In May’s COT of bitcoin futures, sent by the CME to the CFTC, it is stated that among the subscribers there are 4 new institutional investors who therefore have an open interest in the BTC futures market.

The discovery was made by Federico Izzi, trader and analyst of CryptoLab and BigBit, analyzing the CFTC Commitment of Traders (COT), the official report that provides information on the open interest of each market of American futures.

This information comes from all the U.S. managers recognized by the agency that regulates the markets of commodities and futures (the CFTC, in fact), and regarding the open positions on various futures contracts.

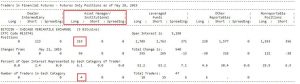

In the COT of 28th of May 2019, in the section marked with code #133741 which refers to the bitcoin futures market of the Chicago Mercantile Exchange (CME), it is stated that the total number of traders who have signed these contracts is 47.

Of these, 18 are funds with long positions and 15 are funds with short positions. To these should be added 6 funds in spreading and especially 4 institutional investors, or asset managers, with long positions, in addition to 6 other traders who fall into the category “other”.

In total these 4 institutional investors have opened 319 positions, which is a few compared to those opened by the funds, but still important because it is the first time that they appear in this report.

In fact, until now the items specified by the CME in this report were not so detailed, so it is possible that institutional investors have opened positions in the past few days.

In the same report, in fact, it turns out that, compared to the previous week, there was a variation of +96 open contracts, however, at least until May 14th these positions were at zero.

Federico Izzi said:

“With this May figure is officialized the entry of the first institutional investors in the BTC futures, remained so far absent from the launch in mid-December 2017”.

It should be noted that each of these contracts has a countervalue of 5 BTC, therefore 319 contracts have a total countervalue of 1,595 bitcoins, equal to more than $13 million U.S. dollars.

The identity of these four institutional investors, or asset managers, has not been made public, although they are still required to report their positions.

If we add to this news the highest historical record just recorded for the trading volumes of these futures on the CME, we can understand how the scenario is currently undergoing strong evolution, also and above all, thanks to traditional finance.