BlockState, together with the Frankfurt School Blockchain Center, today published a detailed report on the state of the art of the crypto market in 2019, interviewing more than 200 companies in the sector, including 17 banks, especially Chinese.

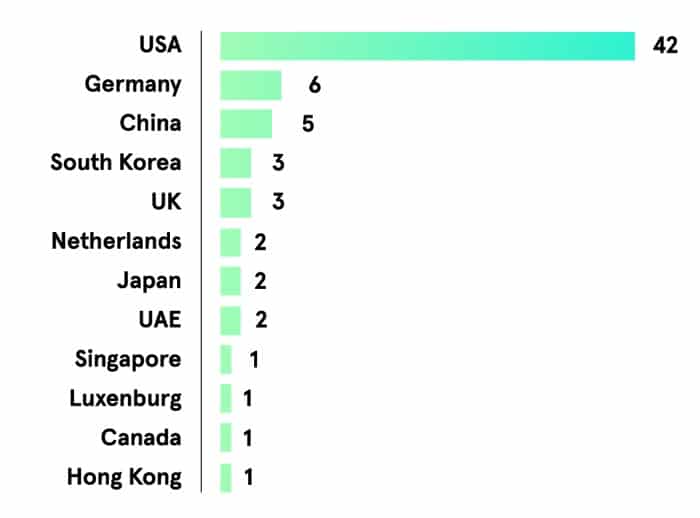

Overall, Europe is definitely the leading giant, with 88 companies identified, located mostly in Germany, Switzerland and the UK, whereas in the US the companies analysed were 83: generally speaking, in Europe there are more insurances, while in America there are more investors and funds.

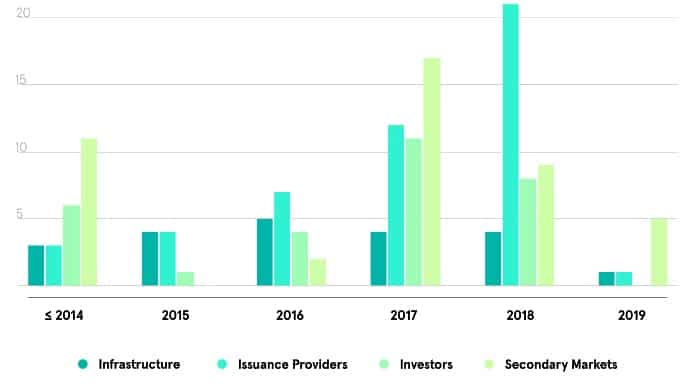

In fact, most of these companies were incorporated in 2018, as can be seen in the chart below taken from the report itself:

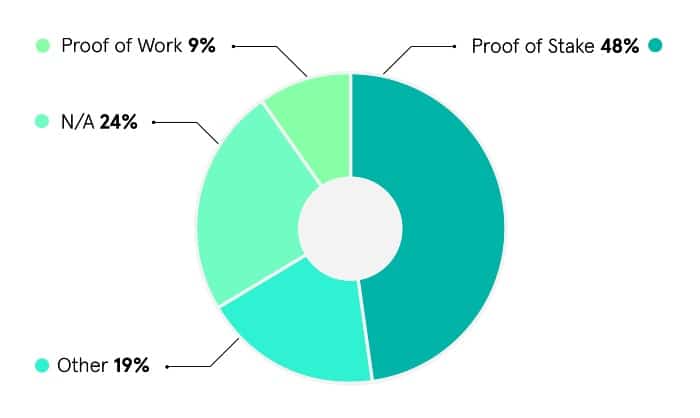

The new blockchains and their consensus method

Among the new blockchains, 46% of which are public, Proof of Stake is the dominant consensus algorithm, reaching 48%, most likely as a result of Ethereum changing its verification mechanism in 2020.

The role of STOs in 2019

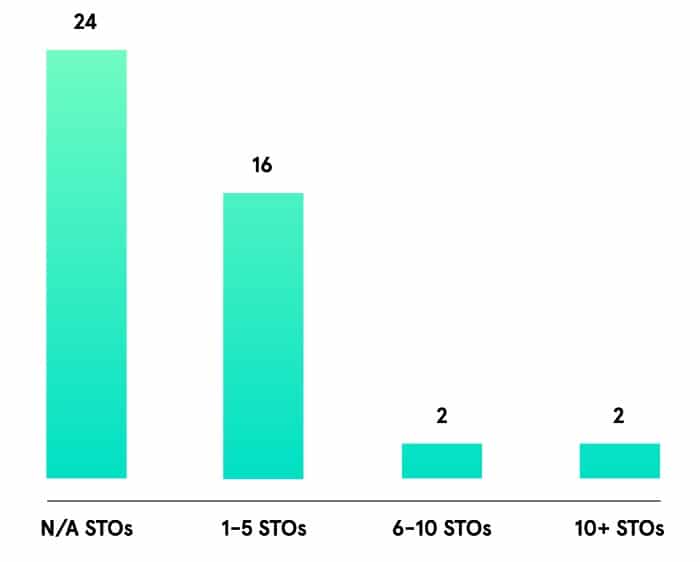

It is likely that after the ICO boom of 2017, in 2019, but especially in 2020, it will be the turn of the Security Token Offering (STO) boom.

Despite the sometimes uncertain regulations, the US is the leader of the STO phenomenon, despite the fact that it is still very limited, with an average collection of $3,400,000 using Stellar and Ethereum as blockchains.

Companies that have decided to act as issuance providers for STOs, on average, have only launched between 1 and 5 STOs.

As for secondary markets, however, the highest percentage of companies is responsible for the custody of cryptocurrencies (56%), while 39% are wallets, both custodial and non-custodial.

But the most interesting part of the report is the one dedicated to banks and financial institutions that have decided to become part of the crypto and blockchain world. In total, as mentioned above, 17 banks around the globe were examined, 9 of which have tokenised assets for more than a billion dollars (1,573,300,000 USD).

Most of them are corporate banks (34%), while investment banks are only 24%.

Among the banks that have pledged most in this area are the Agricultural Bank of China, Bank Frick of Liechtenstein and Bank of Communications in China. The latter alone has tokenised assets for 1,300,000,000 USD.