Ownera, in collaboration with Novablock and the Security Token Summit, presented a report that analyses the state of smart securities in 2019 and their application on a large scale.

Smart Security is a synonym for the so-called Security Token, that is, a digital representation on blockchain of a set of real rights on physical assets or financial assets.

If the years between 2015 and 2017 saw the birth and development of crowdfunding linked to centralised platforms and 2018 was the year of the ICOs, Initial Coin Offering, 2019 is about to be the year of the SSOs, the acronym of Smart Security Offer, ie the transfer of financial assets on the blockchain.

The adoption in July of the Jobs Act in the US, a regulation that introduced alternative ways of participating in the company’s capital for new companies, linked to the quality of investors or the amount of capital raised, opened the way to the regularisation of SSOs for venture capital activities.

This is just one aspect of the introduction of SSOs, because the same tool is applicable to the digitisation of an immense amount of physical assets that can be represented on the blockchain and then transferred with this system.

Potentially, the value of the assets that can be transferred on the blockchain is higher than 800 thousand billion dollars, whose transfer and the use of smart contracts can make them much more usable.

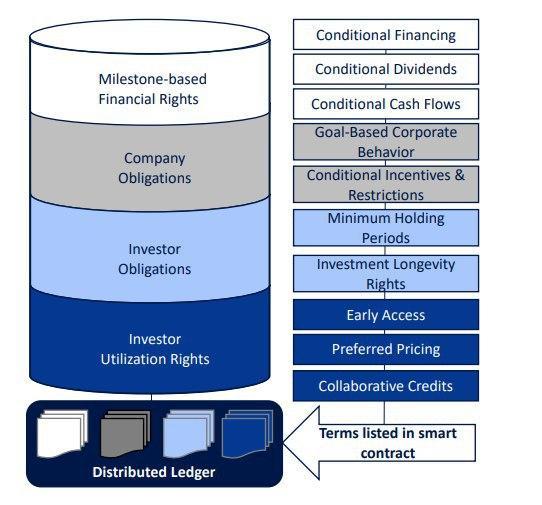

This can be done through a clear definition of the rights and duties of the individual parties, automatically regulated through the application of smart contracts, without uncertainties or external interventions.

Complex situations from the legal point of view, which normally make the transferability of physical assets complex, such as for example, real estate, can be automated, simplified and made more efficient, opening up a huge market of assets that can be represented on the blockchain.

In addition, the application of Smart Securities also allows the fractionability of rights of use or rights of property even in those cases where this mechanism would appear very complex because it is linked to a single physical good.

2018 saw enormous progress thanks to the launch of the first Smart Securities with the first tokens linked to a real estate property and the first tokenisation of a student loan.

Now the conditions for an almost unlimited expansion of the sector are present and this may change the structures of the financial markets.