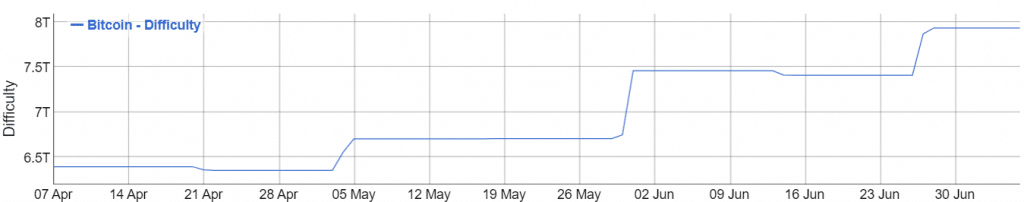

As a result of the continued growth of the network hashrate, the difficulty of bitcoin mining has undergone a new increase in the last correction, which took place on June 27th, one day earlier than expected.

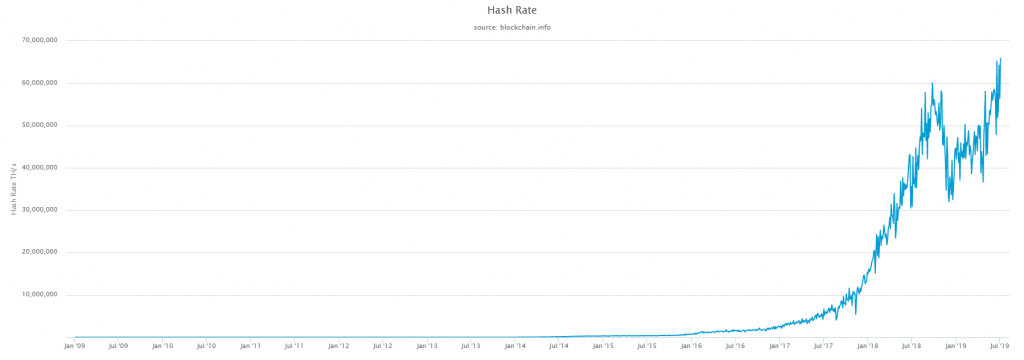

In fact, the race for bitcoin mining does not stop despite the (temporary) pause of the price, which for several days has been fluctuating between 11 and 12 thousand dollars. Over the last few days, the all-time high of the network’s hashrate has been reached again, touching the 74.5 Exahash/s threshold.

On average, a mining period has a typical duration of 14 days (2016 BTC blocks), while in the most recent instance this period lasted just under 13 days. The reason for this is, as mentioned at the beginning, due to the hashrate of the rapidly growing network, which has significantly reduced the average extraction time per block, making it possible to anticipate the change in difficulty by one day.

The average time per bitcoin block is set to be around 10 minutes. To keep this average time per block as constant as possible, the difficulty of bitcoin regulates the extraction process, balancing an increasingly higher hashrate that would otherwise significantly shorten the average time per block, which is what happened in this case.

Recently, during the hashrate peaks on the bitcoin network of the past few days, 8 minutes per block were reached, a value well below the theoretical average of 10 minutes.

The difficulty of bitcoin mining hits a new record

The latest correction of the bitcoin mining difficulty led to a 7% increase, raising the threshold to €7.93 billion, which is well above the previous record of October 2018.

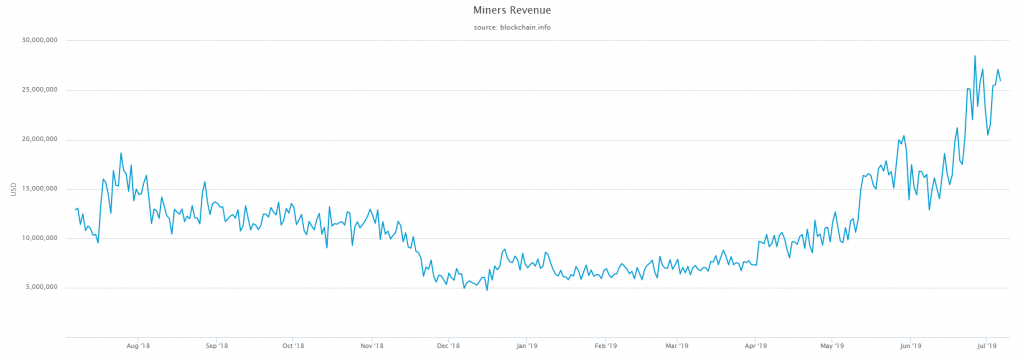

Despite this, profits for miners are continuing to rise, due to the upward trend in the price of the currency.

The strong parabolic growth of BTC’s price in the last week of June has certainly led to a new increase in interest in bitcoin mining. Several ASIC manufacturers, in fact, have reported demand for mining machines almost three times greater than production capacity, just as happened in 2017.

The growth of the hashrate is very positive, as it makes the network increasingly robust and secure. Not only that, several times in the past the growth of the hashrate has followed and even anticipated the trend of BTC’s price. This year, in fact, the bitcoin hashrate, as well as the difficulty of mining, began to increase as early as the beginning of 2019, so at least three months before the substantial price increase was triggered.

The reason could also be due to the BTC halving, which will take place in less than a year and which, as happened with Litecoin recently, will increase even more significantly the interest in bitcoin, especially for the miners. The latter, in fact, are probably taking advantage of the remaining 10 months to accumulate as many bitcoins as possible, since from May 2020 the reward per block will be reduced by half.