The day begins in green and Bitcoin’s golden cross signal is back, which should be evaluated carefully.

75% of the cryptocurrencies are in positive territory. It’s the fifth consecutive day on the rise. Yesterday, after a slow start in the second part of the day, there has been a return of purchases and prices have returned to review the highs of recent weeks.

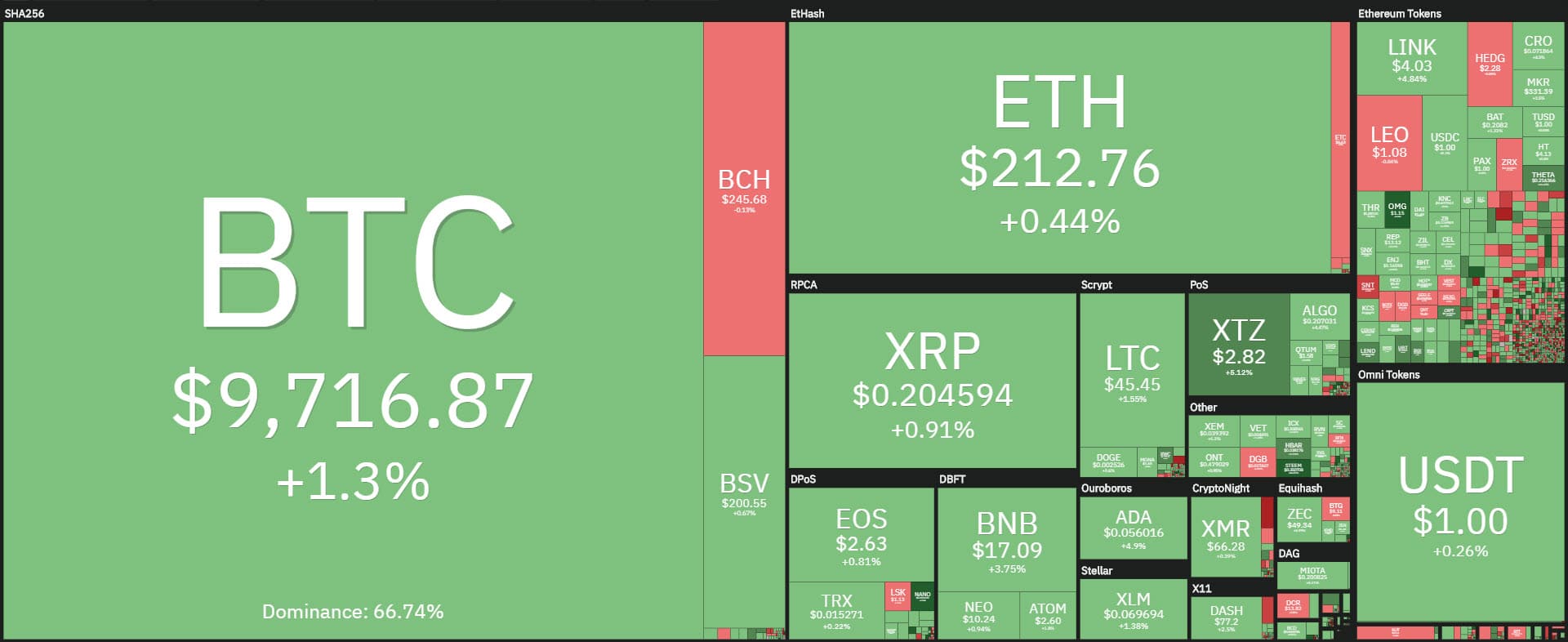

Scrolling through the list of the most capitalized among the top 30, there is only one red sign, that of Hedge Trade (HEDG) which slips by more than 3%. Among the big ones, the best of the day today are Tezos (XTZ) and Chainlink (LINK) which today rise by more than 5%.

Among the best of the top 100, the podium is occupied by Steem (STEEM) which flies more than 25%, followed by OmiseGo (OMG) and Theta (THETA) both up 15%.

All three share the common denominator of being part of the entertainment sector which in this pandemic period seems to be rewarded by traditional financial markets. Steem, a project founded in 2016, is a social media network that offers its community news content, Q&As and job ads, rewarding those who interact with tokens. Theta is a peer to peer streaming platform that offers content for sports, founded in November 2018, which also sees the involvement of Tencent Games and has a user base from eSports, a leader in sports content.

On the opposite side today there is Electroneum (ETN) with a drop of over 15%: it is the only one to see a double-digit drop. Electroneum continues to be highlighted for its strong upward and downward excursions during this period.

Bitcoin’s market cap grows

The market cap remains stable at $265 billion. Bitcoin continues to hold 67% of the market share with just under $180 billion of capitalization. This is a crucial level for BTC. This market share was only touched this year in mid-February, the highest level that had previously been marked only in September 2019.

Both Ethereum and Ripple prices are holding up well, both on the rise, Ethereum by 1.5% and Ripple just below 1% on a daily basis. Even on a weekly basis, they both rise, Ethereum with a double-digit gain of 12%, like Tezos, while Ripple rises by 3%.

Nevertheless, both lose market share. Ethereum drops to 8.3%, the lowest level since early April, while Ripple slips to 3.3%, going to update once again the lows of the last three years dating back to December 2017.

Bitcoin and the golden cross

Bitcoin tightens the range of the oscillations of the last three days, remaining close to the $9,900-10,000 threshold that becomes a psychological threshold and a crucial wall to break down.

Today comes the signal of the golden cross, the intersection between the bottom and the top of the moving average at 50 on the 200 periods.

The golden cross is a bullish technical signal that must be confirmed in the coming days. The last time the golden cross happened was last February 19th and it was an inauspicious signal because from that cross the prices started a descent that ended with the yearly low. It happened at current levels, with prices just below $10,000 but instead of giving a bullish signal, it ended with a sharp decline that led prices to lose 60% from the cross. There are several similarities.

Bitcoin, however, continues to give comforting signals with volumes that yesterday exceeded 2 billion dollars in value.

Prices remain within the bullish channel at the highest end and this is a comforting signal. Negative indications would only come in the short term with breakthroughs below $9,400. In the medium term, a worrying signal would only come with declines below $8,500 corresponding to the lower neckline of the bullish channel.

Ethereum (ETH)

Ethereum manages to stay just under $215. Even yesterday it tested this threshold, but the lack of major purchases means that in the short term the defence by sellers of this technical level prevails.

For Ethereum, the price fluctuations continue to remain within the bullish channel that last week was violated for most of the time and that currently sees the dynamic support passing in the $210 area, so very close to the oscillations of the last few hours.

A consolidation above $210 would bode well for a push over $225, which is the highs at the end of April and corresponds to the relative highs at the beginning of March, before the strong bearish movement that started on March 7th and ended the following week with the March 13th low, which saw prices fall more than 64% in a few days.

For Ethereum, it is important to maintain the dynamic bullish support in the short term. In the medium term, it is necessary not to go back under the $185 area, support violated last May 10th-11th.