Light and shadow of token sales. ICORating Analysis. Leggi qui l’articolo in Italiano.

ICORating, a company dedicated to the evaluation of token sales, has drawn up an ICO Report that analyzes those launched in the first quarter of 2018.

If the data from the financial point of view appear exciting, the same cannot be said from the organizational point of view of the ICOs, which often lack a true business model.

According to this ICO Report, 3.314 million dollars were raised from 412 completed projects, compared to 3.148 in the last quarter of 2017, confirming that 2018 is the year of ICOs.

ICO Report excludes Telegram

In this issue, however, Telegram’s ICO TON was not considered, it stopped after a presale that raised 1.7 billion dollars

In reality, the sector is highly fragmented: only 50% of the projects had an income of more than 100,000 dollars, showing the still pioneering phase of this financing tool.

Very often the projects come from first-time entrepreneurs: only 9% of the ICOs come from existing companies, while 46.6% of the projects had not been developed before the ICO.

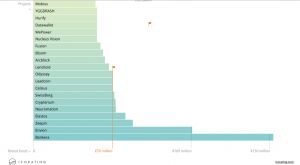

This can also be easily seen in the graph of successful projects:

According to this ICO Report, there is a real dichotomy between the token sales: alongside a myriad of micro-initiatives from a few tens of thousands of dollars, there were also real fundraising giants: Bankera, Envion, and Zeepin among the leaders.

However, the market is becoming more complex and mature and the average collection time of an ICO has reached two months in 2018, while in mid-2017 it was only a few minutes. This means that investors are becoming much more attentive and marketing is increasingly necessary.

The sector in which ICOs are most active is the financial sector, followed by wallets and blockchain infrastructures.

The regulation of ICOs

Only 25% of the ICOs are heads of duly registered entities, while 40% have not even disclosed the identity of their CEO and 9% have even closed their accounts as soon as they finished with the ICO, turning out to be real scams.

Moreover, from an economic point of view, there is a real massacre: the average value of tokens after the launch is 49.32% of the sales value indicated.

Only 17 tokens exceeded the starting price proposed by the ICO creators.