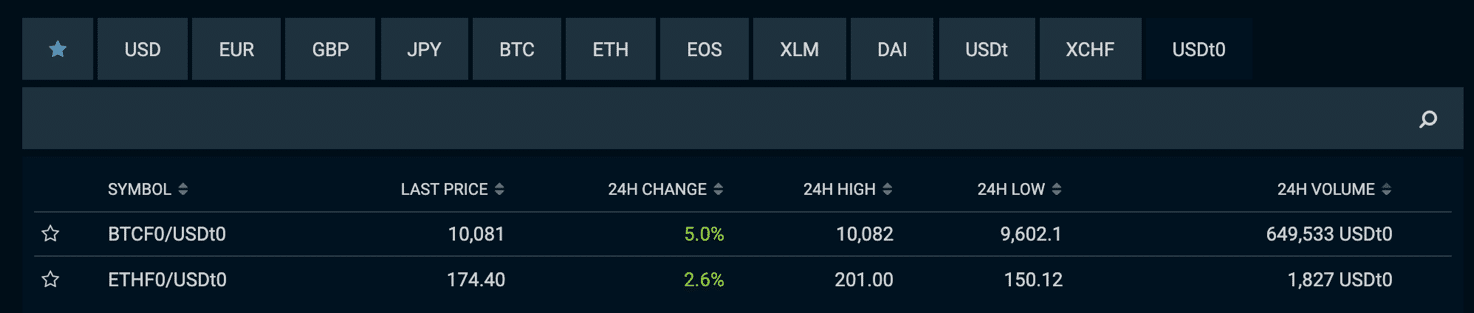

Following yesterday‘s successful update of the Bitfinex platform, the exchange has introduced two new products, namely two new types of derivatives, the BTCF0/USDt0 and the ETHF0/USDt0.

These derivatives are perpetual contracts that use Tether as collateral and allow leverage up to 100x, obviously available only for certain accounts, as mentioned by the whitepaper.

“Qualified Bitfinex account holders will be able to trade a new hedging product through a derivatives wallet. The product will have USDt-based collateral (unavailable in the rest of the market), up to 100x leverage and isolated margin for individualized risk level.”

The derivatives will be managed by a subsidiary of iFinex, iFinex Financial Technologies Limited registered in Seychelles.

The CTO of Bitfinex, Paolo Ardoino, explained:

“We are excited about the possibilities for creating new, previously unavailable products through our new platform. The new platform expands our ever growing portfolio and cements Bitfinex as a market leader in innovation.”

However, Bitfinex derivatives will not be available to users in the United States, Canada, Switzerland and Seychelles.