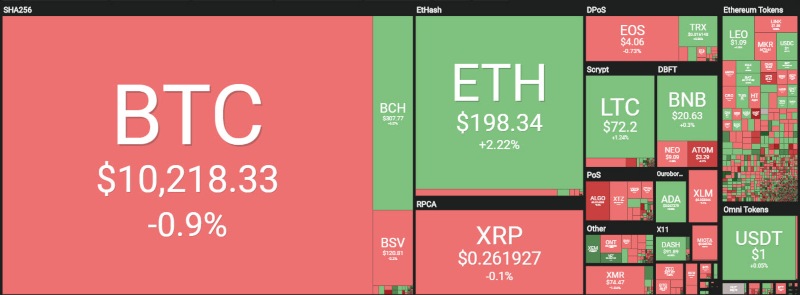

Today, the price of Ethereum rises to around 200 dollars, a condition that favours the altcoin sector, which has been suffering a great deal in the past few months.

The rise in the price of Ethereum, which still accounts for the vast majority of tokens developed on its platform (despite the competition from new blockchains), is a positive signal that will have to be confirmed in the coming days, as the decline suffered in late June was an important signal and until a few days ago Ethereum was on very delicate thresholds.

Today sees an alternation of positive and negative signs. Among the best, there is ABBC Coin (ABBC) which rises by about 10%. Out of the best known, there is VeChain (VET) which rose by 7% confirming the bullish trend of yesterday.

Among the worst, Zilliqa (ZIL) is back in the spotlight, down 6%. The same goes for Cosmos (ATOM) and Algorand (ALGO).

Cosmos, after the strong rise that has doubled the prices in 10 days, today loses 6%, which becomes 12% if added to yesterday’s decline. This does not affect the rise of the last 10 days: the holding of the 3 dollars is maintained. The 48-hour downturn brings ATOM back to 21st place, after having crossed the 18th position occupied by IOTA over the weekend.

The volumes remain very low, around 50 billion, which indicates how operators remain alert waiting for other traders to make moves. Sunday has been the least hectic day of the year and this should cause absolute caution.

Such low trading volumes anticipates an increase and a directionality for the entire sector and in particular for bitcoin, with the explosion of volatility that today falls to 2.5% on a monthly basis, reaching the levels of April. So this is a signal that must keep the attention high.

The dominance of the bitcoin now falls to 69%. The increase in the price of Ethereum, approaching the return to 200 dollars, pushes ETH to regain 8% of the total market share, a level abandoned at the beginning of August.

Bitcoin price today

Despite the slight decline of yesterday and today, with a -1%, bitcoin remains above the threshold of 10,000 dollars, trying to consolidate at 10,300 dollars. For bitcoin prices continue to fluctuate within the bearish triangle, and it is necessary to recover the 11,000 dollars as soon as possible. An eventual downward movement breaking the $9,500 support with low volumes could create a dangerous sell-off.

Ethereum price today

Ethereum, after having broken the 185 dollars over the weekend, is resuming today the quota of 200 dollars. A recovery of 200-205 dollars could bring back the volumes, which already yesterday returned to rise, closing with the peak of the last month.

This is a positive sign that needs to be confirmed in the coming days.