In the last few days, Ethereum has been attracting attention, in part due to the significant growth of its value, which in little more than 48 hours has increased by about 12%, in part because the network has recently achieved its usage record, as well as having triggered a slow but steady growth of the hashrate.

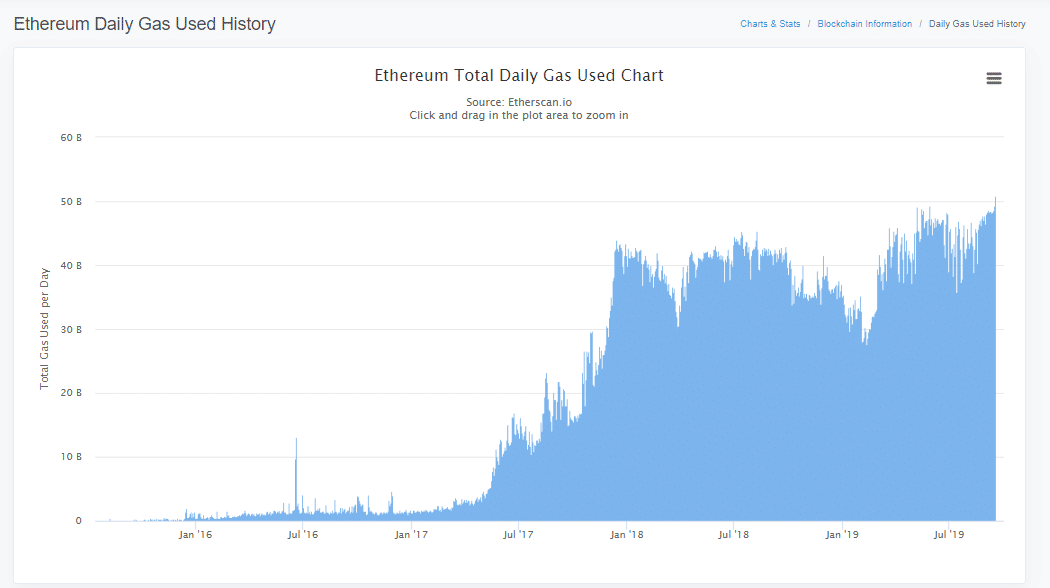

Precisely in these last hours, one of the key parameters related to the use of the Ethereum network has recorded its maximum value. It is the GAS of ETH, a parameter related to the activities that are performed on the decentralised network of the cryptocurrency: when performing a transaction with ETH, an ERC20 token or an operation within a smart contract it is necessary to use GAS to pay the network fees.

Vitalik Buterin recently proposed to increase the GAS limit to temporarily address the problem of congestion in the ETH network. As evidence of what has been recorded in recent days, in fact, the ETH network is being used increasingly and, apparently, it is not all attributable to the Tether (USDT) stablecoin at which many pointed the finger.

Looking at the chart taken from Etherscan it is possible to notice that on Tuesday, September 17th, 2019 the threshold of 50 billion GAS units used was reached, a value never reached before. Statistics on the percentage of network usage also confirm the recent peak of activity, which has brought the ETH network to 96% of its capacity.

Ethereum network: 20% of transactions come from Tether

Analysing the peak of use, it emerges that the main utiliser of the ETH network is not the Tether stablecoin, despite the fact that the smart contract of the USDT ERC20 token has managed to reach a peak of 20% of all the fees paid to the network.

In recent days there has been a peak of activity in several ERC20 smart contracts, while the regular ETH transactions have suffered a general decline, making room for the ERC20 token movements and the operations of the various smart contracts.

1/ Gas usage on #Ethereum hit ATH.

How is it being used?#Tether has been on the rise, with a recent peak of 20% of all network fees used to transfer $USDT.

While less gas is used to move $ETH, the bulk is consumed by non-standard contracts, that require heavier computations. pic.twitter.com/fKcC4m8GL1

— glassnode (@glassnode) September 16, 2019

When looking at the transaction charts, only 30% of the transactions executed concern the ETH currency, whereas USDT has recently reached a volume close to 25% of all transactions performed on the Ethereum network.

The remaining 45% of transactions, on the other hand, derive from smart contracts, most of which are closely linked to DeFi.

2/ Transaction activity paints a similar picture.

More than 25% of transactions were used to move #Tether last week, up from less than 1% in June.

While $ETH transfers are at around 30%, smart contract interactions make up ~45% of recent transaction counts (many in #DeFi). pic.twitter.com/EByTbOupry

— glassnode (@glassnode) September 16, 2019

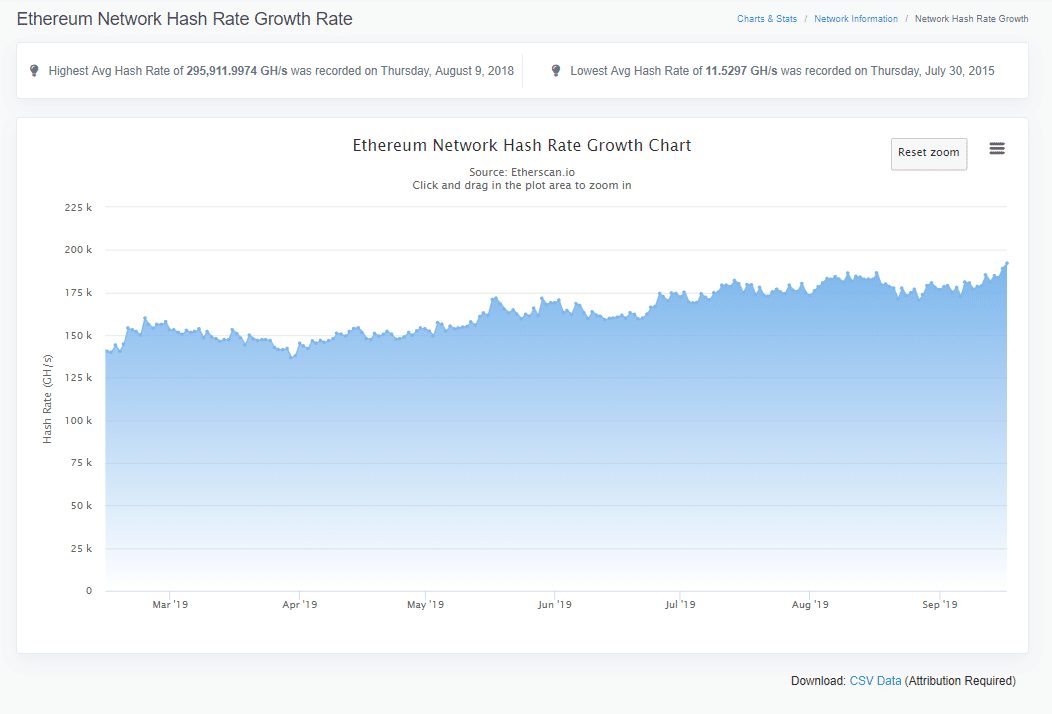

The Ethereum hashrate is also growing slowly

Not only transactions and smart contracts, Ethereum’s hashrate is also slowly recovering, continuing the growth trend undertaken in the first part of the year.

In fact, as August approached, the slow recovery had come to a halt, with a slight correction of the hashrate to the levels of July 2019. In September, on the other hand, the value of the hashrate slowly started to rise again, up to the current values, equal to the maximum of this year.

Despite these timid, encouraging signs, the hashrate is still well below the peak of 295 TH/s recorded in August 2018.