Chainalysis has published a report analyzing the bitcoin price collapse of March.

The most significant data that emerges from this analysis is the volume of BTC in and out of exchanges.

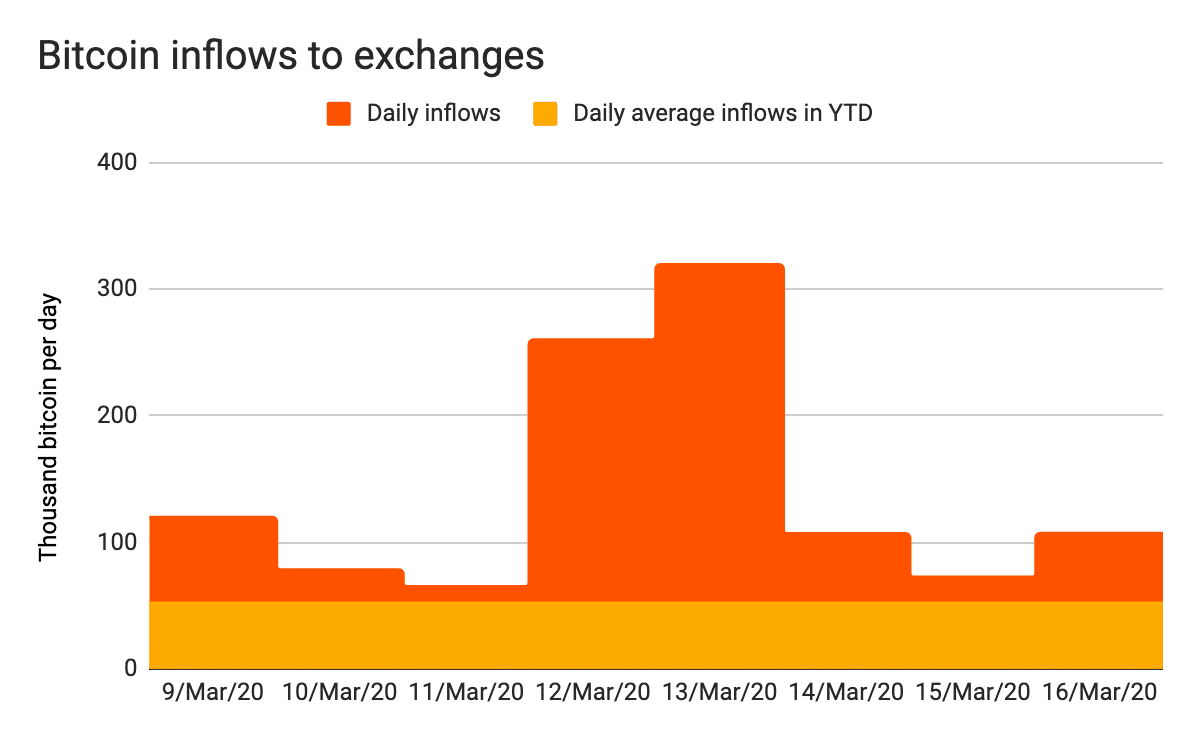

Chainalysis has discovered that in these days, exchanges have recorded the largest BTC inflows in their history, with a total of 1.1 million BTC deposited in eight days between March 9th and 16th, reaching a peak of 319,000 BTC on March 13th.

The daily average is usually around BTC 52,000, and between March 12th and 13th, 9 times the average bitcoin volume was deposited on exchanges.

According to the report, these deposits resulted in the sale of huge amounts of BTC, and the pressure generated by these sales led to a price drop of about 37%.

This pressure has now been reduced, in part because the volume of BTC entering the exchanges has dropped to about twice the average.

70% of these incoming BTC were deposited by professional traders and investors, although small retail investors also participated, as evidenced by the fact that the volume entering and exiting exchanges with transactions between 0.1 and 10 bitcoin almost doubled. But it was mainly transactions between 10 and 1,000 BTC that made the difference.

Although the data is still under investigation, Chainalysis claims that most of the sales were attributable to professional traders and investors, with small retail investors playing a significant but less important role.

It should be noted that 1.1 million BTC deposited between March 9th and 16th corresponded to more than $6 billion in bitcoin entering exchanges over eight days. This is an unprecedented figure, further reinforced by the trading volume figure.

Until March 8th, the average trading volume on crypto exchanges was just over 200,000 BTC per day, but between March 9th and March 15th, it rose to almost 800,000, equivalent to more than 4.5 billion dollars per day. This means 36 billion dollars traded in eight days.

These huge selling volumes were concentrated on seven exchanges, which accounted for almost two-thirds of the increase in deposits. Prior to March 9th, these seven exchanges averaged 249,000 BTC traded per day, and after that, the average rose to 790,000 bitcoin.

To date, most of the BTC that have entered the exchanges to be sold have actually been sold, and for now, the worst seems to be over. Moreover, the vast majority of BTC in circulation has not moved, revealing that the hodlers are still numerous.