The launch of Bakkt’s futures does not seem to bring luck to the price of bitcoin, which is showing its – hopefully temporary – weakness. After just over 24 hours from the launch of the platform that allows the purchase and sale of futures, with daily and monthly expiration, backed by physical bitcoin, the market retreats and BTC returns to the threshold of the lows already tested for the 5th time since last June in the $9,500 area.

The weakness of bitcoin, as usually happens, drags the whole sector down.

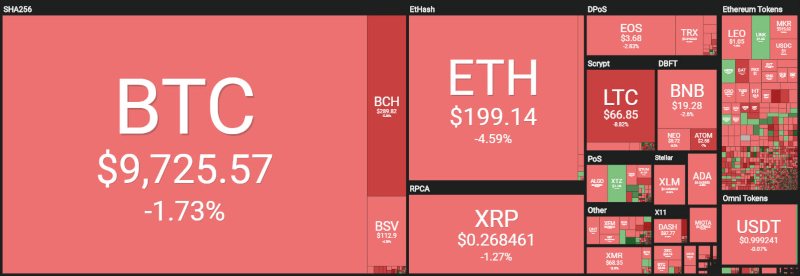

The current day records more than 85% of the first 100 cryptocurrencies in negative territory. Among the first 20, only two are able to stay above par: Tezos (XTZ) and Chainlink (LINK), which rise around 2%.

Among the worst sinkings of the day are Cosmos (ATOM) and Litecoin (LTC), both losing 7%.

Yesterday saw a return of trading volumes that went back above the daily average of the last month. Despite this, volatility continues to decline, which for bitcoin reaches the low of the last 5 months, at 2%.

With the generalised downturn across the industry, bitcoin recovers a small fraction of dominance to 68.5%, remaining close to the peaks recorded a few weeks ago.

For Ethereum and Ripple, the step backwards in the last few hours causes Ethereum to miss 9% of market share, slipping close to 8.4%, while Ripple remains at 4.5%, a level above the lows reached at the beginning of the month.

Cryptocurrencies listed on CoinMarketCap approach the 2,900 threshold, continuing the trend of new launches with an average of more than 100 tokens listed on a weekly basis.

Bitcoin (BTC) price

With today’s weakness, bitcoin returns to test the support base of the descending triangle by re-testing alarming levels. A possible break of the 9,500 dollars, which since last June has managed to counter the bearish scenario five times, could trigger the coverage of the positions upwards and the danger of a sell-off with prices that could be pushed to 9,000 dollars in a few hours. For bitcoin, it is necessary to defend this level.

In order to breathe a sigh of relief, bitcoin must resume its share of $11,000, a threshold currently 15% away from today’s levels.

Ethereum (ETH) price

For Ethereum, the technical situation softens last week’s euphoria with prices returning below the $200 threshold, a level that was preferable not to violate downwards.

In order not to risk a further fall, the threshold to be maintained is between 175 and 185 dollars, where prices have been fluctuating for more than two weeks last August and where a lot of trade is concentrated.

For Ethereum, it is necessary to push with determination towards recovering the highs reached last week, at 225 dollars, and then go to 235, leaving behind all the weakness trend that has characterised the crypto for most of the summer that has just ended.

Ripple (XRP) price

After returning back below 30 cents last weekend, XRP is now testing 26 cents, which is one step away from the lows of the last two years at 24 cents touched in August.

For Ripple, last week’s movement is only a dangerous pullback in the medium to long term. It is necessary for Ripple to resume the 30 cents as soon as possible, otherwise, there is a risk of sinking further.