From the lows of May 10th, the price of Bitcoin began to regain altitude after the sinking that had caused fear a few hours after the halving and is now back to a step from 10,000 dollars.

This movement is supported by the entire sector and has seen excellent reactions from some big names. In these last hours Ethereum, which last Monday saw the prices break the bullish channel that was accompanying the rises after the crash of mid-March, puts the turbo back and goes to regain the threshold of $215, moving decisively back into the bullish channel after a week of thrill.

Ethereum thus regains the relative highs of May, but it is still far from the highs of the last three months, which hit $226 on April 30th. Nonetheless, Ethereum achieves one of the best rises of this week with a jump of more than 7%, a high jump that is tarnished only by the Bitcoin Satoshi Vision‘s rise that among the top 25 is the best, scoring +8%.

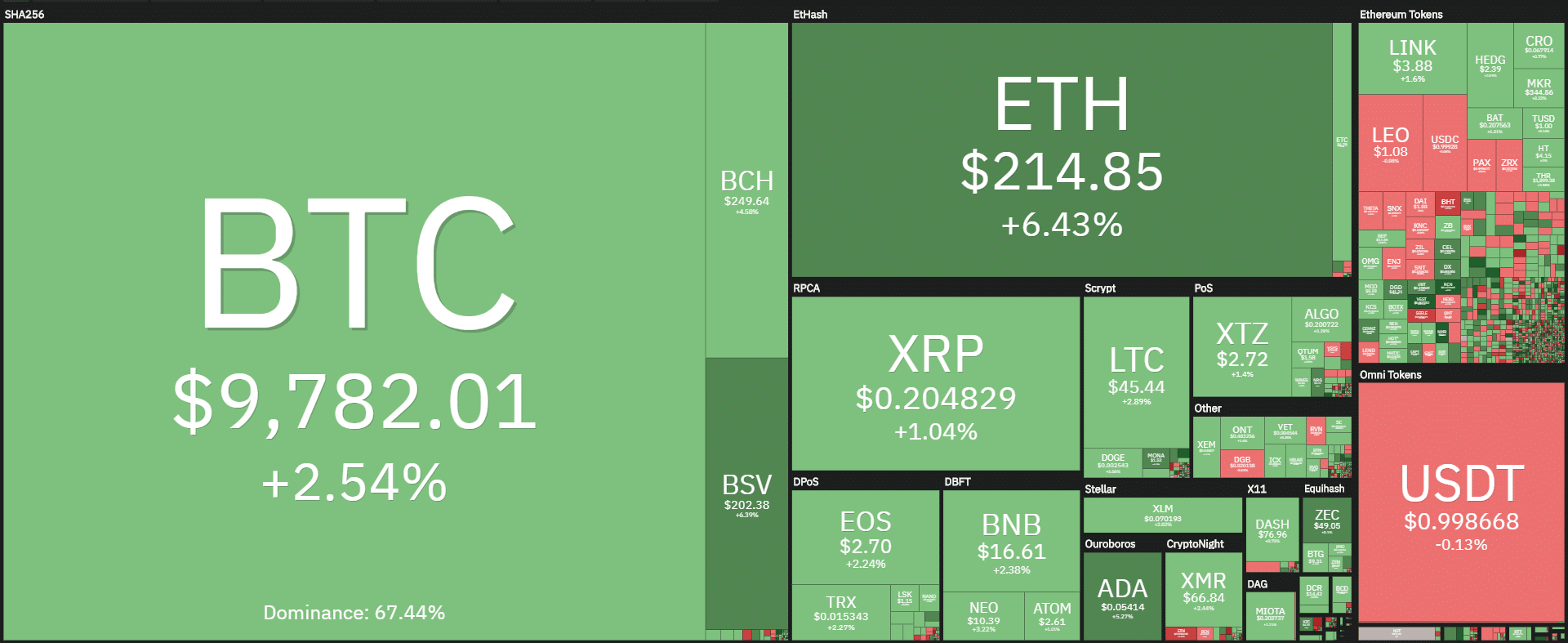

The day sees a prevalence of green signs for 80% of the cryptocurrencies. Positive signs also on a weekly basis: from last Monday’s levels among the top 30, there are no negative signs.

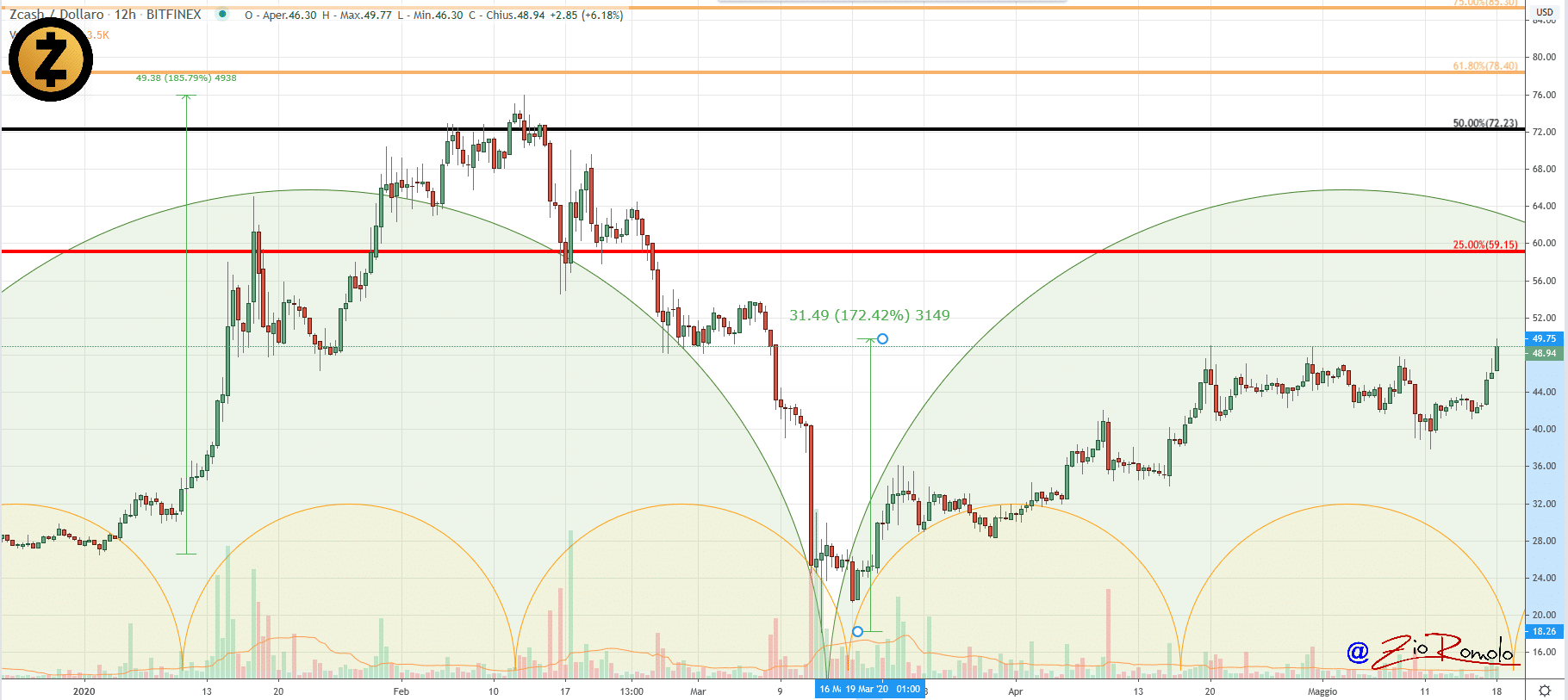

Among the best of the day, there is ZCash (ZEC) that with an increase of more than 10% sees its quotations regain the $50, values that it had abandoned at the beginning of March. With today’s jump ZCash sees a performance of over 170% after the risky sinking in mid-March.

This is the best performance since mid-March among the three privacy coins. Dash (DASH) today climbs more than 2%, but stops at 140% from March’s lows, while Monero (XMR), despite a good recovery after last week’s slide, regains $67 and goes on to attack the April’s high, $68, the highest level since March 7th, with a performance similar to ZCash’s, about 160%.

On the opposite side, the most pronounced drop is today for Electroneum (ETN), which slipped by more than 15%, but Electroneum does not put in the bag the strong rise of the last week that from Monday’s levels has seen a 160% gain by positioning itself on the weekly podium as the best performance among the top 100 capitalized.

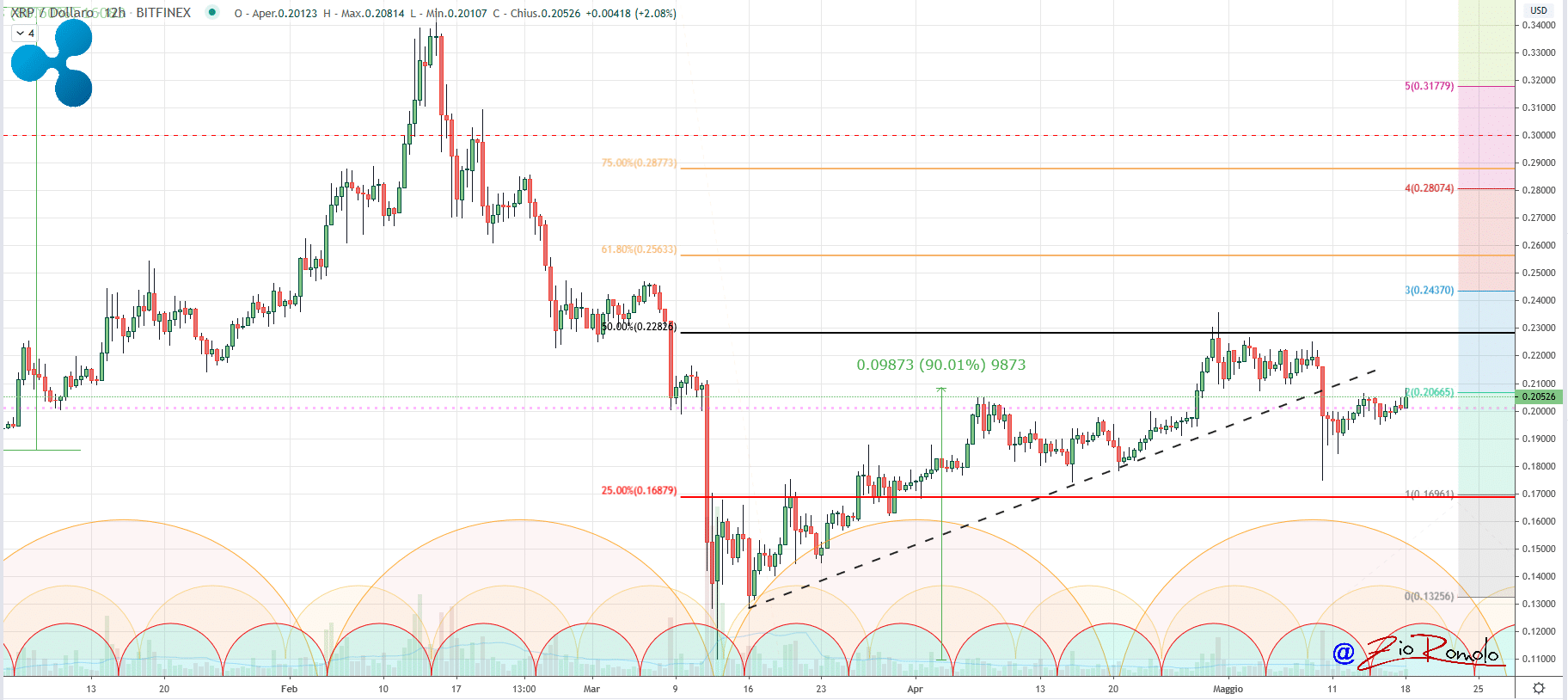

Among the top three crypto per market cap, the one that remains behind is Ripple (XRP) that struggles to rise despite a gain of 90% after the mid-March declines.

But Ripple, unlike Ethereum and Bitcoin that remain at the highest levels of the last three months, despite today’s rise of +2.5%, can not return above 21 cents.

From March’s lows despite the gain, Ripple remains the most restrained compared to the rises of Ethereum and Bitcoin that instead have gained more than 140%.

The weekend also saw good trades with Bitcoin that remains above the equivalent of a billion dollars in daily trades. Today’s day also recorded a total volume of 130 billion, an increase of 20% from yesterday’s levels.

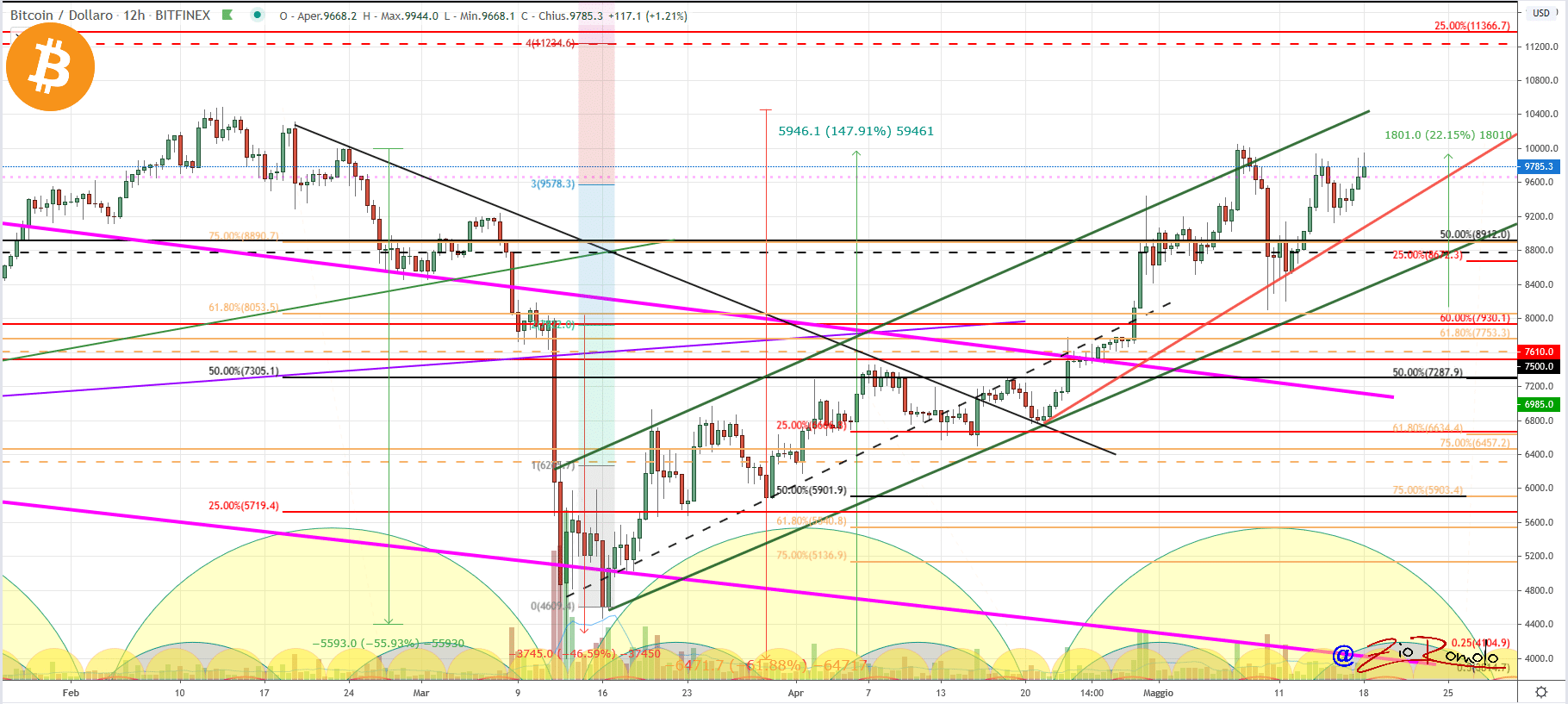

Bitcoin (BTC) at one step from 10,000 dollars

Bitcoin’s price is now one step from $10,000 and remains within the bullish channel which sees prices fluctuate in this bullish trend from the March lows. A possible extension in the next few hours above 10,050 dollars would attract purchases with the possibility of extending prices to 10,300 dollars, the tops of 2020 marked in mid-February.

For Bitcoin, at the moment there is absolutely no danger as long as prices remain as they are. First dangers would only exist with declines below $9,200. The first drop sees support in the $8,600 area.

If prices were to remain above these support levels there would be no danger for Bitcoin.

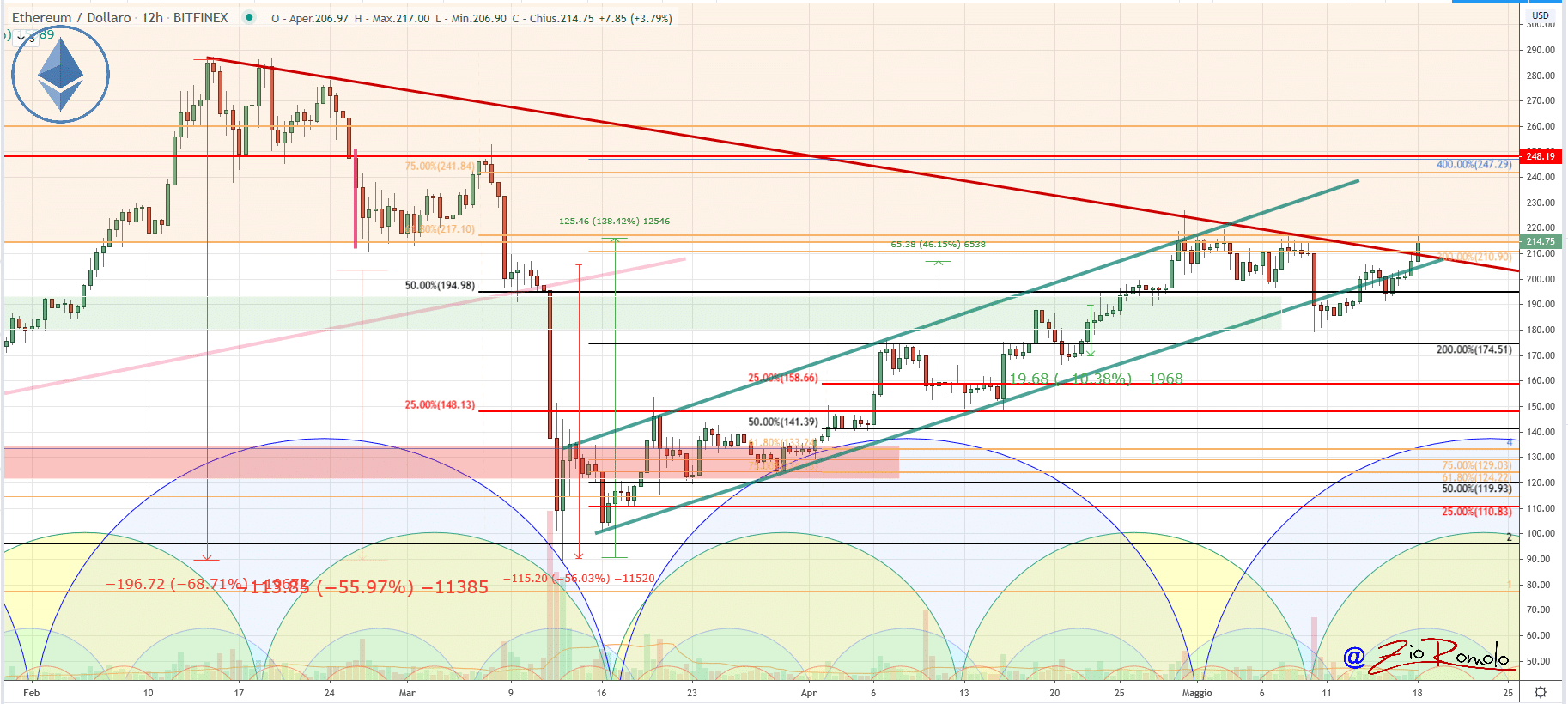

Ethereum (ETH) price

With the recovery of the $215, Ethereum is back in the bullish channel. A signal that in case of consolidation could lead to the attack of the $225, the levels of mid-April.

Ethereum at the moment remains uncertain: the technical analysis does not indicate the escaped danger because the breaking of the lower neckline of the bullish channel last Monday shows signs of uncertainty, so it is necessary, in the coming hours or days, to stay above the psychological threshold of $200 to consolidate the recovery.

Sinking under the $200 psychological area or under the $190 technical support could open a bearish trend for ETH, however, today’s bullish signal puts aside these fears present up to Saturday.