In a context characterized by uncertainty, investors are shifting their attention to other markets, including the crypto sector, which yesterday saw another sharp rise in cryptocurrency volumes, especially in the case of Bitcoin, which returns to trade $1 billion on a daily basis.

The day sees the highest trading volumes in the last two months: no comparable volumes have been recorded since January 14th.

It has been a bad day for the global stock markets, leaving behind the worst trading session in years. In just a few hours, the European stock exchanges have swept away the increases accumulated since the beginning of the year and have achieved the worst daily loss since 2016. The same trend, albeit more contained, for the American stock exchanges with less panic than the European markets and the Italian market in particular, but even overseas the listings are again preceded by the negative sign in terms of performance since the beginning of the year.

As a result, fear and tensions are returning in traditional markets, with US treasury bonds at an all-time low.

The performance of VIX, the index that measures the volatility of options, rose and closed yesterday at +45%, which in some parts of the day has gone over 50%. At the same time, Bitcoin’s volatility fell -75% from the highs recorded last February 20th, returning to the average that since last October has seen daily fluctuations on a monthly basis of about 2.5%.

At the same time, the prices of gold yesterday reached the highs of $1,700, the highest level unseen since the beginning of January 2013.

In a context of strong investor awareness due to exogenous tensions, gold is once again the main asset of choice. To date, all stock indices have been performing negatively since the beginning of the year, while gold has gained 10%. Gold is maintaining the bullish phase, together with Bitcoin, as being among the few positive assets since the beginning of 2020.

However, the negative sign continues to prevail in the cryptocurrency market today. Scrolling through the ranking of the first crypto assets by market cap, it is necessary to go down to the 34th position to find a positive sign, occupied by Algorand (ALGO) that even today deviates from the majority of altcoins by scoring a 4% on a daily basis. Despite this, Algorand continues to fail to exceed 50 cents, yet in such a delicate and particular context it still manages to maintain the positive sign.

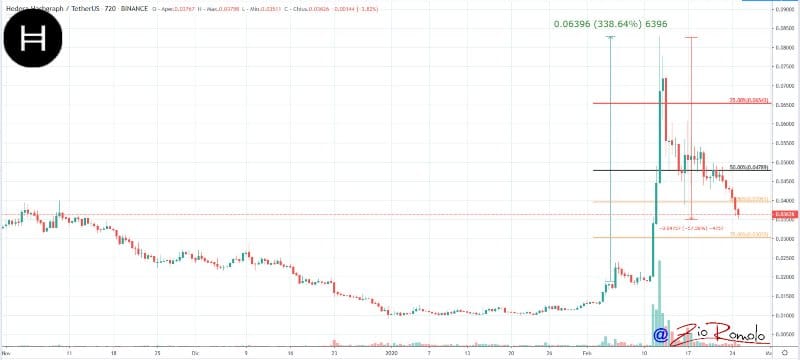

Among the worst is Hedera Hashgraph (HBAR) which, after being characterized in mid-February by a fourfold increase in prices, from the tops of February 12th began a descent that with today’s decline (-12%) cancels more than 50% of the bullish movement that had characterized it in the middle of the month.

The market cap is falling further back to just over 275 billion dollars. Bitcoin today loses 1.5% but returns above 63% dominance. Ethereum on a daily basis loses just over 3% but maintains its dominance over 10%, while Ripple is stationary at 4.3%.

Bitcoin (BTC) volumes

After having touched the tops on February 13th with the rise that reached almost $10,500, in the medium term Bitcoin continues a downward phase with lower lows and highs. Prices managed to stay above $9,600 confirming a phase of possible consolidation.

It is necessary for Bitcoin to keep prices above $9,500. In case of a downward extension, the next level of support is identified in the $8,800 area.

Ethereum (ETH)

Ethereum remains above $260, a key level that allowed last week to close the best weekly series of the last 4 years. But now this uncertain trend with the drop in trading volumes gives a hint of a possible bearish head and shoulders.

It is necessary for ETH not to go below $245 to avoid triggering this hypothesis of a technical figure that in case of validation could extend the decline beyond $225, a level of support that would indicate a first sign of danger for the intact bullish trend started from the lows of the first days of 2020. Ethereum, despite the difficulties of these days, gains 100% since the beginning of the year.