BitMEX data on Bitmain: the exchange analysed in depth the balance sheet of the mining giant.

It’s happening right on the eve of the IPO which is expected to raise 14 billion on the Hong Kong stock exchange and which, in the company’s projects, is expected to be announced in detail by the end of August. We are therefore only a few hours away.

The BitMEX exchange performs an analysis of Bitmain’s mining and business activities, starting from some solid foundations and then arriving at other interesting “speculations”, although the origin of the data presented is not entirely clear.

It should be remembered that in the Hi-Tech sector an investment is considered attractive if it concerns the sector leader by market share or by growth rate.

From this point of view, Bitmain wants to present itself as the leader of the Crypto & Blockchain sector.

Unfortunately, mining is only a temporary part of the virtual currency sector, without considering the general tendency to create blockchains based on POS algorithms or using “ASIC-resistant” POW algorithms, i.e. not suitable for the type of machines produced by Bitmain.

The activity of the company is then divided into two categories: mining and sale of ASIC hardware for mining.

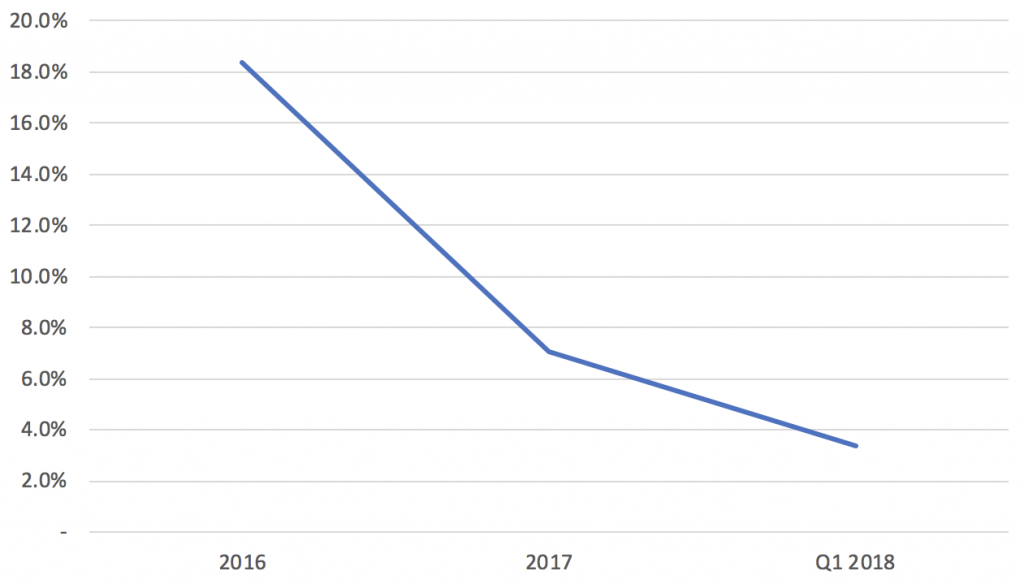

The first activity, according to the BitMEX data, is in sharp decline, as can be seen from the graph (below) that shows the mining turnover in relation to the total:

It follows that mining is becoming irrelevant in the balance sheet, both for the low direct profitability of the activity and for the greater corporate commitment in the sale of hardware.

Bitmain is the leader in hardware, with a share that from 67% in 2017 rose to over 70% in 2018.

The company’s problems are, if anything, related to two factors: the obsolescence of the stronger product lines, due to the increase in the difficulty of mining algorithms, and the reduced attractiveness of mining as a whole due to the fall in prices of BTC and altcoins.

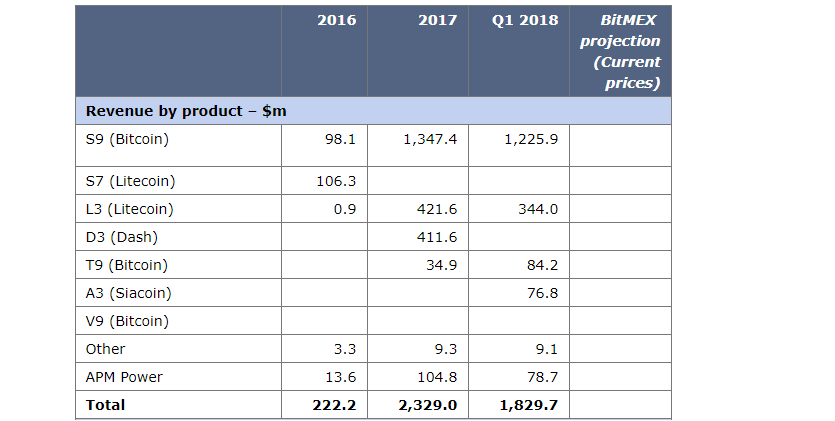

On the first point, BitMEX analyzes Bitmain’s product lines and their profitability:

Sales in absolute values seem good, but BitMEX says that the profitability of the lines is expected to decline:

Unfortunately, we have no data to confirm the calculations relating to the drop in profitability of the product lines.

Certainly the company’s main product, the line S, has been on the market for a long time.

As far as the lower profitability of mining is concerned, it is evident, given the prices of cryptocurrencies in January compared to now.

We remember that, according to Bloomberg, the break-even for the mining of Bitcoin is currently equal to about 8000 dollars, higher than the current market price of cryptocurrencies.

In this situation, it is obviously more difficult to sell the relevant hardware.

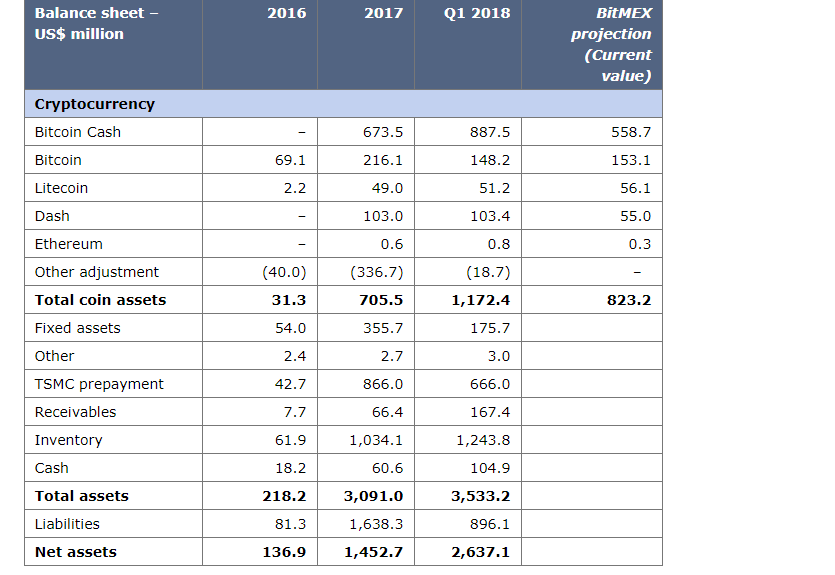

According to BitMEX there would be a Warehouse/Sales ratio of 52%, i.e. a period of inventory rotation of more than 180 days, a very high figure for the high-tech sector which indicates that a substantial part of the company’s financial resources is currently invested in final inventories.

In fact, if we take the same data provided by BitMEX for the first quarter of 2018 we have a Warehouse/Sales ratio of 66%, frankly worrying.

Finally, a large part of Bitmain’s operating cash flow was used for investments in Bitcoin Cash and in smaller cryptocurrencies, which generated only losses.

Why, then, according to BitMEX, does the giant Bitmain intend to be listed on the stock exchange?

The answer is: to find some liquidity, maybe to pay for the company’s conversion and also because its competitors want to get listed as well, including Canaan, the second company in the industry.

To be continued when clearer documents from Bitmain will be presented to the Hong Kong stock exchange authorities to proceed with the possible IPO.