Il volume aggregato dei derivati di ieri ha superato per la prima volta i 4,3 miliardi di dollari di open interest su Bitcoin, livello più alto da marzo scorso.

Nelle ultime ore si sono registrati timidi accenni di scongelamento dal torpore che sta attanagliando Bitcoin ormai dallo scorso maggio e che nei giorni precedenti ha visto scendere la volatilità ai livelli più bassi degli ultimi 4 anni.

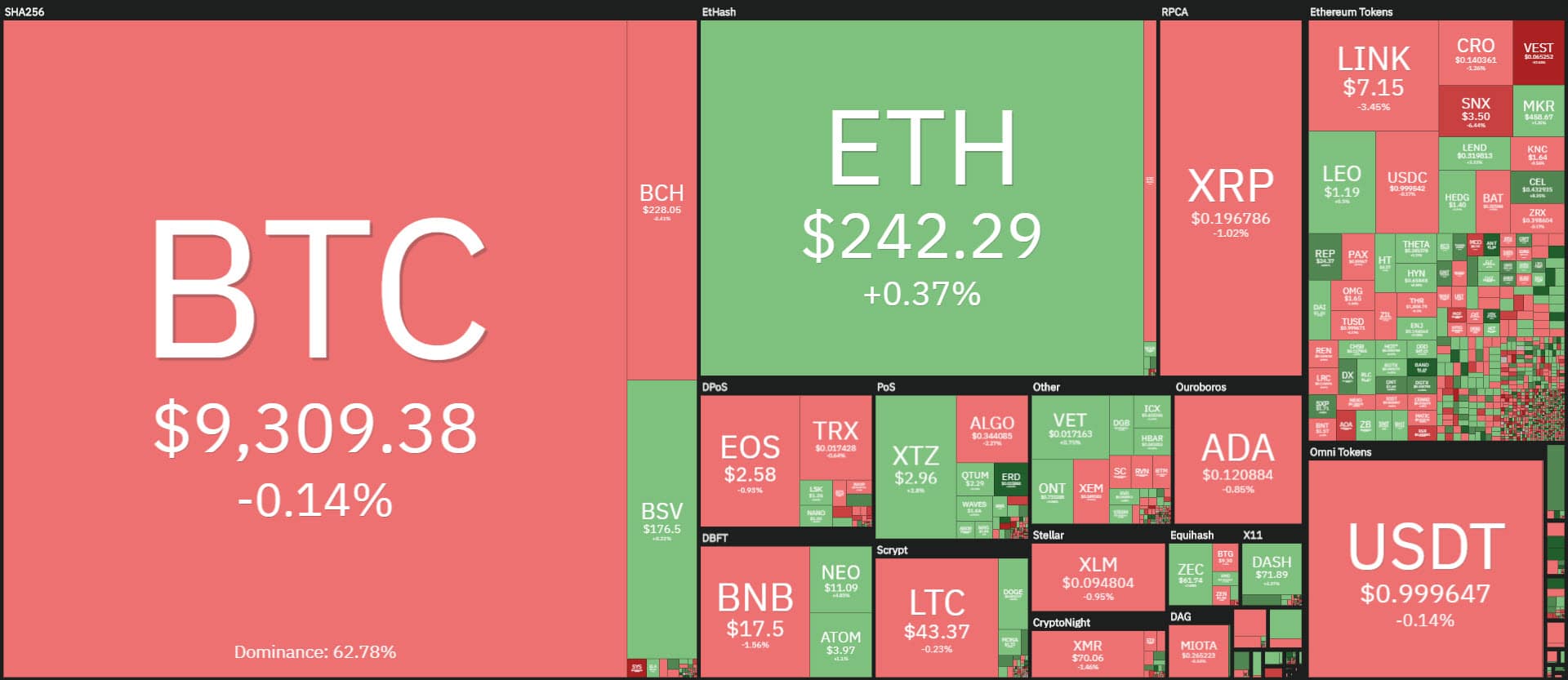

Ieri il timido movimento al rialzo (+1,8% dai livelli di ieri) ha riportato le quotazioni di Bitcoin a 9.400 dollari, livelli che non registrava dalla prima settimana di luglio. Questo ha iniziato a smuovere un po’ tutto il settore. Ne hanno beneficiato la gran parte delle altcoin.

Oltre il 75% è in territorio positivo. Tra le prime 20 prevalgono nettamente i segni positivi. Solo due segni sono sotto la parità, Stellar (XLM) che scivola dello 0,5% e Chainlink (LINK) che arretra del 3%, dopo i forti rialzi che hanno caratterizzato la metà di giugno e che si sono conclusi a metà luglio.

Grazie a questo rialzo Chainlink ha sfiorato i 9 dollari. Attualmente oscilla poco sotto i 7 dollari dove cerca un supporto da cui ripartire.

Il piccolo balzo di ieri del Bitcoin smuove anche i volumi, che tornano a crescere a livello generale e arrivano a 80 miliardi di dollari nelle ultime 24 ore, +30% dai livelli di lunedì.

Derivati: record per l’open interest su Bitcoin

Non solo il mercato spot ma anche i derivati (futures e opzioni) tornano ad essere pimpanti.

A farla da padrone il primo exchange del settore, BitMEX, che segna scambi per un controvalore di poco più di 1 miliardo di dollari, livelli che non si vedevano da inizio marzo.

Stessi livelli per l’altro exchange per importanza, Huobi. Gli altri exchange che permettono di operare sui derivati future del Bitcoin, ByBit e Binance, registrano 450 milioni di dollari, i livelli più alti di sempre, sui volumi dell’open interest di Bitcoin.

Anche le opzioni vedono l’open interest salire, e non solo per Bitcoin. Su Bitcoin l’open interest supera 1,4 miliardi di dollari, livello più alto dal 25 giugno, ma anche le opzioni su Ethereum volano oltre i 125 milioni di dollari.

Paragonato ai livelli del 1 luglio, è raddoppiato il controvalore in dollari dell’open interest anche sulle opzioni di Ethereum.

Ciò evidenzia che anche gli operatori vedono gli scambi e l’attuale movimento più come un’opportunità di consolidamento per un prossimo balzo in alto, e ciò consente di coprire il rischio alzando le coperture delle put per il rischio di eventuali ribassi.

Nelle ultime 24 ore il volume totale delle opzioni aperte sulle put doppia quello aperto sulle call che coprono rischi di eventuali rialzi. Ciò evidenzia che gli operatori professionisti stanno scommettendo di più su un prossimo movimento al rialzo pur mantenendo la difesa delle coperture.

I record delle stablecoin e della DeFi

Non solo Bitcoin e le altcoin, ma è una giornata storica anche per le stablecoin peggate al dollaro statunitense che per la prima volta rompono la soglia dei 10 miliardi di capitalizzazione.

Tether detiene l’83% del market cap, scambiando un volume che doppia il market cap, con 22 miliardi di dollari, pari oltre al 97% dell’intero volume di scambi su tutte le stablecoin.

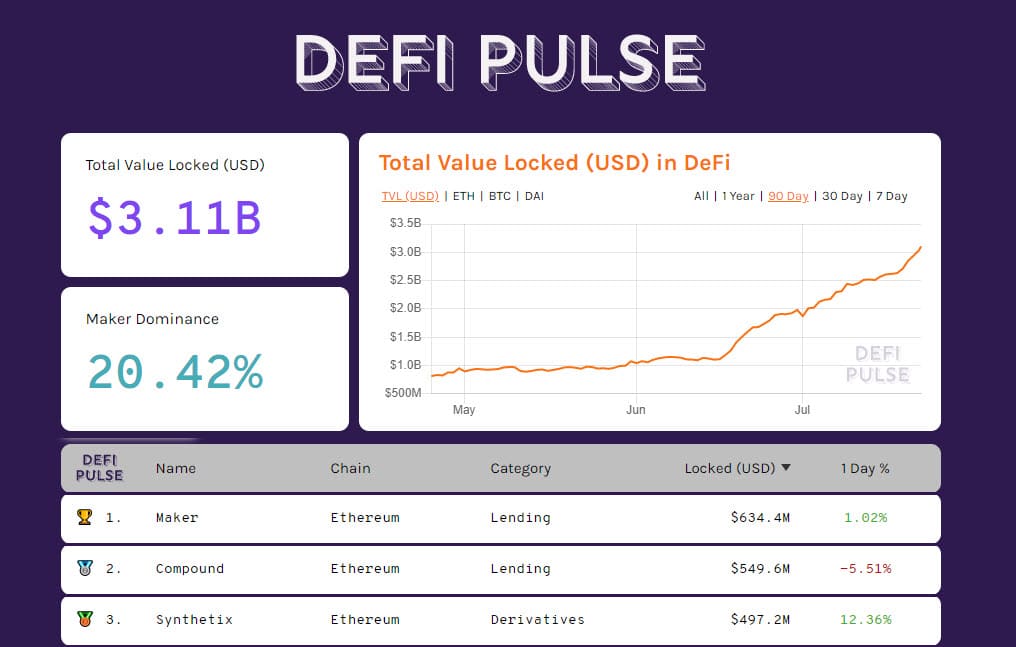

È una giornata storica anche per il valore totale bloccato sulle dApp della finanza decentralizzata che supera per la prima volta i 3 miliardi balzando per la prima volta sopra i 3,11 miliardi di dollari. Per la DeFi continua l’ascesa che vede il TVL (Total Value Locked) triplicare la liquidità sull’intero settore rispetto al totale di 1 miliardo registrato il 12 di giugno.

Giornata gloriosa per Aave (LEND) che conquista, per volumi di collaterale bloccato, per la prima volta la terza posizione con oltre 508 milioni di dollari bloccati. Maker, Compound e Aave insieme detengono circa il 65% dell’intero mercato.

Eidoo continua a salire evidenziando un trend sempre più rialzista. Nelle ultime 24 ore PNT mette a segno un ulteriore balzo di oltre il 15% riportando le quotazioni a superare 1,15 dollari, dopo aver rotto ieri il livello del dollaro.

PNT torna ai livelli di giugno 2019, che corrispondono ai massimi degli ultimi 2 anni. PNT (ex EDO) si trova ad un punto cruciale in ottica di medio e lungo periodo. Il mercato premia i recenti sviluppo del team di Eidoo che registra un performance che dai minimi di metà marzo sfiora il 2.900%.

Con i rialzi di oggi il market cap sale a 277 miliardi, una manciata di miliardi in più dai livelli di ieri. La dominance del Bitcoin rimane invariata poco sopra il 62%. Invariata anche la dominance di Ethereum al 9,8% e Ripple al 3,2%.

Bitcoin (BTC)

Bitcoin supera per la prima volta dallo scorso 7 luglio i 9.450 dollari. Un cenno di possibile rialzo che oltretutto fa aumentare i volumi tanto che per la prima volta dal 6 di luglio, i volumi di scambio pari a 1,7 miliardi di dollari.

Questo evidenzia come basta un breve accenno per movimentare gli scambi durante l’arco della giornata. Ancora non ci sono chiari segnali di rottura al rialzo anche se gli operatori in opzioni vedono aumentare il volume di protezione sui livelli di supporto. Il principale rimane a 8.950 dollari. Dopo la rottura dei 9.350 iniziano ad alzarsi le coperture in area 9.250 dollari. Al rialzo il livello cruciale da abbattere rimangono i 9.600 dollari, registrati l’ultima volta esattamente un mese fa.

Ethereum (ETH)

Buon balzo al rialzo per Ethereum che si riporta per la 6° volta negli ultimi due mesi a testare i 248-250 dollari. Per ETH è l’ennesima dimostrazione di voler rompere la fortezza della resistenza dei 250 dollari.

Sono però necessari i volumi, che ieri sono tornati a salire dopo 10 giorni, superando i 600 milioni di dollari, livello che non registrava dall’8 di luglio. Per Ethereum le coperture degli operatori in opzioni rimangono stabili. Il principale inizia a spostarsi dai 215 ai 225 dollari, mentre invece il più vicino è a quello dai 235 dollari. Questi sono i livelli da monitorare in caso di cambio trend per Ethereum.

Dall’inizio di giugno, nonostante l’andamento laterale, Ethereum dimostra di non voler cedere i supporti di medio e lungo periodo, appunto a 225 dollari.