Today the positive signs once again prevail and this strengthens yet another bullish week, particularly for the price of Ethereum as well as Bitcoin.

For Bitcoin, in fact, it is the seventh week on the rise, something that has not been recorded since April-May last year.

For Ethereum, there are as many as eight bullish candles with higher highs and lows, and this has not happened since January to March 2017. The current week sees an intensity, in terms of an increase in price as a percentage that has not been recorded since May 2019, but a year ago, at today’s levels, this bullish movement from $185 to $280 had developed in only a week, while this time it has taken twice as long.

This, however, does not diminish what is happening for Ethereum and the same is happening for other altcoins that are further lengthening their rises during the course of this week and during the last few hours.

In fact, in this second phase of the day, after a slow start, rises and prices that are close to the recent highs are prevailing again.

The increases that have accumulated during the course of the week show an increase in confidence in the entire sector, so much so that the confidence index has risen to the highest levels, something that has not been recorded since August 2019. Meanwhile, volatility has fallen to 2.2%, the lowest level in five months. It is a mix that is giving more signs of strengthening than the current trend that has been going on for several weeks now.

Just in weekly optics, among the first 25 crypto with higher capitalization there are only two negative signs: Ethereum Classic (ETC), in 17th position, which drops by 2%, and Iota (IOTA) down by 4%, which is suffering the attack of a coordinating node that has been hacked and then deactivated to avoid theft within the network itself.

IOTA on a daily basis is among the few decreases among the main altcoin, yielding the 1.5% that goes to affect the weekly negative performance.

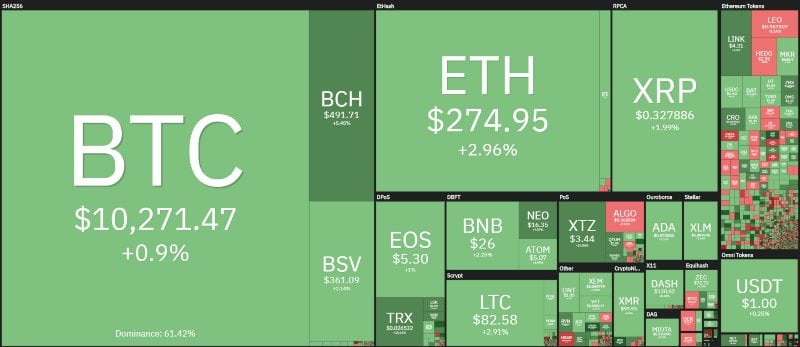

The capitalization is back above 305 billion dollars, higher levels than in recent months. Bitcoin’s dominance regresses and falls to 61.5%. Ethereum continues to rise and with today’s increases (+1.7%) brings the dominance to almost 10%. Ripple consolidated at 4.7%, a level recovered in the last 24 hours.

Bitcoin Price (BTC)

Bitcoin, after having slowed down for two days the climb that saw him regain the $10,000 and go up to $10,500 dollars, consolidates its prices in the area $10,200 dollars.

It is important for Bitcoin even over the weekend to stabilize above the 5 digit threshold, it would be a very important signal from a technical point of view.

Only a drop below $9,600-$9,500 would trigger a first warning bell but there is room for retracements.

Ethereum price (ETH)

Even better the technical structure of Ethereum that, despite yesterday’s retracement, confirms the climb and remains at $280 dollars, higher levels since July 2019. It is an increase that makes the prices double since the beginning of the year.

It is a signal that restores confidence in the queen of altcoin, a signal that has been missing since the end of the first half of 2019. There is plenty of room for manoeuvre even downwards. Only a return below $225 would give a warning signal, a level about 20% away from current values.

If over the weekend ETH confirmed the $255 could open to new extensions and this would be a very strong signal for Ethereum and a return of the second cryptocurrency by capitalization behind Bitcoin.