Grayscale has published a new report highlighting, among other things, the achievement of a new record for Ethereum.

The study is entitled “Q1 2020 Digital Asset Investment Report” and covers the first quarter of this year.

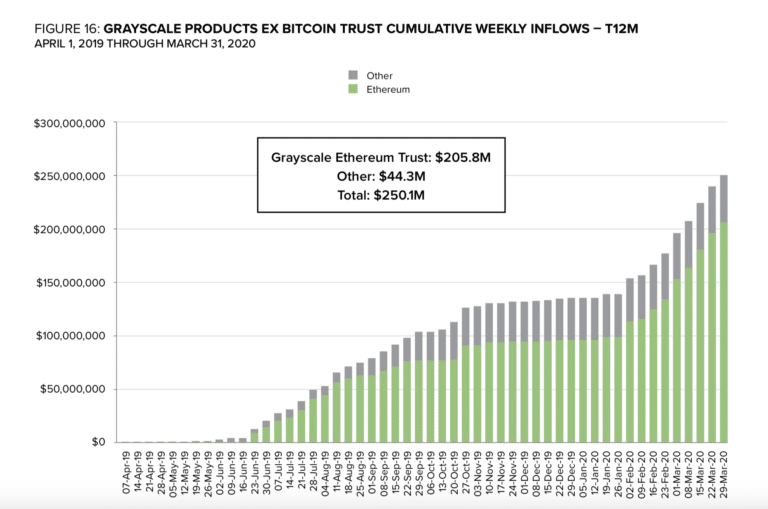

The record relates to Grayscale’s Ethereum Trust, which has set an absolute record for new quarterly capital inflows of over $110 million.

The record is tremendous because in the last two years the total capital inflows to this Trust has been 95.8 million dollars, so in just three months more capital has entered the Ethereum Trust than in the two previous years.

In addition, Grayscale raised a total of $503.7 million in the quarter, hence more than a fifth was raised by the Ethereum Trust.

In 2019, the fund raised 1.07 billion, so in the first quarter of 2020 alone, it raised half of what it had raised in the whole of last year.

As usual, it was the Bitcoin Trust that dominated, with 388.9 million raised out of 503.7 (77.2%), but with a lower percentage of collection than in the past, thanks to the resounding performance of the Ethereum Trust.

According to the authors of the report, these inflows came from institutional investors who decided to invest in BTC and ETH despite the financial market crisis.

In addition, analyzing the weekly inflows, it can be seen that the flow to the Ethereum Trust has been concentrated especially since February, with a steady growth even during the mid-March crash, although it slowed just at the end of March.

Moreover, just in the weeks following the mid-March collapse, inflows into the Ethereum Trust began to outstrip those to the Bitcoin Trust, suggesting perhaps a change of course on the part of investors.

Another indicator that seems to suggest that something is changing is the volatility of ETH.

According to Santiment, this could increase in the near future, due to the prolonged indecision of the market and the recent behaviour of miners and whales.

In other words, if a new bull-run on the crypto markets were to be triggered and the volatility on ETH actually increases, one could expect an interesting performance of this asset in the medium term.