The CBOE Futures Exchange (CFE) has decided to suspend the issuance of bitcoin contracts as of this month. The communication is official and was made through a notice made yesterday to traders stating that:

“CFE is not adding a Cboe Bitcoin (USD) (“XBT”) futures contract for trading in March 2019. CFE is assessing its approach with respect to how it plans to continue to offer digital asset derivatives for trading. While it considers its next steps, CFE does not currently intend to list additional XBT futures contracts for trading. Currently listed XBT futures contracts remain available for trading”.

A straightforward communication which also shows a certain disappointment for the BTC market and that of digital assets in general.

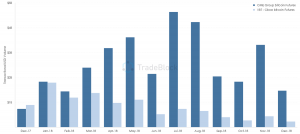

The reason for the decision is purely commercial since trading volumes of contracts have remained low, reflecting, in part, the collapse of the BTC price and the loss of interest in the sector after the collapse of the first half of 2018. Moreover, the main competitor of the CBOE, the CME, has been able to prevail in the competitive struggle.

The volumes of CBOE futures were now so low that the news had no effect on the BTC price, which remained essentially stable at around $3900. The CBOE was the first market to offer derivatives on BTC, followed by the CME within a couple of weeks, opening up a market in which it failed to play a leading role.