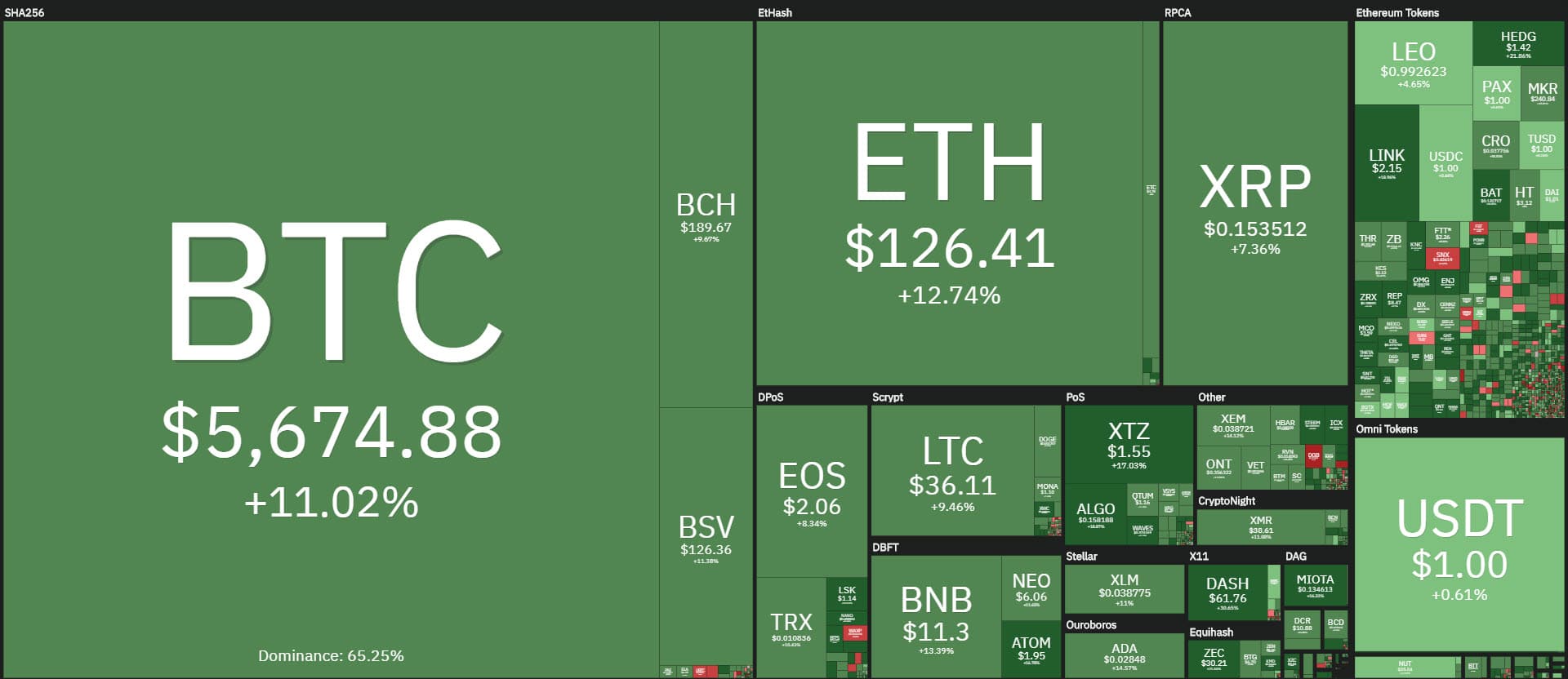

Bitcoin continues with a pullback of prices, returning to exceed the $5,600 threshold today, the highest level in the last 5 days, gaining 8% on a daily basis.

Ethereum (ETH) also keeps the pace, regaining the $125 with a rise of 8%, while Ripple (XRP) remains a little behind with a rise of +3.5%.

Among the big ones, the Tezos (XTZ) and Chainlink (LINK) pair, both up 15%, stand out for their rises.

Among the best of the day, on the top step of the podium, there is Steem (STEEM), flying over 150% on a daily basis, climbing up to the 40th position. Steem faces the fork expected in the coming days, leading the blockchain to return independent from Justin Sun.

Enjin Coin (ENJ) is also doing very well on a climb of over 50%.

Among the main altcoins, Dash (DASH) also achieved a 27% increase today, followed by the other two privacy coins, ZCash (ZEC) +17% and Monero (XMR) +8%.

These are signs that attempt to restore confidence after the beating of Wednesday, March 11th, which led all prices down.

The slowdown of Bitcoin’s declines and all the main altcoins coincides with the first signs of support stability and a possible reversal of the short-term trend. It is a movement in contrast to the stock markets that continue to see downward days. This scenario shows the first signs of a break in the correlation that characterized the downward trend of Bitcoin and the stock market.

On a weekly basis, some positive signs return, although marked by the performance of recent days. Among the green signs are Litecoin (LTC), which gains 4%, followed by Bitcoin Cash (BCH) with the same intensity, and Stellar (XLM), also rising by 4%, unlike Ripple which continues to fall by more than 3% on a weekly basis.

Remaining on a weekly basis, Ethereum, Tezos, together with Chainlink continue to be preceded by a double-digit negative sign with a drop of over 10%.

Volumes are increasing slightly and rising above $100 billion a day. The trades on Bitcoin continue to be very lively, with volumes over 1.5 billion on a daily basis, within the already high average of the last week.

The rise of Bitcoin today brings the market cap back to 100 billion dollars while the total capitalization returns to 155 billion dollars.

Bitcoin dominance is unchanged above 64%. Ethereum recovers the 8.5% threshold thanks to today’s rise, while XRP remains unchanged at 4.2%.

Summary

Bitcoin (BTC) pullback

After the collapse suffered on March 16th, with the double bottom test at $4,400, the pullback continues with prices that in the last few hours have been pushing, for a few minutes, above the threshold of $5,700, the highest level of the last 5 days and which is near to the short term resistance of $5,900, which had been pushed back twice during the weekend in the middle of the bearish decline.

The 5,900 remains a level of resistance to be monitored over the next few hours. A return below $5,200-5,000 is dangerous.

Ethereum (ETH)

Ethereum also rises again with prices above 125 dollars, a technical level that has always remained crucial in recent months and which corresponds to the minimum recorded in December 2019.

A break of $125 would in the first instance push prices to $135, the relative highs of the pullback recorded after the sinking on Friday, March 13th, that pushed prices below $100 for the first time, reviewing the $90 that ETH had recorded in December 2018.

For Ethereum it is necessary to regain the $135-140 as soon as possible in order to give a signal that consolidation is beginning and restore the bullish structure that was built in early 2020, swept away by recent declines.