The week is coming to a successful end, with Bitcoin returning close to $10,000.

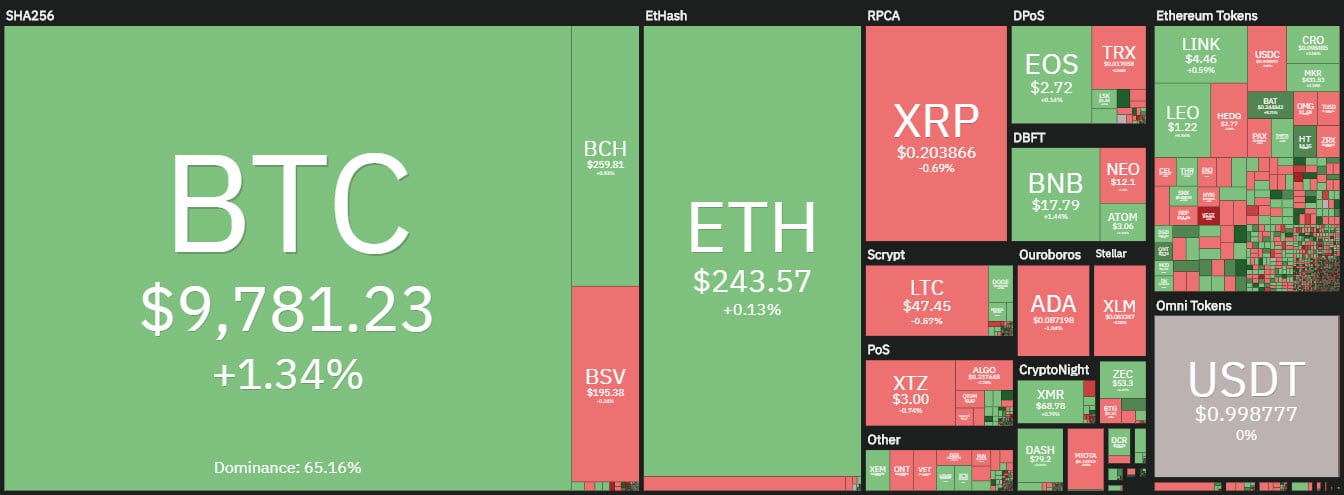

The green sign prevails again today for the third consecutive day. Scrolling the ranking of the first 100 capitalized, 60% are above parity.

In the top 10 per market cap, there is a balance between red and green signs. Below the parity Ripple (XRP) and Litecoin (LTC) with slight declines of 0.5%. EOS drops a bit more, although still just below parity, while Cardano (ADA) loses 1.5% following yesterday’s strong rises, with modest profit-taking prevailing.

The difficulty adjustment for Bitcoin, down 9.29%, represents the second deepest decline since January 2019.

Historically, there have been eight downward adjustments in the Bitcoin difficulty metric. The one in May 2019 was 15.95%, so the current one is the second deepest.

Estimates actually predicted a deeper decline. This indicates that many miners have abandoned mining, particularly those who no longer consider the activity profitable.

This drop in difficulty coincides with an increase in hashrate to 100 exahash/a and does not affect the bitcoin trend, which remains close to $10,000.

With the prices reached in the last few hours, Bitcoin goes to test the $9,850 after the downturn of June 2nd, before which it had recorded the highest highs since last February, with heavy sales that in just over 5 minutes have brought down prices by 5% to test the $9,150.

On a weekly basis, Bitcoin and most of the sector are recording gains that from last Friday’s levels are 3%.

Among the big names, Ethereum is doing much better, rising by more than 10%. Cardano‘s excellent performance stands out amidst the top players, and despite today’s setback, ADA has achieved an increase of 35%.

Cardano together with Zilliqa (ZIL) and VeChain (VET) are the best rises of the week with performances above 30%.

The market cap rose slightly, gaining ground to $287 billion. Bitcoin’s dominance remains unchanged at just under 65%.

The dominance of Ethereum continues to fluctuate just under 10%. That’s a good gain from last week’s levels when it was at 8%. Ripple continues to score new lows, still losing market share and falling just below 3.2%.

The price of Bitcoin (BTC)

Prices continue to fluctuate within the bullish channel present since last March. The test of the support of the lower neckline in the $9,150 area last Tuesday showed resilience with the return of purchases that in these hours push prices to a step from $9,900.

A recovery of $10,000 is needed over the weekend, which from a technical and psychological point of view would be a sign of strength.

Despite the lack of particular positive news, purchases remain tonic. In the last 24 hours, BTC has traded over $2.5 billion on major exchanges.

Ethereum (ETH) price

Ethereum holds the $245 and continues to provide a good bullish signal with prices remaining at the top of the channel that accompanied Ethereum in the rise last March.

For ETH, it is necessary not to go below $225 in the short term. Negative signals would come with slippages at $215.

A weekend climb above $254, the highest level recorded on June 2nd, would attract purchases with the next target area in the $275 area.

Eidoo (EDO)

Eidoo was among the best rises again yesterday, with the EDO token that after the announcement of the integration with PNT and the burning of the tokens saw an excellent reaction from investors. The surge in purchases has accompanied the rise that in the last few hours sees EDO touch $0.48, levels that had not recorded since August 2019.

Yesterday, Eidoo saw a daily performance of +50% in some parts of the day.

From the March lows, the EDO token sees its price multiplied by 15 times.