A new halving of Bitcoin Cash is imminent: it will probably take place on April 7th, 2020 with growing fears and expectations amidst analysis, calculations and many opinions.

Halving is the reduction of the inflation rate in the Bitcoin code by half. The reward to miners for adding a new block to the chain is halved periodically every 4 years.

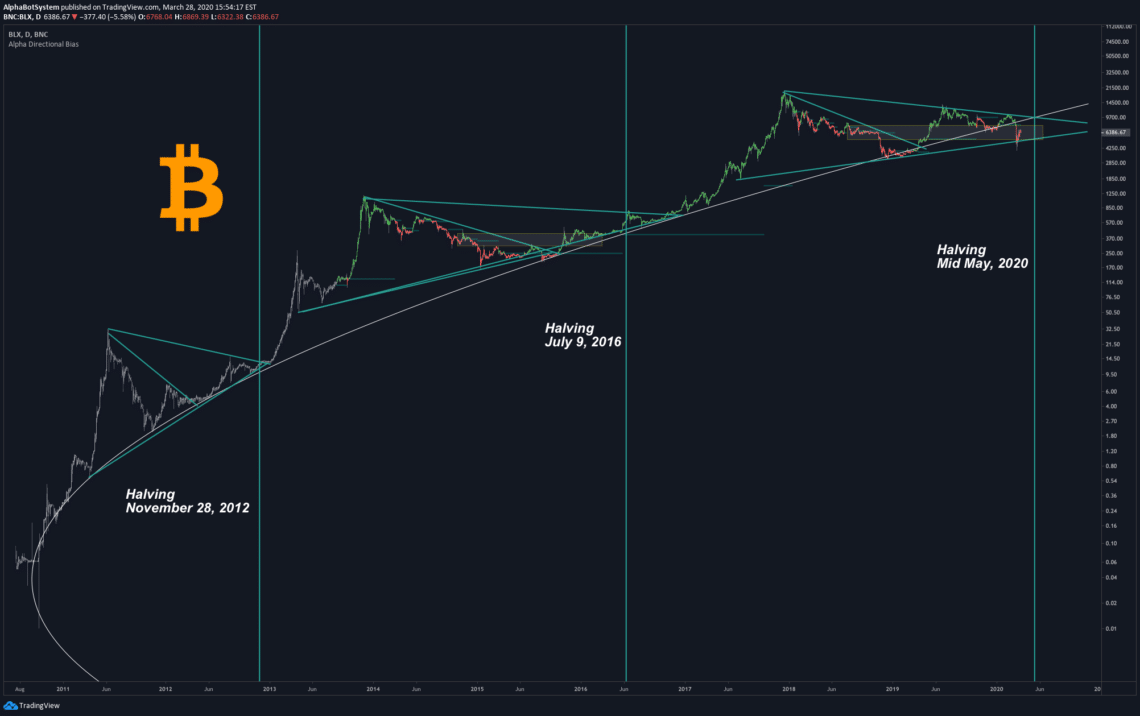

Comparisons with the past and the inflation rate shape the narrative of the Bitcoin (BTC) price. Its response to the halving events has always produced a strong price increase.

- 50 BTC every 10 minutes until the end of 2012;

- 25 BTC every 10 minutes until mid-2016;

- 12.5 BTC every 10 minutes until May 2020;

- 6.25 BTC every 10 minutes until 2024.

The first halving for Bitcoin Cash

Since Bitcoin Cash was born with a fork in 2017, it is facing its first halving in 2020.

By sharing BTC’s history until the moment of the split, it too is reducing the reward to 6.25 BCH. In fact, the two chains are the same age precisely because they shared the first years of life on the ledger.

- Many in the community believe that the project will experience the same fate as the chain from which BCH has split, thus leading to a desirable price increase;

- For many others, this will not happen and instead, there will be major security issues.

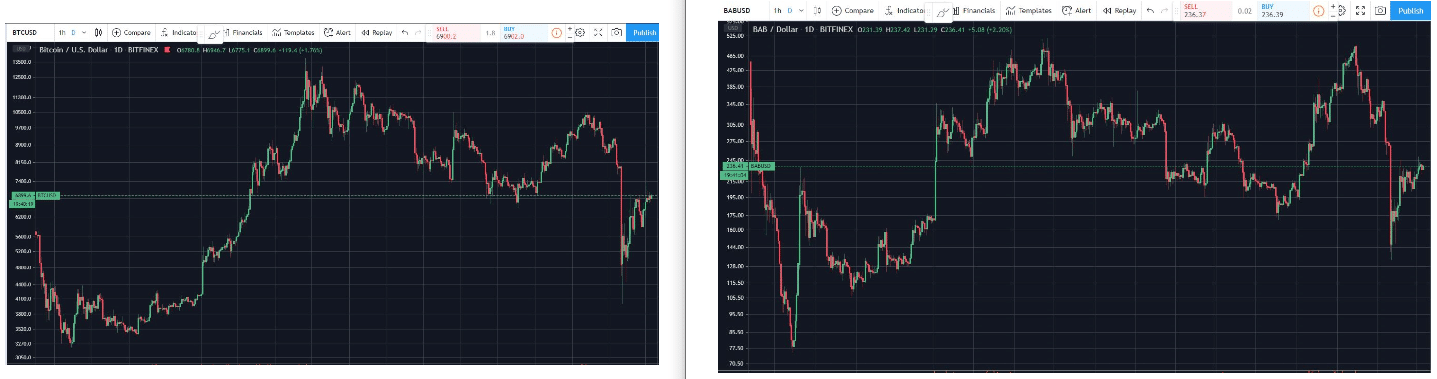

The price trend is not all that different and for this reason, the expectations are that the halving will lead to similar effects.

Roger Ver, referring to this halving in 2020, told The Cryptonomist:

“This is my third halving. Nothing exciting happened the last two times and I don’t expect anything exciting to happen this time either.”

The drop in issuance on the Bitcoin Cash network will change the inflation rate to 1.8% per year.

In contrast to traditional monetary policies, this model is intended to be successful when compared to that of central banks, such as the Federal Reserve, which claims to keep the inflation rate at 2%, but then reveals a realistic rate close to 10%.

Dangers for Bitcoin Cash

What is worrying, however, is not the external speculative dynamic but the internal one.

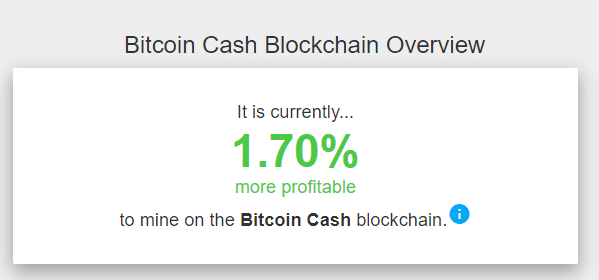

Many miners are focusing their computing power on the most profitable chains. At the moment BCH is supported by miners not only because of its fundamentals but because it is interesting in economic terms.

Upon lowering BCH’s profitability (ahead of BTC), there may be a decrease in hash power which will migrate to BTC. BTC will remain more profitable until May, the month of its respective halving.

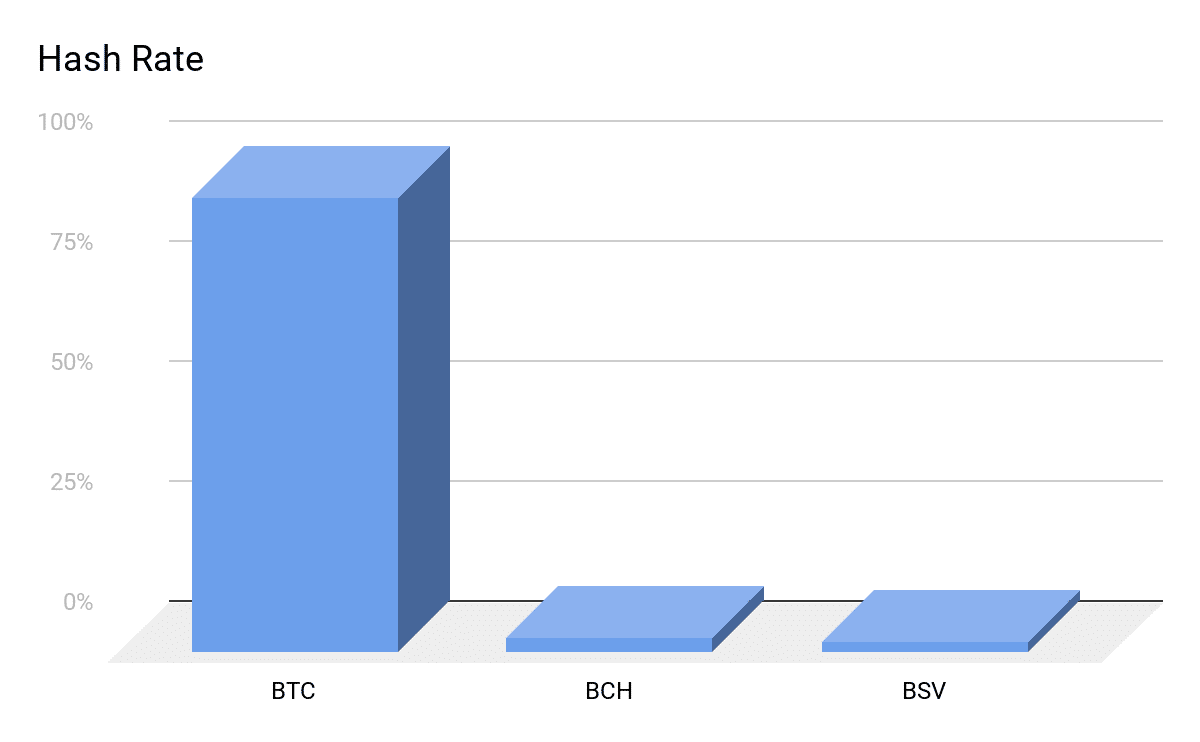

BCH’s hashrate is very low compared to the total power of SHA256 ASICs available worldwide. Any decrease could subject it to the risk of a 51% attack.

If now only 3% of the network is enough to attack BCH, after halving it could be 1.5%.

The reason why BCH has not been attacked to date is very simple: the network of miners considers the survival of the project to be fundamental, and with it that of BSV.

The two chains represent a defence against the scaling model set by the BTC developers.

Miners have no intention of hindering the development and maintenance of projects that through an increase in the size of the block, propose a scaling model more in line with what was foreseen by Satoshi Nakamoto’s whitepaper.

Why is the Bitcoin Cash halving before that of BTC?

The Bitcoin fork in August 2017, which led to the birth of BCH, included the implementation of a different adaptive difficulty adjustment algorithm than the basic Bitcoin (BTC) algorithm.

Amaury Sachet designed this system to avoid the inconvenience of lower hashing power in the first days of separation from BTC. The model served to avoid being overwhelmed by BTC’s computing power and survive the fork.

This algorithm was used in the first months by miners who varied their hashing rate from day to day accelerating the generation of new blocks.

The acceleration is the reason why Bitcoin Cash is now ahead of BTC, anticipating the block number that halves the reward.

In November 2017, a hard fork was implemented on BCH to solve the difficulty adjustment problems. After this fork, the block count from day to day was much more reliable and stable.