After the calm market of last month, yesterday was the busiest day of the last two weeks. In a few hours, the price of Bitcoin has risen from a low of $9,050 to a high of almost 9,400 points.

This is an intraday deviation of over $350 that has not been recorded for 10 days, taking as reference the lows and highs.

To find a more intense movement it is necessary to go back to the days between the 22nd and 24th of June when BTC prices moved about 500 points during the same day.

With yesterday’s close, the price of Bitcoin is up, which is also reflected today, with a gain of more than 2%.

Ethereum is doing better, earning more than 4%, and is one step closer to its mid-June relative high of $250.

Among the top 10, the day sees Bitcoin Satoshi Vision (BSV) gain about 20%, although there is no particular news that justifies this movement. Therefore for Bitcoin SV, this strong jolt of the last 24 hours suggests speculative shifts.

Cardano (ADA) continues its climb, and today it is still up 6%. This allows updating the records of the last year with Cardano which is one step closer to 11 cents, the highest level recorded since the end of June 2019, breaking the record of August 2018.

Cardano consolidates its 8th position in the ranking of the largest capitalized companies, one step from Litecoin‘s 7th position (LTC), with a difference of less than $40 million between the two capitalizations. Today Litecoin defended its position with an increase of 4.5%.

Among the top 20, in addition to Bitcoin SV’s jump, Chainlink (LINK) is also doing very well, rising 15% to the 12th position with just under $2 billion in capitalization.

LINK, with today’s high jump, returns to $5.75, going to establish its absolute historical maximum. It’s a leap that adds up to the last month’s rises. Chainlink has achieved one of the best and stable increases since last March, registering a gain of over 270%, multiplying its quotations by about three times.

Among the best of the day, Aave (LEND) in the DeFi ecosystem earns over 20%. Ren (REN) and Bancor (BNT) also rose by over 12%.

Going past the first 100 capitalized, today there is a return of strength for Eidoo (EDO/PNT) that undermines the last year’s records set about two weeks ago, attacking the 79 cents. Eidoo today earns 20% and returns among the top 100 capitalized.

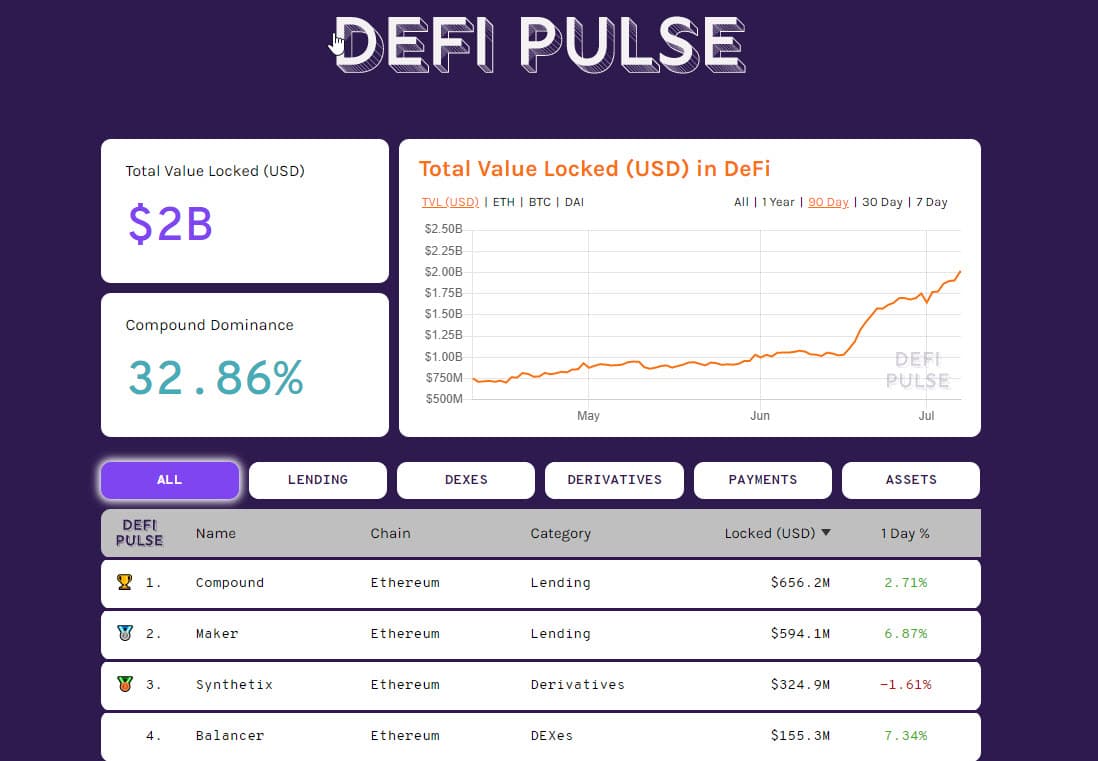

It is the DeFi sector that continues to attract attention. Decentralized finance locked crypto collateral today set a new all-time record at $2 billion. Deposits have doubled since mid-June, just 20 days ago.

The leadership continues to be held by Compound with just under 33% and 655 million as collateral, followed by Maker with just under $595 million. It is these two that together hold more than 55% of the collateral deposits.

With today’s rises that see more than 80% of crypto in positive territory, total capitalization is rising again to just under $270 billion. This is due in large part to the rises of altcoins.

Excluding Bitcoin’s total capitalization, altcoins are back at a pace of $100 billion in capitalization, the highs reached in mid-June, the highest since late February.

This confirms that the rises in the last few hours are due in particular to the effervescence of the altcoins. So much so that the Bitcoin dominance falls below 64%, the lowest levels since the end of April.

Volumes rise, +30% from yesterday’s levels. Bitcoin trading volumes rise again, reaching over 1.7 billion dollars.

Also Bitcoin derivatives volumes are on the rise: yesterday the volumes on CME futures established the highest trades since June 25th.

Bitcoin (BTC) price

Bitcoin revisits area $9,300, after about 2 weeks. At the moment, however, the increase in progress does not clarify the general picture in the medium to long term.

Volatility continues to contract and today falls below 1.5%, the lowest level since last April 2019. The possibility of an explosive movement in the next few days is becoming more and more likely.

In these hours, Bitcoin goes to attack the $9,400. The rise above $9,350 is worth monitoring, causing the repositioning of the first upward defences of the options. The put options increase and position themselves in the $9,250 area, registering the first defence levels between $8,950 and $8,700.

On the other hand, the next defence levels between $9,600 and $9-850 continue to rise, coinciding with the relative highs since mid-June.

Ethereum (ETH) price

With today’s leap, Ethereum returns to undermine the highs of the second decade of June in the 250 dollar area. Ethereum goes to test the bullish trendline that joined the rising lows of mid-March, violated with the last downward movement of June 27th.

This trendline continues to give indications of its importance, with prices that in the last few hours go to undermine the dynamic technical level, close to 245 dollars.

Professional investors not only confirm the $215 defence but also begin to raise the first levels of defence at $225, which coincides with the technical threshold that has rejected the downward movement twice since mid-June.

Upwards, Ethereum is dominated by the defence positions against downward movements. The first resistance is between 245 and 250 dollars.

Above these levels, there would be a repositioning of professional investors with the defence of 260 dollars, the first level of resistance in case of a break in the highs at the beginning of June, which coincide with levels last seen at the end of February, before the Covid crisis.

Ethereum shows better overall resilience than Bitcoin, and this seems to drag the altcoin sector.