Among the big cryptocurrencies, the deepest declines today are the prices of Bitcoin Cash (BCH) and Bitcoin Satoshi Vision (BSV), which, during the week, have shown both upward and downward volatility, with today’s volatility speculating downwards and towards selling positions.

For Bitcoin (BTC), volatility continues to remain at its maximum levels, the highest since January 2014. The price of Bitcoin today falls slightly more than +4% with the volatility that, after having pushed over 11% in recent days, levels which on a daily basis from a monthly perspective have not been recorded since January 2014, falls slightly below the threshold of 11%. This level remains very high, highlighting how this is a period of high tension.

April had started off on the right foot, but in the last three days, it is clear that the profit-taking has left room for the declines that have been prevailing in the last few hours and which bring out the most negative day of the month.

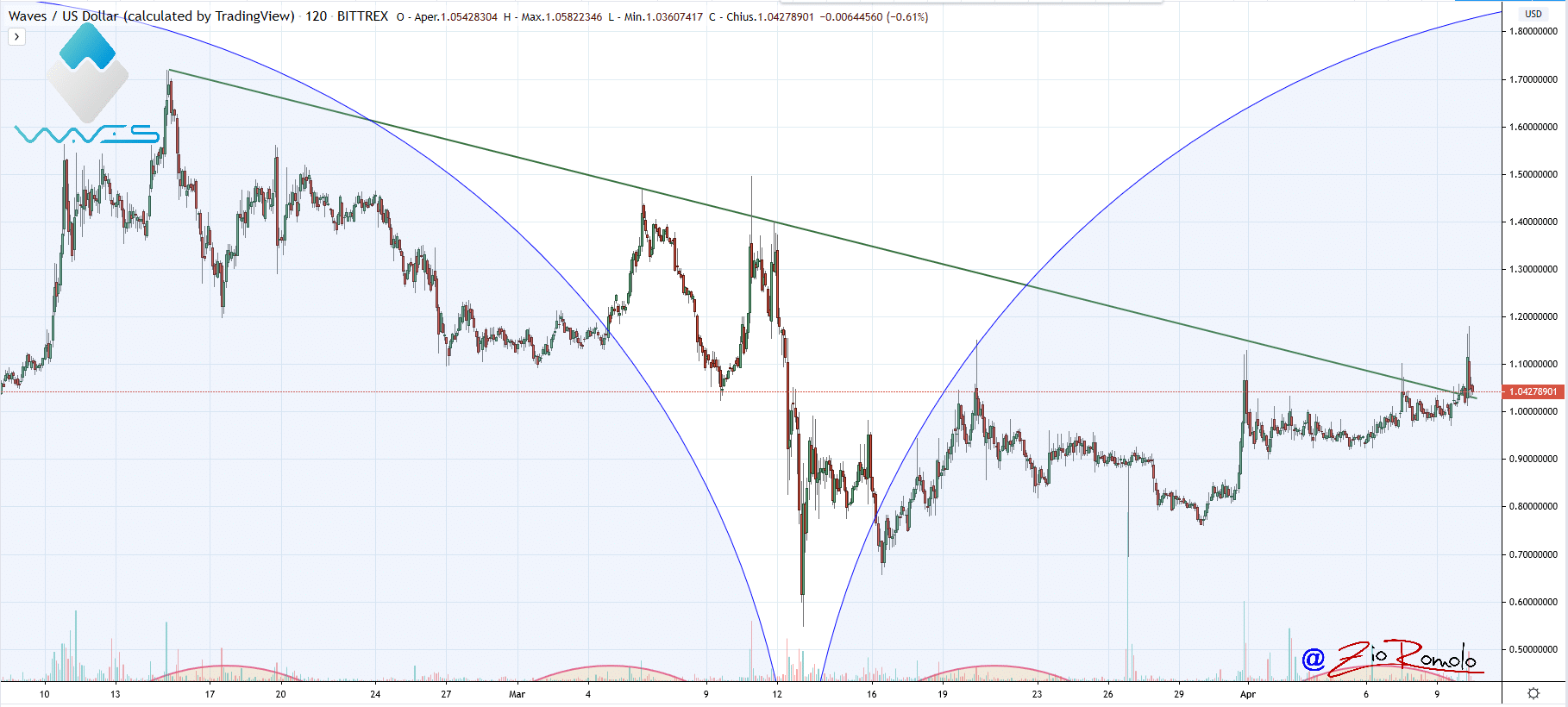

Going through the list of the first 100, there are only three positive green signs, Waves (WAVES), Swipe (SXP) and Hedera Hashgraph (HBAR). All three are not showing strong rises in these hours, but they all benefit from yesterday’s rises, which pushed the movement even double-digit. Today Swipe gains just over 1%, Hedera is just above parity, at 0.2%. Waves is the best of the day with +4%.

On the other side, there are several declines, which sometimes reach even more than -10%. Among the worst of the day, there is Algorand (ALGO). After testing the 20 cents in the last two days, Algorand sees prices retracing just under 18 cents, showing how the 20 cents, a support area between September and November 2019, has become an area of resistance after the mid-March declines.

The 20 cents are an area that in the last few hours has also seen profit-taking prevail for Ripple (XRP). After pushing above the 20 cent threshold earlier this week, a threshold that last March 12th had been the support level driven down and that pushed Ripple’s prices to their deepest lows since 2017, the 20 cent threshold has also made itself felt on Ripple in these hours when sales are prevailing.

Today’s declines bring the total market cap just below the $200 billion threshold.

The day also sees an increase in volumes on a daily basis, about 20% higher than yesterday’s trades.

The closing of today’s financial markets can be linked to the increase in volumes precisely in a short-term perspective, also because the attention of the operators remaining active in these hours is shifting to the cryptocurrency sector.

After three days of very narrow fluctuations, the increase in volumes is probably due to the closure of short-term speculative positions.

The dominance of Bitcoin remains unchanged at just over 64%. Ethereum drops slightly back to just under 9%, due to the price drop that loses about 7% from yesterday’s levels. Ripple remains unchanged from yesterday’s levels at 4.2% market share.

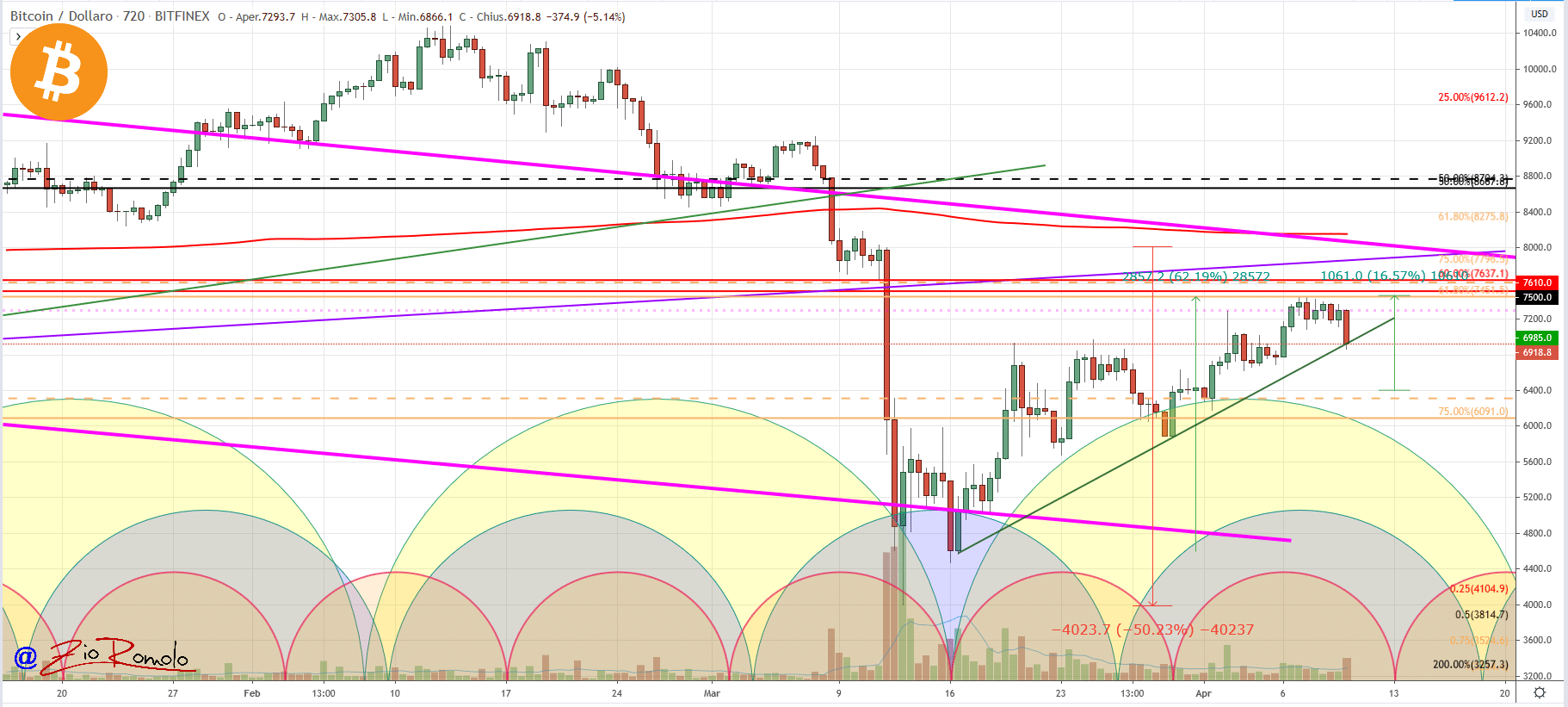

Bitcoin (BTC) price

Today’s decline brings the price of Bitcoin back below the psychological threshold of $7,000, a level that last weekend was a level of resistance, but which today coincides with the bullish trendline that is joining the rising lows after the sinking of mid-March.

It’s important for Bitcoin to keep the 6,900 threshold and not to go below the 6,700 threshold during the Easter weekend. A holding of the $6,700 and $6,500 would maintain a good bullish stance in the medium term.

Sinking below $6,500 would begin to create fear for this bullish trend that is still going on. On the contrary, a return above $7,500 would show a good bullish sign.

Be careful in the next few days during this long weekend as Bitcoin should start to conclude the second cycle at 15 days started with the lows at the end of March.

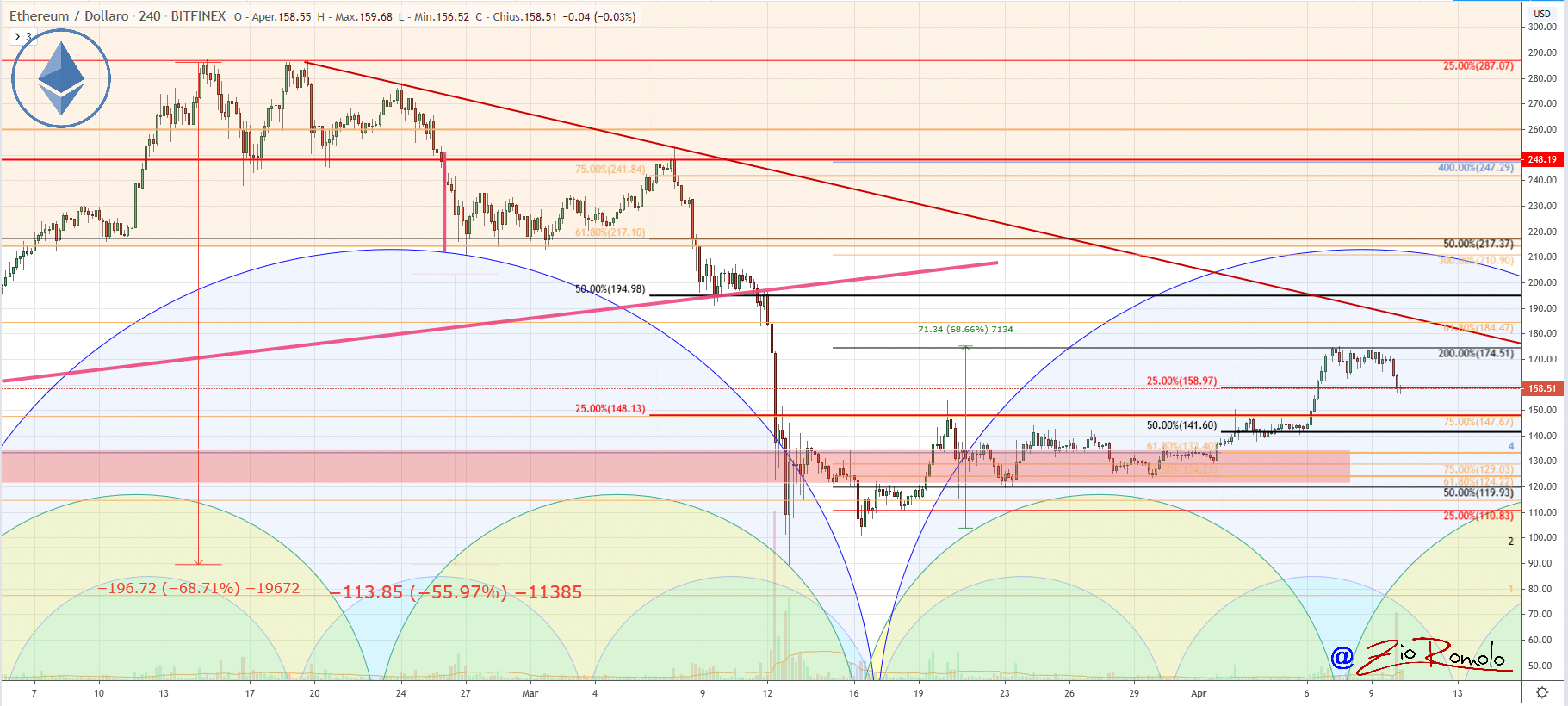

Ethereum (ETH)

The sinking of Ethereum sees the loss of more than 10% from the maximum recorded only 48 hours ago. Ethereum returns to test the $155 threshold. A level of support, formerly resistance, that in case of a further drop would open the doors to go to test again the resistance of March in area 145 dollars.

For Ethereum the trend, as for Bitcoin, remains set upward in a monthly perspective. Only a sinking under 140 dollars in the next few days would affect the uptrend built in about a month, from the lows of mid-March.

For Ethereum, the bullish uptrend started at the beginning of the week keeps good projections for the coming days. It is necessary for Ethereum not to go below the threshold of $145 and exceed this level unscathed beyond Easter Monday. If this were the case, the consolidation would open next week targets to go to test with greater vigour and conviction the $180-185, the threshold crossing the downward trendline that combines the decreasing highs since last February.