In spot trading in the crypto market, the last 24 hours have seen operators take a break, trying to understand the trend of the next few days, whether the downward force will continue to prevail, or if, as was the case statistically in the last two months, after 4 days of decline the Bulls begin to reappear.

Today this trend is confirmed and the green sign clearly prevails, with over 80% of cryptocurrencies in positive territory. These are increases caused by a reaction, to the profit-taking, arrived after two days of decreases with losses of 10%.

The attention is also turned today towards the Bakkt platform that just over a month ago launched the futures backed by physical bitcoins. Wednesday, which saw trading reach 650 contracts in 24 hours, marked a new record three times higher than the previous one. Yesterday, despite the contraction that resulted in about 324 contracts traded, still managed to set the second daily trading record since its debut.

The bearish movement that is bringing the 5th most negative week for bitcoin to a close, since the beginning of July has seen the third most serious sell-off in the last two months, with BTC losing over $600 in just over two hours, waking up traders who had been following the daily spot trading in sharp contraction for over two months.

On a weekly basis, among the balances of the top 20 crypto, the red sign prevails, with the first three, bitcoin, ethereum and XRP, which lose about 5% from last Friday’s values. Litecoin and Binance Coin also lost 5%.

On a daily and weekly basis, Bitcoin Satoshi Vision is highlighted, which is now pushing to earn 20%. Added to this is the good performance of the last few days that amount to a 30% increase on a weekly basis.

However, this is a movement due to speculation, driven by the announcement of the hard fork that will be implemented next February 2020.

The day as a whole is in positive territory, although the increases are still very contracted.

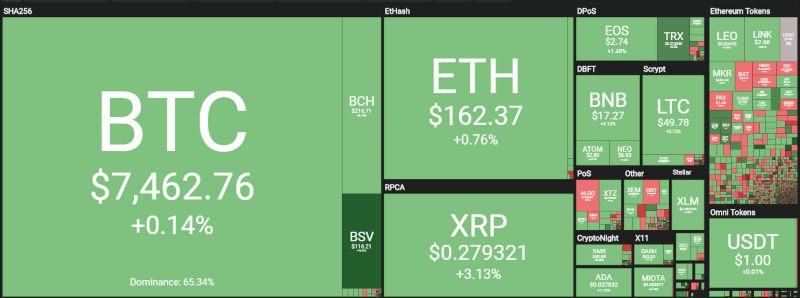

Bitcoin oscillates just above parity, Ethereum earns 1%, while Ripple performs better rising 3% and pushing toward 28 cents with the ambition to recover the 30 cents of the dollar, which has already tried to break in recent days.

Total capitalisation recovers $3 billion and remains at its lowest level since last May at $206 billion.

The dominance of bitcoin drops to 65.5%, the lowest level recorded since last July. Bitcoin returns to the levels of three months ago, but this is not leveraged by Ethereum which remains at the levels of the last two days just above 8.5%.

While it continues to erode small market shares, Ripple benefits from the stability that allows it to better contain the bearish sinking of recent days, so much so that XRP on a weekly basis has lost 3% but remains closer than the others to the highs of recent days.

The market share benefits from this, rising by a few decimals to just a few points from 6%, the highest level since last June.

Bitcoin (BTC) trading

Bitcoin continues to face the support of the 7,500 dollars, with volumes that contract and do not sweep away any new bearish threats that would push prices, in case of breakage of the 7,400 dollars, to test the next medium-term support at 7,200 dollars, endangering the long-term support related to the annual cycle identified in the $6,800 area.

For bitcoin, it remains important to show signs of a reaction in the coming days and try to reverse the bearish trend. From the highs of the end of June, bitcoin marks a balance of -45%.

Ethereum (ETH) trading

Ethereum continues to defend the support threshold of 155-160 dollars, a level that if violated would make Ethereum drop towards the 125-130 dollars area.

This would be the confirmation of the reversal of the current annual cycle started by the lows of mid-December last year.

For Ethereum, the breaking of the triangle three days ago highlights the bearish trend started by the highs of late June and see a loss of 55% in value for the queen of the altcoins.

For ETH it is important to recover as soon as possible the 175-180 dollars area to give the first indications to the rise.

Ripple (XRP) market

Ripple, contrary to the two previous cryptocurrencies, despite the difficulties and the strong sell-off that two days ago caused it to lose more than 4 cents of a dollar in a few hours, continues to give a medium-term bullish technical signal on the current monthly cycle that began with the lows at the end of September.

If XRP exceeded 30 cents of a dollar in the next few days, it would give the first signal of the bullish cycle that has been missing since last July, reversing the trend also on a quarterly basis.