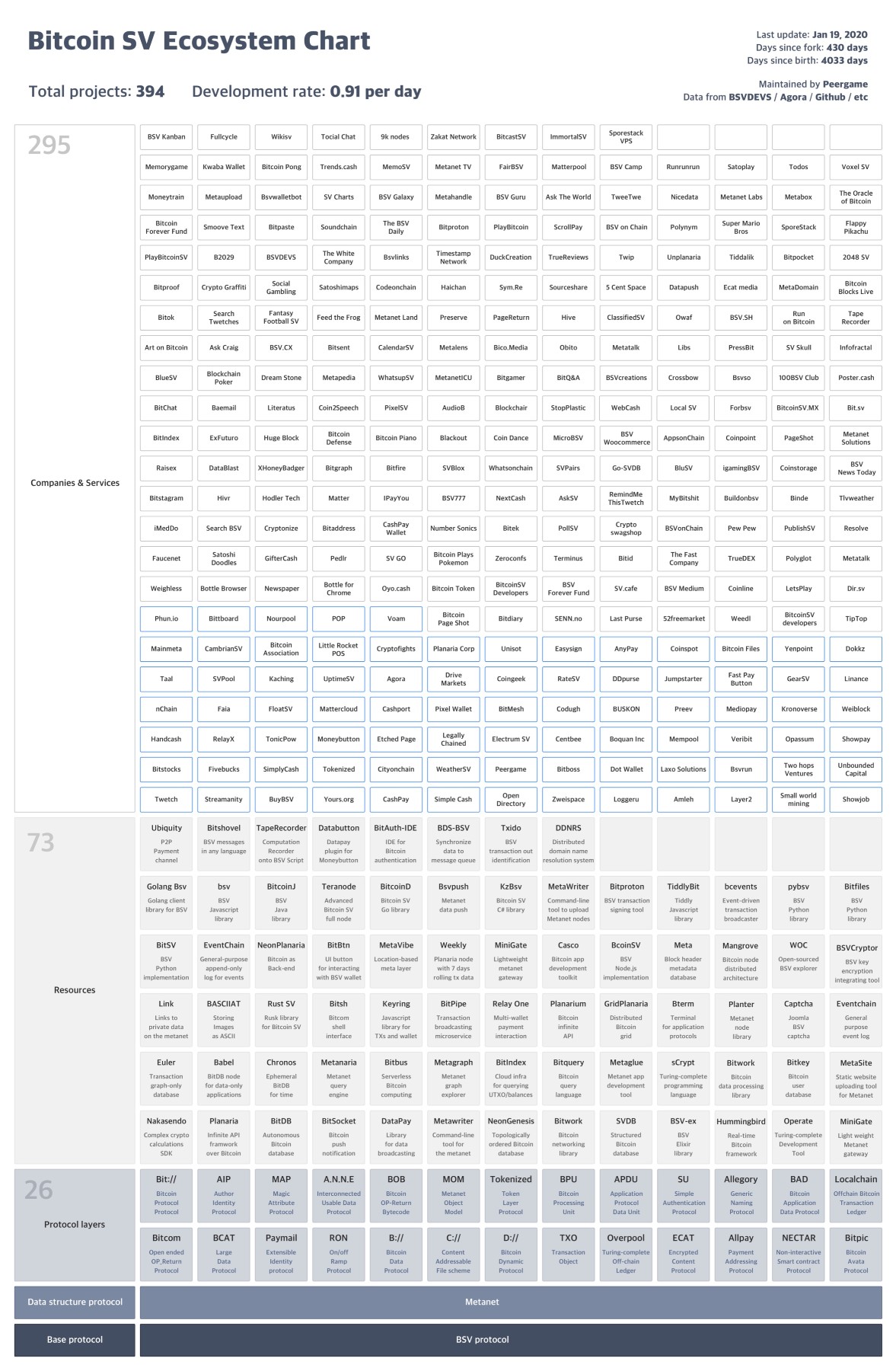

The Bitcoin SV ecosystem has rapidly grown to about 400 companies and projects worldwide. To be exact, 394 companies and services are trying to use this blockchain.

The rate of development is nearly 1 (0.91) new projects per day. The use of BSV extends across several areas, with a particularly strong presence in the United States, Asia, Australia and Europe. The information has been collected by BSV/DEVS, Agora.icu, GitHub, etc…, as communicated in a PR released today.

Bitcoin SV’s projects cover several industry sectors, with initiatives that are already implementing use cases involving entertainment, social media, gaming, supply chain, digital advertising, big data, Internet of Things, banking and, of course, payments.

Protocols and multi-purpose tools are also offered for tokenization and smart contracts, with a different approach than the one used with Ethereum’s ERC20 tokens.

The development of Bitcoin SV

BSV emerged just over a year ago, in November 2018, in an attempt to reconstruct a lost identity of what its supporters regard as the original Bitcoin.

What drives the growth of Bitcoin SV

The rapid growth results from simple reasons:

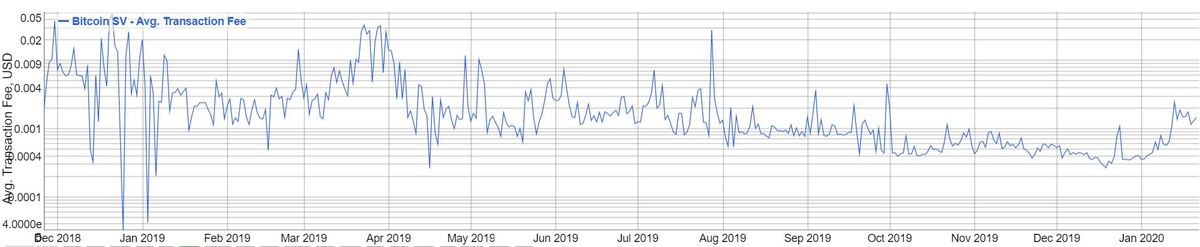

- Immediate scalability thanks to the removal of the block size limit, which translates into low transactional costs and fast network response speed.

- Low costs and speed depend on the miners’ ability to aggregate multiple transactions within the same block.

The block size limit has forced transactions to remain in the mempool.

The fee market born with RBF in the 2016 version of Bitcoin core 0.12.0, favoured a selection of transactions based on traffic and fees paid to miners to include the transaction in the block. This has generated an unforeseeable cost of execution that has not favoured, and does not favour, the emergence of projects in which the management of these costs is essential.

The use cases hypothesized on a blockchain that allows costs equal to the fraction of a penny are very different from those possible on a slow and expensive network that prefers an approach that limits the growth of the block and the weight of the entire blockchain.

That’s why BTC is referred to as digital gold and store of value. The killer application glimpsed by the Bitcoin core team, and the entire community that supports developments in that direction, is for the exclusive use of BTC as “hard money”.

This choice is also motivated by the fact that the growth of the block and the entire blockchain, in the eyes of some analysts, is impractical as a method of scaling, unsustainable and worrying for the decentralization of nodes.

The argument is divisive and needs more in-depth analysis, but the reality is that also the market is giving confidence to the BSV system.

If transaction costs decrease, the number of on-chain transactions increases as can be seen in the bitinfocharts charts.