Three days after the launch of the Compound token, introduced on June 16th, COMP seems to be attracting investors who are pushing its price up to $167, with a 160% gain.

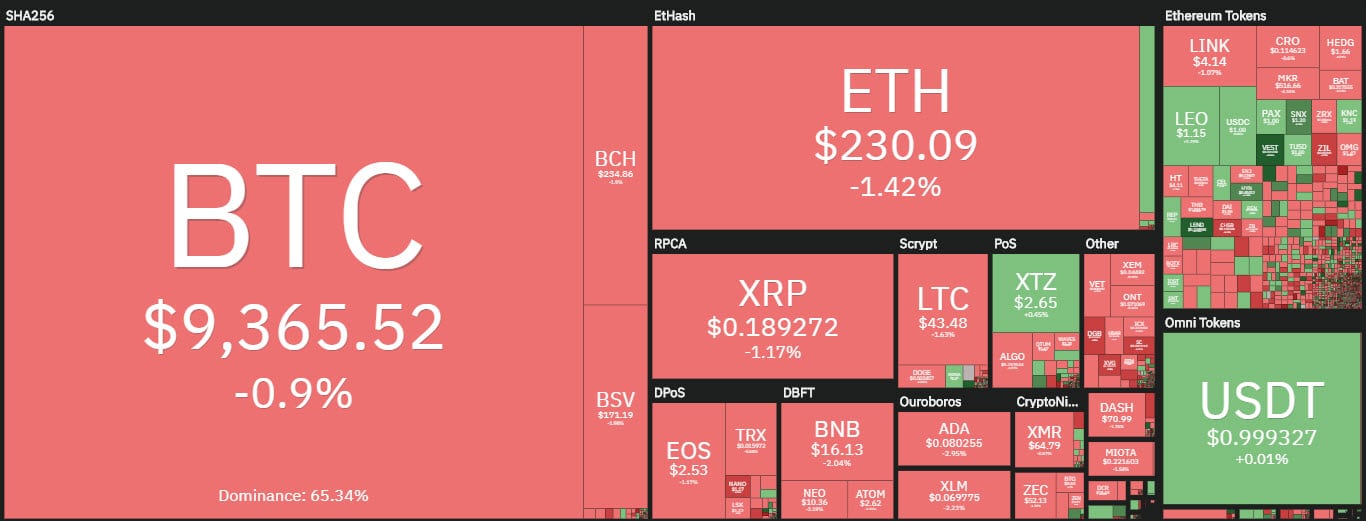

This performance is situated in a cryptocurrency market with a fluctuating trend. The central week of June is about to end with a negative balance.

There are still two days to go, but with Bitcoin closing below $9,350, this would be the second consecutive week in the red, breaking the record that from the end of March saw a strong prevalence of the positive balance on a weekly basis. Since the first half of March, there haven’t been two consecutive negative weeks.

This day, with a decided prevalence of red signs, also highlights the balances on a weekly basis. To find the first sign above parity today, it is necessary to go down to the 37th position occupied by Synthetix Network (SNX) with +4%. Aave (LEND) does better, with +21%, and Nexo (NEXO) +13%, although far from Compound’s performance.

Compound can be defined as one of the leading projects in the DeFi industry. In fact, the token lock up on Compound’s lending exceeds $360 million, challenging Maker’s leadership, which has $431 million locked up, leading the way with over 50% dominance.

Precisely in these hours, the total number of tokens in lending across all DeFi reaches the highest historical peak ever. The current value of 1.270 billion goes to undermine the record set in mid-February, highlighting how the DeFi sector is increasingly attracting the attention of investors even from a professional level.

Eidoo, which is changing its ticker from EDO to PNT in these hours, is continuing its strong movements in DeFi. Eidoo in the last few hours has seen a jump that pushes the prices for the first time since mid-July 2019 to review the 66 cents. This consolidates the rise that has seen Eidoo’s prices double since early June. In these hours Eidoo is characterized by high volatility that on a daily basis has seen fluctuation of more than 20% in the last 24 hours.

From the March lows, Eidoo gains over 1600%, which shows that the market is positively influenced by the announcements and the adjustment of the token structure.

Crypto.com (CRO) on a weekly basis marks the best performance of the first 30 with an increase that fluctuates around 5%. Crypto.com fights for the 10th position with Cardano (ADA) with market caps of 2 billion dollars and a difference between the two of a few tens of millions of dollars. These values lead the two to battle for the 10th position.

Today CRO loses 1.5%, Cardano slips 4%.

The best increase of the week among the altcoins is that of Compound which rises by 80% and moves into 30th position among the most capitalized with a market cap of more than 430 million dollars. Since it was launched only a few days ago, CoinMarketCap hasn’t included it yet, but the jump allows it to be among the big ones with the best weekly performance.

The market cap with the prevalence of today’s declines falls again below $263 billion.

Today’s trading volumes are over $60 billion, slightly higher than yesterday.

The dominance of Bitcoin is at 65%. Ethereum, after failing to exceed 10% in recent days, is trying to consolidate its market share now at 9.5%. XRP remains just under 3.2%.

Summary

Bitcoin (BTC)

Bitcoin slips during the last hours under 9,300 dollars, missing the 9,500 that technically would have probably attracted new purchases. The $9,590 remains the week’s high. This is the level that if exceeded this weekend could bring it back up again.

The volumes of Bitcoin in the last 24 hours are above 1.5 billion. These are the lowest levels in the last 10 days.

A break in the week’s lows at $8,900 would project prices to the monthly static support test of $8,500-8,600.

Ethereum (ETH)

Ethereum goes just below the lower neckline of the bullish channel that has accompanied the trend since mid-March.

It is not a worrying signal because the break comes with low volumes. It is necessary for ETH to confirm above $215 over the weekend. At the moment it is trading just under $230.

Only a slip under $215 would begin to alert the next target placed in the psychological area of $200. On the contrary, a recovery of 235 dollars would project the prices of Ethereum within the bullish channel that then will have to find confirmation with extensions over 250 dollars. ETH will have to monitor this last level in the medium to long term.