A few days ago, a large number of ASICs related to the mining of the Bitcoin SV blockchain appeared, increasing its hashrate. They aren’t revealing their identity, by operating in an invisible way.

The new hashrate on the BSV chain is identifiable thanks to the Bitcoin code, which records the hash power dedicated to mining at every uncovered block.

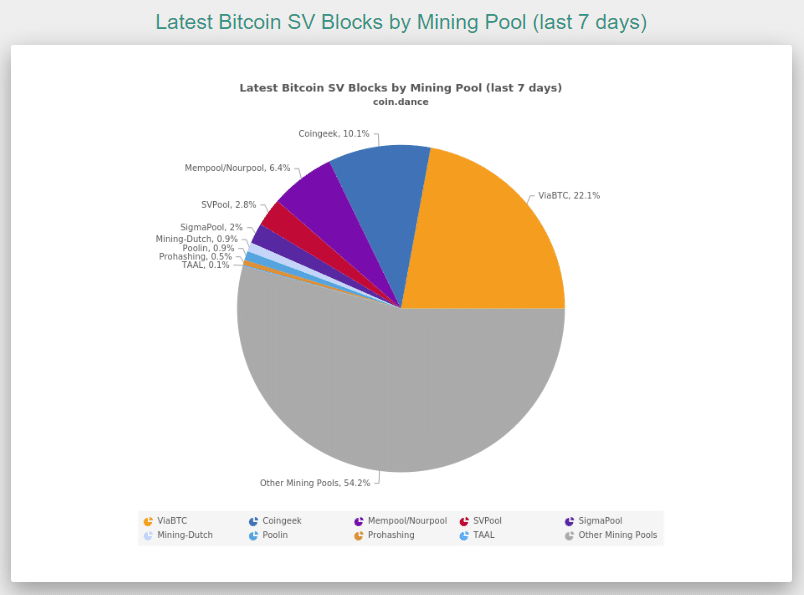

As can be seen with the Coin Dance service, the computing power indicated as “other mining pools” is well over 50%.

The event happened shortly after BTC’s prices collapsed. What surprised the observers is the fact that the blocks discovered by unknown miners do not collect transaction fees, so the electricity provided for the computation is only compensated by the block reward in BSV.

There are those who take this operation lightly convinced that it is a joke, others who consider the danger of a possible 51% attack, in the case that the pool is controlled by a few miners colluding against BSV.

😜Breaking:😜 $BSV being **trolled hard** "on-chain"

Unknown Miner/s collecting block rewards without recording any weather data or paid tweets

Has more hash power than your entire BSV country!

I smell an emergency fork in the oven, or a court case lol 🤣🤣🤣

😝😝😝#bsv pic.twitter.com/FrmdBiZQUg— Wild🃏 (@MADinMelbourne) March 23, 2020

There are those who instead prefer to see the operation as a bet on BSV and the increase in its future value, an indication that would justify the choice of unknown miners to mine now, before the halving of BSV that will take place in 15 days.

Halving is approaching for all SHA-256 cryptocurrencies, this is a very unique time after an exciting growth of Bitcoin’s hashrate.

The price has plummeted due to the cash out triggered by Covid19 while the difficulty for BTC has increased thanks to the increase of ASICs connected to the network competing for the reward.

This means that the profitability of mining has decreased for BTC, which holds a large slice of the SHA-256 hashrate available on the market.

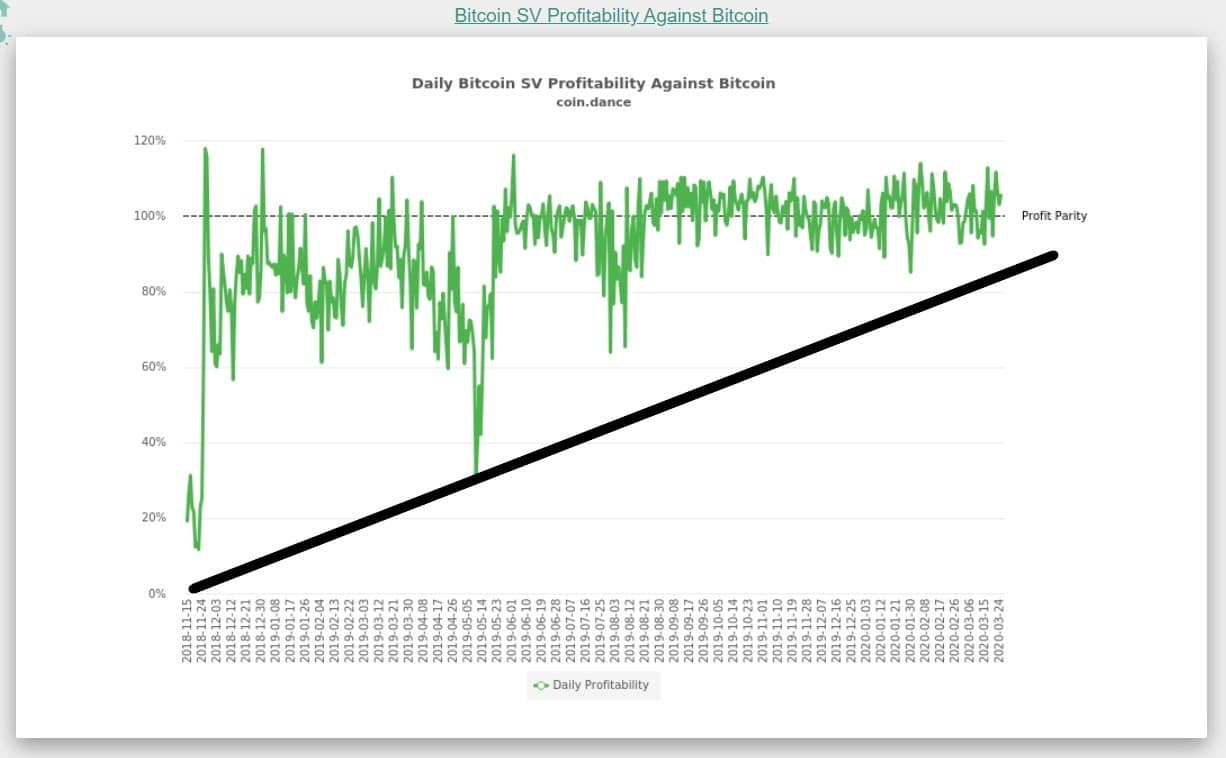

Since the birth of BSV, leaving aside the issues of decentralization, the patents of Nchain, Craig Wright and all the crypto-drama, a mere profitability calculation sees BSV increasingly interesting in the short term as far as profitability is concerned.

Just like BCH and BTC, every 210,000 blocks BSV miners experience a reduction in the mining reward which drops from 12.5 BSV to 6.25 per block.

Currently, miners contributing to the rest of the BSV hashrate include Taal, Coingeek, Viabtc, Prohashing, Mining-dutch, Mempool, Svpool, Sigmapool and Poolin.

The network will experience a reduction in the block reward in 15 days. Long before BTC which still has 46 days left until the halving. This difference is due to the first fork that saw BCH split from BTC.

Despite constant controversies, Bitcoin SV has gained more than 178% in the last year.

Some people claim that the price has been manipulated, although history teaches that on Bitcoin, whatever version it is, it often happens to hear this kind of claim.

The BSV chain has always been surrounded by controversy, ever since the fork, most of the chain’s transaction data comes from a Twitter-like application called Twetch and a meteorological platform that records meteorological data. Coin Metrics reported last July that 96% of BSV transactions were derived from the WhaterSV application. In the last 24 hours, the BSV chain has processed 599,851 transactions with an average block size of around 1,795 MB.

BTC miners face a rapidly approaching future where the market price of the coin may not rise enough to cover costs.

While financial markets face a possible global recession, investors have not yet rushed to buy BTC.

If processors continue to support the Bitcoin BTC network, they will have to perform twice as many calculations with a corresponding increase in electricity consumption to earn the same amount of Bitcoin they are receiving today.

This would be offset if many of them shut down in favour of a retargeting of the difficulty, which would increase the probability of mining a block.

The halving will force many to switch to new specialized high-performance hardware because older generation models like Antminer S9 are becoming uneconomical to run.

While some processors will be discontinued and the hashrate will temporarily decrease, new players will quickly take their place.

Many smaller companies may cease operations and end up selling their equipment to larger operators who are better prepared to optimize costs through economies of scale.