Bitcoin (BTC) is down again and this time with a double-digit drop: in less than an hour, the collapse led to a loss of about 18% and made it reach $7800, a level that has not been touched since June 11th of this year.

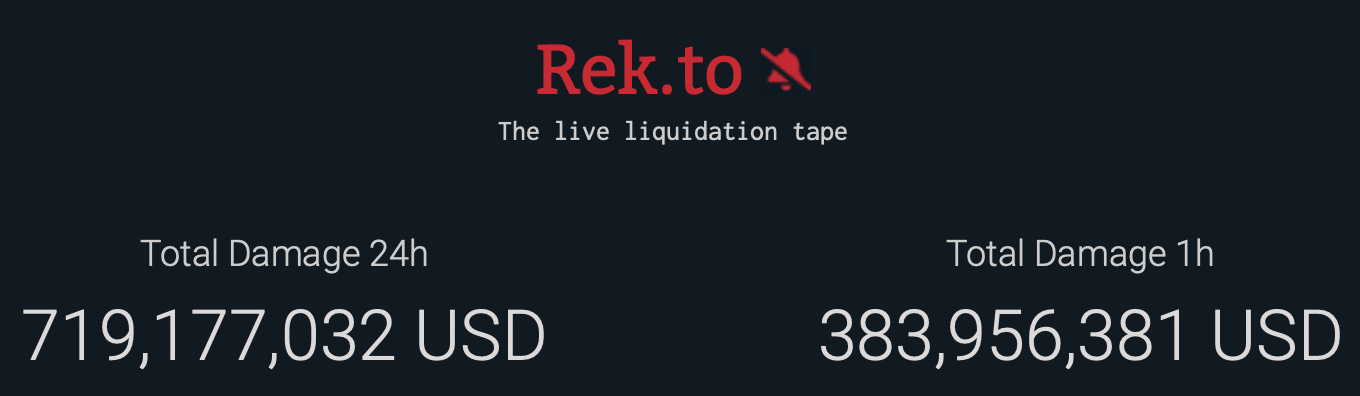

According to data from Rek.to, the BitMEX exchange has liquidated contracts worth over $719 million in 24 hours, while analysing the one-hour timeframe we are talking about $383 million.

The launch of Bakkt has not caused the desired effect from the crypto community as far as bitcoin (BTC) is concerned, the cryptocurrency was losing more than 10% considering the 24 hours and several BTC options will expire on September 27th, an event that historically has always exerted a negative trend on the price of this asset.

The altcoins are certainly not better off: among the worst, there are certainly EOS, Ethereum Classic (ETC), TRON (TRX) and Binance Coin (BNB) that have recorded a negative figure ranging between 20% and 40%. However, the dominance of bitcoin (BTC), despite the collapse, remains quite high, around 69%, an indication that it is still gaining ground and that the alt season may not have started yet.

According to data from GoogleTrends, interest in Bitcoin is gradually decreasing, compared to the peak three months ago. The searches that are carried out today are about a fifth compared to 90 days ago and, historically speaking, the increase in interest for a financial asset occurs when it grows in value, vice versa, in this case, the ongoing collapse of bitcoin (BTC) corresponds perfectly with the data analysed by Google.

Even the volumes have dropped significantly, corresponding to about 14 billion dollars, without considering yesterday’s day which counts about 22, against the 50 billion of three months ago. At present, CoinMarketCap does not show any cryptocurrency in positive, over 40 billion dollars of capitalisation have been burned in a single day.

Marvin Chebbi, a twitter user, pointed out that the “break down of the ascending triangle doesn’t necessarily mean the end of the bull market”:

A break down of the ascending triangle doesn’t necessarily mean the end of the bull market.

We had a similar price action in June 17 with some sort of descending triangle formation (lower highs+equal lows) that broke down and found support a bit lower.

This is not over yet ! ???? pic.twitter.com/OCaKj8yCOz

— ????Marvin Chebbi???? (@marvinchebbi) September 24, 2019