Yesterday evening, the price of Ethereum (ETH) returned to the spotlight, rising today to $300, driving the entire industry.

There were no particular shocks during the weekend, which was characterised by the lowest trading volume in the last month. Such low levels were recorded on June 8th-9th. Today there is a return of volumes that are still far from the peaks reached two weeks ago at double the amount traded in these days, which is now around 70-80 billion.

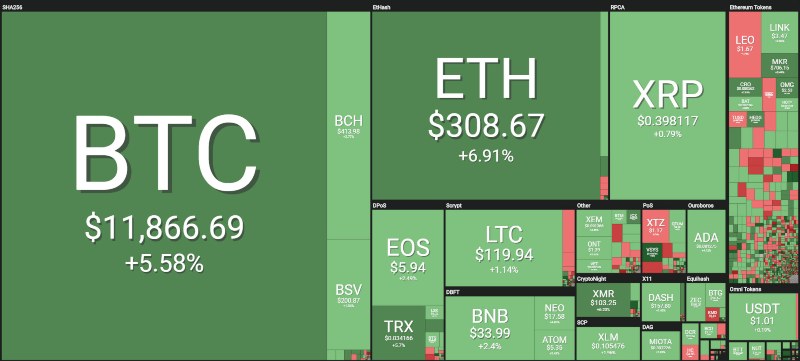

Among the top 30 cryptocurrencies, only 3 are in negative territory: the Leo token (LEO), which drops -2.5%, Tezos (XTZ), which drops 3%, and finally Dogecoin (DOGE) which, after the climb of recent days, today is just below parity.

Today sees a prevalence of green signs for 70% of cryptocurrencies. Privacy coins like Monero and Dash are back in the spotlight. Monero, with today’s rise of over 6%, rises above 100 dollars and sees a performance among the best on a weekly basis with +10%. At a distance, there is Dash, who scores +2.7%.

The day is characterised by the movement of TRON which, with a jump of 8%, tries to review the 0.036 dollars. The rise is perhaps due to the expectations of the dinner between Justin Sun and Warren Buffett on July 25th.

Among today’s best cryptocurrencies there’s also Icon (ICX), scoring one of the biggest increases, reaching almost 20%. There is no particular news that justifies this excellent rise. It seems that users of this token, which has the ambition of decentralising the blockchain ecosystem, are positively affected by the postponement of the launch of the app on the Apple Store due to a problem with Apple itself. This news seems to give vigour to Icon’s performance, which today rises by 20%. This increase, when added to the relative lows of the beginning of the month, sees the price rise by more than 40%.

Total capitalisation remains above $335 billion. Despite Ethereum’s strong rise, bitcoin maintains its dominance close to 63%.

The bullish movement of ETH does not move its dominance which remains just under 10%. This movement, however, weighs on Ripple, which returns to almost 5%, the lowest level of the year and which it had abandoned in December 2017.

The price of Bitcoin (BTC) today

Bitcoin seeks to confirm and consolidate prices above the 11,000 point threshold. At this time it’s going to attack the $12,000, last week’s relative high.

A possible break of the 12,000 dollars, would project the prices to the test of the 12,500 points, probably attracting the purchases with extensions that could bring the quotations to the test of the 13,000 dollars, the maximum relative of the end of June.

A break of the $11,000 downward would draw a bearish trend in line with the end of the mid-month cycle that started with the lows at the end of June.

Ethereum (ETH) price rises today

Today’s bullish movement brings the price back to the levels of the end of June. To find further confirmation and consolidate this leap of the last hours is necessary for Ethereum to go beyond $320.

If not, it is necessary to observe the holding of the 295 dollars, levels where Ethereum has fluctuated with its quotations for most of the weekend, before the rise that is characterising it since the late afternoon of yesterday.