The trading volumes of Ethereum are going up today as yesterday.

Yesterday, in fact, the volume increase was reflected on Ethereum with a rise for ETH that was one of the best in the last period, with jumps that have exceeded even 15%, while its volumes marked the highest figure since mid-March with about 700 million dollars traded in the last 24 hours.

These are important trading volumes for Ethereum which have supported it upwards highlighting that for ETH yesterday was an important day.

After having pushed over 210 billion dollars yesterday, a level that had not been recorded since last March 11, today the total capitalization remains just below this threshold, but still highlighting how there has been a general recovery by the entire sector.

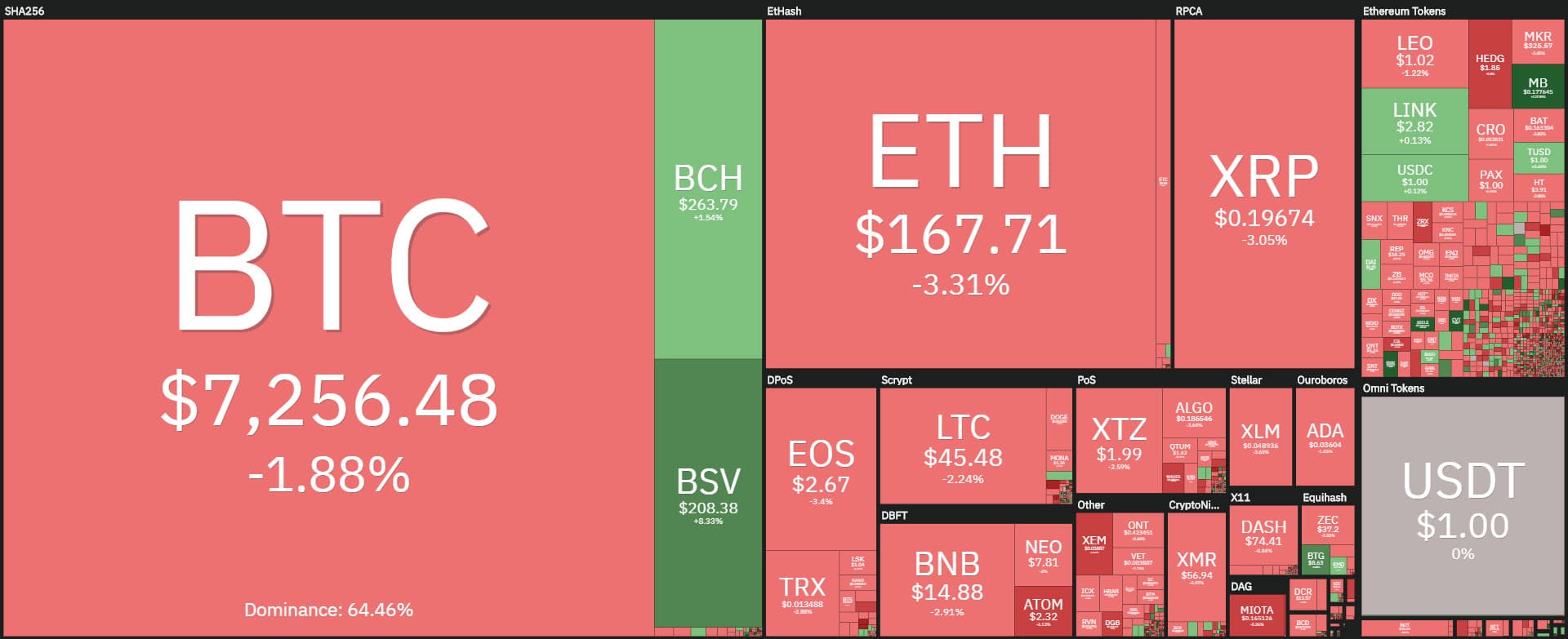

The dominance of Bitcoin remains around 65%, while those of Ethereum, which regained its 9% share, and Ripple at 4.2% have remained unchanged since yesterday.

When analyzing what has been happening since the beginning of April, the balance is decidedly positive with a generalized increase and leaps that at the moment go beyond the double digits. Separating the days between positive and negative, there is a substantial balance. From April 1st until yesterday there are 4 positive and 3 negative days.

However, unlike what happened between February and mid-March where the bearish days showed a much more evident downward pronunciation than the upward ones, in these last 4 weeks the bullish days are prevailing for intensity, highlighting how there is the desire for an upward turn.

This upturn sees the sentiment, the fear & greed index, stationary on the lowest levels of the scale of the last 18 months, returning after 4 weeks to rise above the level of 20 points, which still shows a prevalence of fear (fear and extreme fear are below 20 on a scale from 0 to 100) and gives indications of a possible change of pace.

This change of pace sees the recovery of more than 70% among the main cryptocurrencies, with the day turning green again.

Among the top 20 cryptocurrencies per market cap, however, the red sign prevails: Bitcoin (BTC) loses more than 1% and falls below the highs reached yesterday when it pushed just over $7,450, while today it is at 7,300.

Same bearish intensity for Ethereum (ETH), which sees the prevailing short term profit-taking. Ripple (XRP) also drops just over 1%. Among the top 20, the only green signs are those of Bitcoin Cash (BCH), Bitcoin Satoshi Vision (BSV), Tezos (XTZ) and Chainlink (LINK).

In particular, the day features among the biggest rises the direct cousins of Bitcoin that originated from the two different forks, Bitcoin Cash which rises by 6% and Bitcoin Satoshi Vision up 15% in some parts of the day.

Among the positive signs in the top 20, there is Tezos that rises 2%, as does Chainlink. Similarly to what happened last month, even during a not particularly euphoric, sluggish day, Tezos and Chainlink stand out for being the ones that instead are marking the most pronounced rises among the big players, albeit these are moderate rises.

Bitcoin (BTC)

Bitcoin confirms the bullish trend in addition to the new bi-weekly cycle started 10 days ago which continues to maintain the same bullish intensity as the previous one. This is a positive sign that will have to find further confirmation in the coming days with extensions above $7,800.

Bitcoin prices are currently in the $7,200-7,600 range which is now a resistance zone since it was already an important range between last November and December 2019.

Therefore, this current price level is very much felt from a technical point of view, so much so that it is also justified to take advantage of short term operators.

Ethereum (ETH)

Yesterday’s bullish push made Ethereum make up for all the time lost during the last two weeks when it was lagging behind in spite of all the other cryptocurrencies increasing, especially Bitcoin.

With yesterday’s rises, ETH has pushed for the first time since March 12th to review the $175 area. It is now close to the levels of the bearish trendline test that combines the decreasing highs since last mid-February. For Ethereum, yesterday’s rise has been accompanied by volumes, so it’s also logical or at least physiological to expect profit-taking as it would seem to be happening in the last 12-24 hours, but if this should continue without particular downward jolts, without retreats under $155 (now ETH is at $165-170), it would be a very positive signal. This would be a phase of consolidation before returning to the attack of the bearish trendline, which is currently between $185-190.

Only a return below $145 would give a first warning signal that would affect the rise initiated by Ethereum from the relative lows of April 5th.