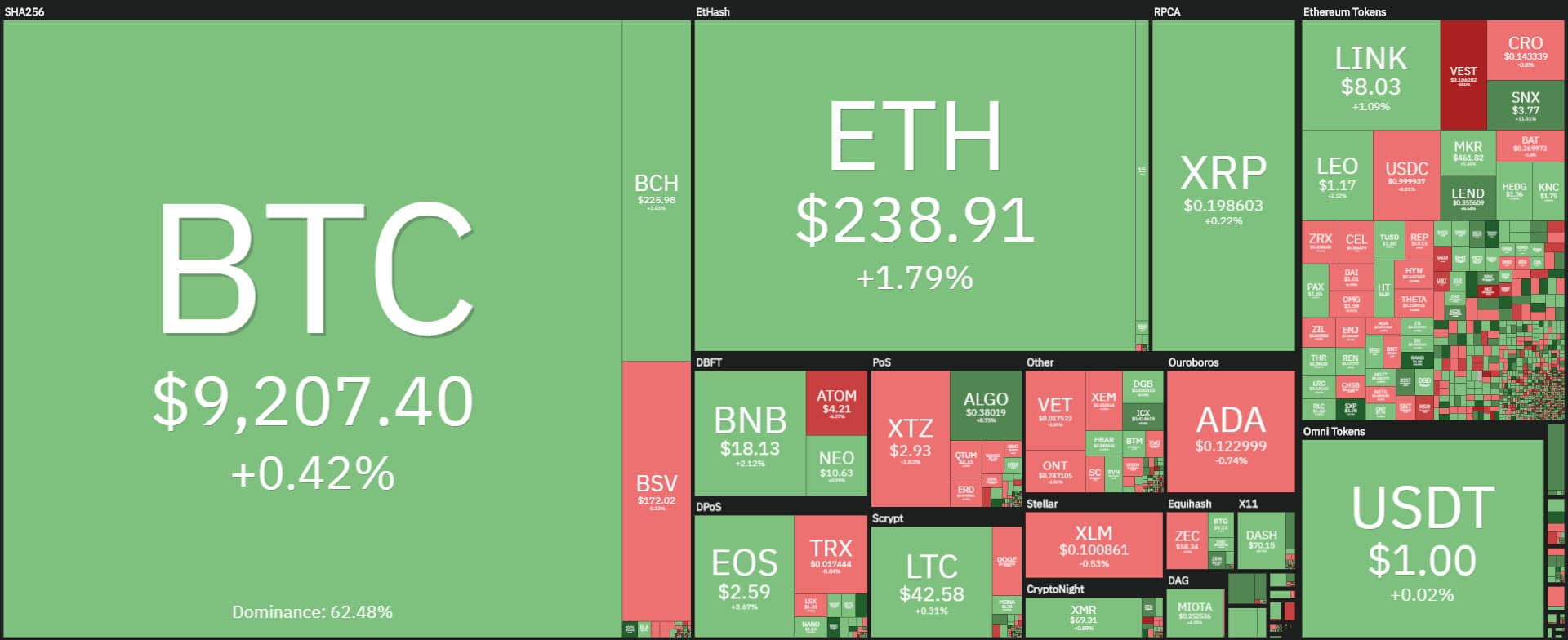

The third week of July closes with a red sign. A negative sign with a faded colour as Bitcoin sees a difference of about $70 between the opening and closing of last week, highlighting a very particular moment that has been keeping the prices of Bitcoin in a narrow range since last May. This is not the case for altcoins, in particular for those defined as “secondary”, which are registering significant increases.

Last week some of them experienced strong positive swings, such as Chainlink (LINK) which reached new all-time highs in the $9 area, where profit taking began, resulting in a drop that characterized the weekend. Today Chainlink is back up 1% and staying around the $8 level, just one step away from the historical absolute highs recorded between Wednesday and Thursday.

Summary

Altcoins on the rise, DeFi sets new records

The week sees positive effects also for other altcoins that play an important role in the DeFi sector.

In particular, the rise of Ampleforth (AMPL) which marks +40%. Aave (LEND) is doing much better with a jump of more than 50%, the same intensity as the Eidoo token, now PNT, pNetwork, which with the jump-started during the weekend in these minutes sees prices return to almost $1, levels that EDO, now PNT, had abandoned exactly last year, in July 2019.

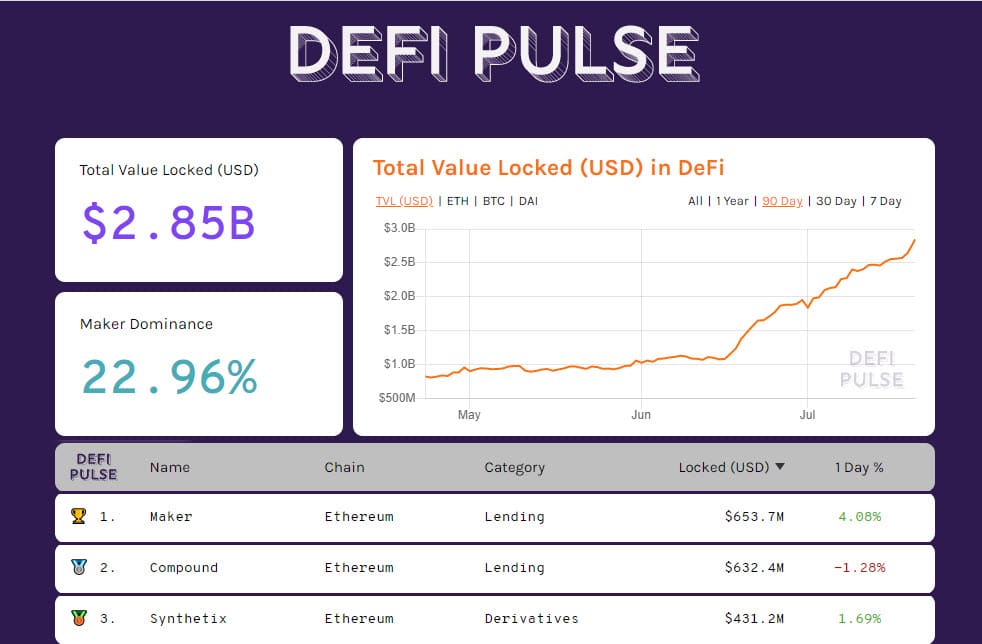

This continues to reflect on DeFi, which seems to know no more standstills. TVL is recording new absolute highs with over $2.84 billion.

The DeFi sector not only continues to attract attention but also sees Maker regain the throne with the highest collateral, overtaking Compound, Maker holds $658 million and Compound $637.

Maker and Compound with $1.3 billion hold just under 50% of the total locked value.

Synthetix (SNX) also continues to rise, even though it is distanced at $527 million. The news of the last few hours also turbocharged SNX. The update of its derivatives platform is positively appreciated by the market and is reflected in the value of the token.

The day sees a slight prevalence of positive signs, for over 60% of the crypto assets. The best is Swipe (SXP), +45% followed by Kava (KAVA) and Ampleforth (AMPL) with increases of over 18% for both. On the opposite side, Flexacoin (FXC) sees its prices lose more than 25%. The only one of today with a double-digit loss.

Bitcoin and Ethereum, peak volatility

Bitcoin recorded yesterday the third consecutive day with trading volumes under a billion dollars. It is the first time that there are three consecutive days with volumes under one billion during 2020. The last time was at the end of 2019 and the first days of 2020. It was a holiday context, definitely different from the current one.

Even the total trading volumes in the last 24 hours are worth about 50 billion dollars. An average daily trading level well below the average of the first half of the year.

By contrast, there is a return of significant trades in derivatives and in options in particular. The open interest of options on the main platforms returned to the levels at the end of June when it reached an all-time high.

The open interest on Ethereum is even better, with over $178 million reaching its absolute peak on a summer day. This shows that professional traders are ready to take advantage of an upcoming movement and an increase in volatility that in the last few hours for Bitcoin drops to the lowest levels since October 2016. A daily volatility on a monthly basis that in these hours reaches 1.14%.

The volatility of Ethereum also drops to the lowest levels since the beginning of January 2020.

Bitcoin (BTC)

Bitcoin shows no news from a technical point of view, despite the weekend that saw prices not move from last Friday’s levels.

Positions remain very active on options, which increase hedges to break through technical levels. Downwards 8,950, while upwards between $9,350 and $9,600 are the levels that professional traders are following covering the risk for a next and increasingly expected explosion of volatility.

Ethereum (ETH)

After failing last week to exceed $245, over the weekend Ethereum sees a price consolidation above $230-235, levels that correspond to the first level of support to cover options, which sees the trading volumes increase by overcoming the previous barrier set at $215.

Professional options traders attribute an upcoming break upwards rather than downwards. In fact, option positions, in contrast to Bitcoin, are more exposed to put positions, so downwards. Upwards, traders see the levels between $245 and $255 as being possible for Ethereum to continue rising.