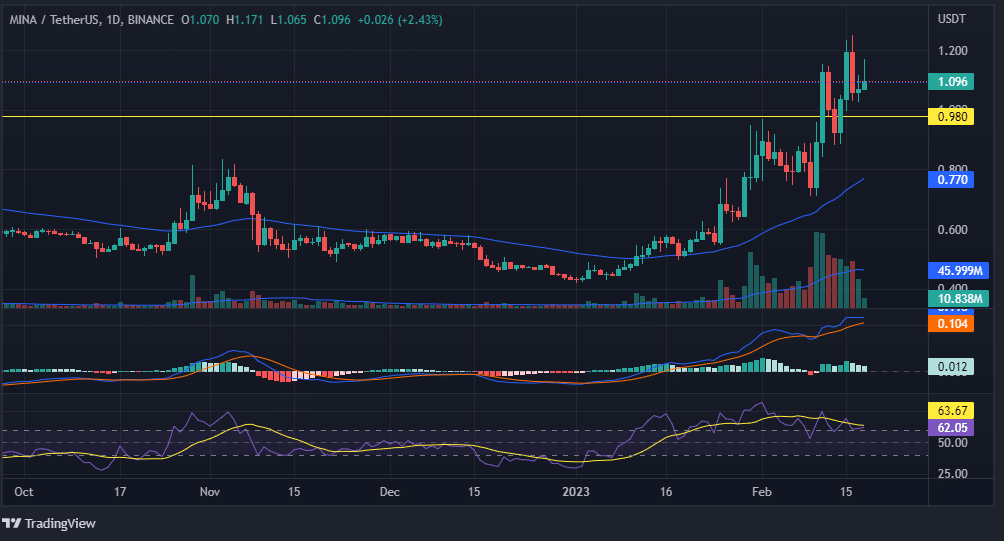

Focus regarding the price change of Mina

MINA‘s ongoing price correction has fallen 53% in one month. The V-top reversal nearly evaporated the January and mid-February gains and sent prices plunging to a Fibonacci low at the 0.786 level.

However, the price of the coin then bounced off 0.786 FIB support at $0.6 and triggered a bullish reversal. The price of MINA is currently trading at $0.6366, showing a 6.2% increase from earlier.

If buying persists, buyers could retest after the resistance of $0.737 and $0.8.

Moreover, about a month ago, on MINA’s daily chart investors could clearly see the currency, after taking a big fall, moved into a sideways trend for a long time.

They might also have noticed that recently the coin showed a big bullish rally from its main support level, that is, from about $0.427. During its bullish rally, it also crossed one of its key resistances.

Apart from that, a Golden Crossover is about to occur on the chart, which could push the currency’s prices even higher. The MACD indicator has shown a bullish crossover, which implies that the bulls have increased in number relative to the bears.

This crossover also implies that investors may now see a rise in currency prices. The RSI curve, however, is trading at 62.05, which is above its 50-point level.

The value of the RSI curve can be seen to increase even more in the future as coin prices rise. Therefore, it is clearly visible that both indicators, MACD and RSI, are showing a buy signal.