Blockchain and cryptocurrency are two businesses that have long been of interest to PayPal, but according to the company it is still early to do business with bitcoins. The Silicon Valley group is not entirely convinced of the potential of this currency but does not rule out the possibility of changing its mind in the future.

This was announced by Chief Financial Officer John Rainey, who spoke at a time of strong recovery for the prices of the world’s largest capitalized cryptocurrency. PayPal, according to which today bitcoin and crypto do not represent the future of digital payments, is actually looking around in search of opportunities in the industry.

Rainey explained:

“We have teams clearly working on blockchain and cryptocurrency as well, and we want to take part in that in whatever form that takes in the future — I just think it’s a little early on right now [on bitcoin]”

A threat and a great opportunity at the same time

As Lisa Ellis, an analyst for MoffeNathanson, says, crypts represent a threat but above all an opportunity for large groups of digital payments such as PayPal.

“Cryptocurrency systems could trivialize them, rather than resize them altogether. Unless traditional payment networks are the first to adopt technologies themselves”.

The main threat, on the other hand, could be the risk of giving companies like Ripple and Veem market shares in the area of cross-border payments (person-to-person and business-to-business).

But in general “as ridiculous as it may seem”, explained the 48-year-old businesswoman in Bloomberg,

“the existential threat of cryptocurrency throughout the world, which would upset operators such as Visa, Mastercard and PayPal, is worth watching over, but should not occur soon”.

In light of this, it seems inevitable that sooner or later PayPal will enter the arena of the blockchain and, given the success that cryptocurrencies are experiencing among rival hi-tech companies when the group founded by Peter Thiel will change their minds towards Bitcoin, it may be late.

PayPal risks falling behind Facebook and rivals

In recent years a dozen PayPal executives including David Marcus have not waited for the Nasdaq-listed group to decide and have abandoned him to take part in the team crypto Facebook.

The division is known to be in charge of creating the Facebook coin and working on an electronic payments project. Before working as a mobile product manager for PayPal, a role he left in 2014, Marcus was the owner of Zong, a company he sold to PayPal in 2011.

In short, if PayPal doesn’t hurry, it risks being cut off from the competition. In an effort to decentralize its activities, Facebook has been working for a year on a global payment system that would develop around a cryptocurrency created for the occasion.

The project will allow transactions between individuals, but also to make online purchases without going through a bank account, just like with PayPal. Facebook, which would like to involve dozens of companies active in the e-commerce, has in mind to give its users the opportunity to shop not only on its platforms (Messenger, WhatsApp, Instagram) but also on third-party websites.

Thanks to the presence of a cryptocurrency you can get rewards, through a system that makes money for users who agree to watch an advertisement or those who make purchases directly on one of the flagship App Facebook.

Bitcoin promoted by asset managers

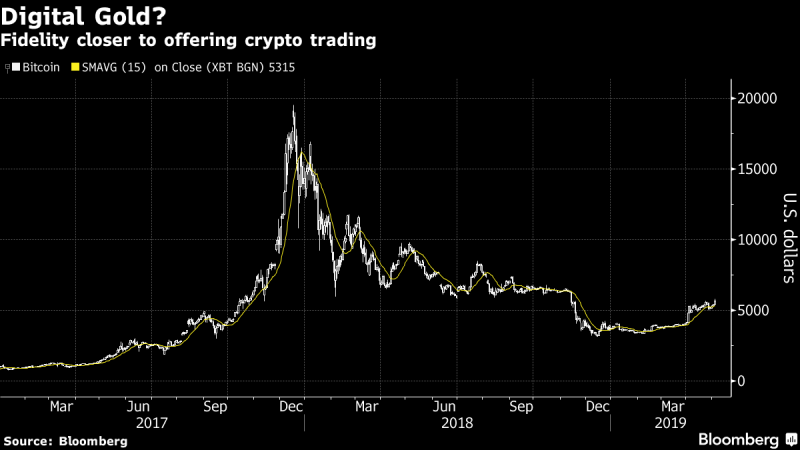

The decision of Fidelity, a major player in the global asset management industry, to add cryptocurrency to its trading offer within a few weeks, pushed the prices of bitcoins on the markets upwards, above the threshold of $6.000 dollars.

The Boston group, which to justify the decision cited a growing demand for such a service, set up last October a trading platform dedicated to crypto for institutional investors, Fidelity Digital Assets.

A study conducted by Fidelity and published on May 2nd showed that 47% of institutional investors believe that it is worth investing in digital currencies. Other large American institutions such as ICE (through the Bakkt division) are also preparing to market crypto products.

This could further strengthen confidence in the market and maybe make PayPal change its mind faster than expected. Perhaps it’s no coincidence that the US company has already invested in a startup that produces digital identity business software based on the blockchain for financial companies.