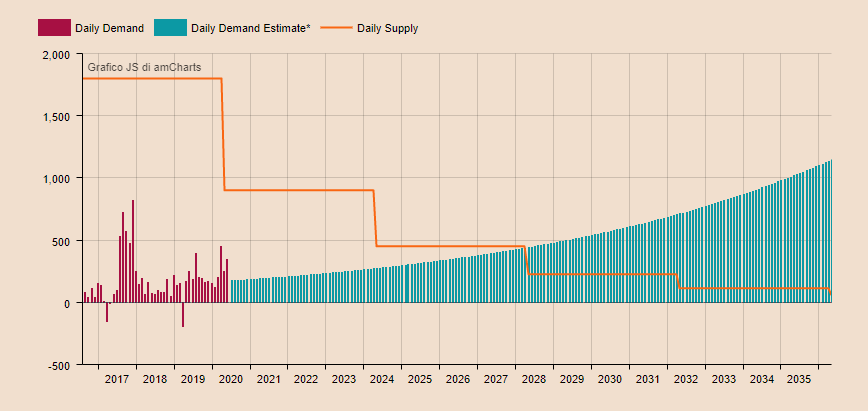

According to recent research, the new market supply of bitcoin will not be able to satisfy demand in the future.

The research was carried out by the digital asset derivatives exchange ZUBR, according to which, assuming current investment trends continue, daily demand will exceed the new market supply after the halving of 2028.

In fact, the study shows that over time there has been a continuous growth in the addresses containing between 1 and 10 BTC, rounded, despite market fluctuations and volatility.

In fact, only on five occasions since bitcoin was created has the total number of BTC held in these addresses decreased compared to the previous month. Moreover, since the beginning of 2020, they have increased by 11%.

There were more than 500,000 addresses with these characteristics in April 2020, and since the beginning of 2018 only in one month have they decreased compared to the previous month.

Currently, however, the total number of BTC held at these addresses represents only 2.5% of the total number of bitcoins in circulation, although their average annual growth rate after 2014 has risen to 1.5%.

However, the study predicts that before the next halving in 2024, retail investors are likely to hold more than 50% of BTC in circulation.

Moreover, unless there are dramatic price reversals, retail investors could fully absorb the new BTC created through mining.

Daily demand from retail investors is expected to overtake the generation of new BTC from the following having, in 2028.

The effects of this imbalance on the price of bitcoin could be similar to those recorded in the past on the price of gold.

The CEO of ZUBR, Ilgar Alekperov, commented:

“At the current steady rate that retail is accumulating Bitcoin, the new market supply will not be enough to address retail demand, let alone institutional investor demand.

Although Bitcoin is still emerging when compared to traditional commodities such as gold, this research proves that there is a growing belief in Bitcoin’s long-term investment case as a real store-of-value. It’s fair to say that it’s this continued belief which could ultimately see it become a reality. While ZUBR focuses on the institutional market, it’s really important that we look and reflect at the retail trends as crypto is still a retail-led market, and this will ultimately dictate investor appetites and behaviour”.