After the strong rises recorded last week, among the best in the last semester, the prices of the major cryptocurrencies are trying to pinpoint the support levels from where to restart pursuing the highs recorded on Saturday. This can be noted in particular with the queen of cryptocurrencies, Bitcoin, which is now trying to consolidate the support levels from which to initiate the bounce to overcome last Saturday’s relative highs, which would give further confirmation of the bullish trend that has been developing since the lows of mid-December.

Bitcoin suffered a strong downward movement during the day on Sunday, when in a few minutes it registered a drop of over $500. This has increased volatility on a monthly basis, which after hitting last quarter’s lows between late December and early January, with the movements recorded last week, has returned to 3.5%.

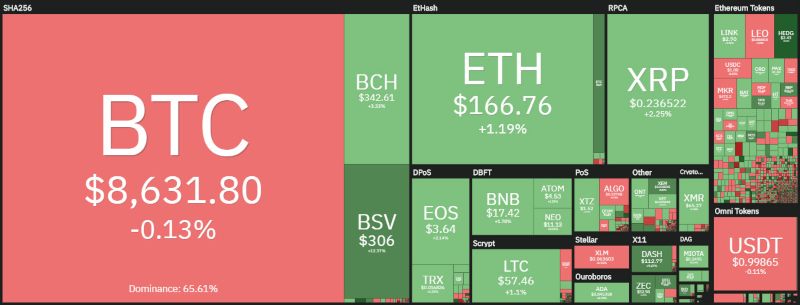

The day sees the positive sign prevailing, with more than 65% of cryptocurrencies above parity. Bitcoin SV continues to be characterized by strong upward and downward volatility. BSV is proving to mirror the controversial figure of Craig Wright. BSV is up 11% today.

A positive result also for Dash, which with a jump of 8% tries to resume the strong upward trend that in less than 10 days from the relative lows of January 10th to the highs of January 15th, has seen its value grow three-fold. This was followed by the profit-taking that brought prices down from $155 to $90 in the following days, more precisely on Sunday. Now Dash recovers the $110 and tries to form a support base in the $100 area. If it holds in the next few days, it would be a great support level to start from.

Ethereum Classic (ETC) does well too and is among the best altcoins of the beginning of the year. The rises on Friday, January 17th saw prices rise to $12, which ETC hadn’t recorded since September 2018. Now with the fall below $10 ETC is trying to climb above the previous high of the last year to shine again. The current uptrend would only be invalidated with falls below $7. ETC, which occupies the 16th position with a little more than a billion dollars of capitalization, today rises by about 5%, which added to the positive results it has been recording since the beginning of the year, sees a performance of almost 100% since the beginning of the year.

Among the best, there is also the other fork of Bitcoin, Bitcoin Gold (BTG), which in the wake of BSV has recorded triple-digit increases, while today gains 6%.

Among the privacy coins, there is ZCash, which today rises by 5%. This movement of consolidation that has been characterizing the market in the last 48 hours, sees the market cap maintain the 240 billion dollars despite the contraction of volumes in the last 24 hours to about 80 billion dollars.

It is important to note that last week’s rises have been accompanied by significant volumes, which have risen with trades of up to 150 billion dollars in 24 hours, such sustained movements have not been recorded since last November when the most intense rise on a daily basis was recorded.

The dominance of Bitcoin recedes by a fraction of a decimal point, falling just below 66% while Ethereum tries to climb above 7.7%, last week’s level. XRP also recovers, rising to 4.4%, which are levels that it had abandoned in early January.

Bitcoin (BTC)

After testing the bearish dynamic resistance just under $9,200 in the early hours of Sunday, Bitcoin now tries to stabilize the level of support in the $8,500 area, levels that it recorded with the drop on Sunday. Today BTC is swinging in the 8,650 area, an area that has characterized the movements of the last 12 hours.

The current uptrend, which started with the relative higher lows on January 3rd, will be confirmed with rises above $9,200. Otherwise, any further retracements will not have to worry investors, as long as prices hold the basis of support in the area 7,800-7,900 dollars, the previous short-term resistance.

Ethereum (ETH)

Ethereum remains well set, confirming the $165. To achieve the break of $180-185 ETH will have to validate the 165 support level in the next few hours.

Otherwise, it is necessary not to return to the $155 and then to $145. With prices above these levels, the trend remains set to rise in the coming days.