With concerns about the future of fiat currencies and endless money creation, a shift is happening and bitcoin is showing strong signs of adoption.

Bitcoin Adoption is Increasing

Despite the “Crypto Winter” and constant negative news about bitcoin from the mainstream media, adoption has only increased. According to Lucas Nuzzi, Network Data Product Manager at Coin Metrics, “a new adoption cycle is brewing”.

In a recent report by Coin Metrics, adoption has gone up by 27% with bitcoin addresses above $10 since the major crash in mid-March. Although this is not an exact indicator of new individuals in the bitcoin space, the metric can give a general idea of further progression:

Additionally, with an online survey conducted by The Harris Poll on behalf of Blockchain Capital, from April 23–25, 2019 among 2,029 American adults, it was found that the percentage of people that “strongly” or “somewhat” agree that “most people will be using Bitcoin in the next 10 years” rose 5 percentage points — from 28% in October 2017 to 33% in April 2019.

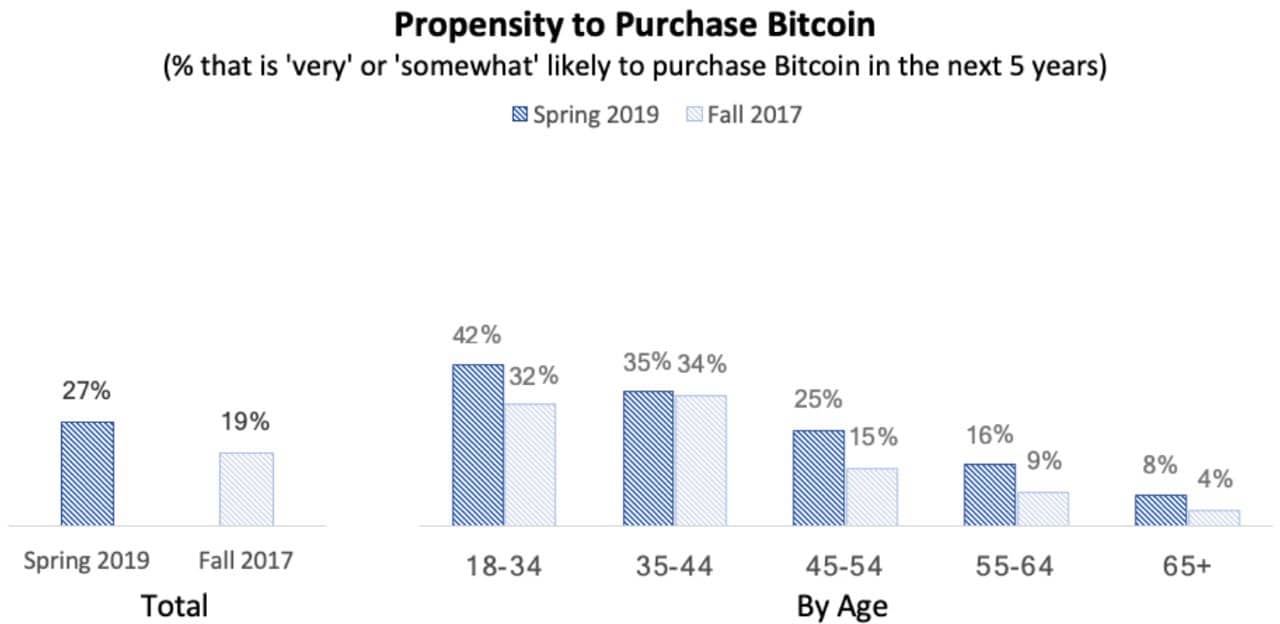

You can also see from the study that the amount of people who are likely to purchase bitcoin within the next 5 years has also increased by 8% from 2017 to 2019:

The most notable were those who are of ages 18-34 and 45-54. This is a clear trend, and the network effect appears to be spreading continuously.

What About Institutions?

Not only is bitcoin adoption and interest growing with normal retail investors, institutional involvement is also gaining traction as well.

In a recent report by Fidelity, nearly 800 U.S. and European investors were surveyed, including financial advisors, family offices, pensions, cryptocurrency and traditional hedge funds, high net worth investors, endowments, and foundations.

In this survey, they found that bitcoin is still the most desired cryptocurrency by quite a large amount, stating,

“Bitcoin continues to be the digital asset of choice with over a quarter of respondents holding bitcoin; 11% have exposure to Ethereum.”

Fidelity found that 36% of respondents said they are currently invested in digital assets (27% in the U.S. and 45% in Europe), and 6 out of 10 believe digital assets have a place in their investment portfolio. They also state that U.S. investors who allocated to digital assets increased to 27% from 22% in 2019.

Square Just Bought Bitcoin. $1 Trillion Market Cap?

With concerns about inflation, massive government and corporate debt levels, and an economic depression, there has been a new wave of notable investors buying bitcoin. Let’s see what happened in the last few months:

May 2020: Billionaire hedge fund manager Paul Tudor Jones allocates 1-2% of his portfolio in bitcoin, stating,

“We are witnessing the Great Monetary Inflation — an unprecedented expansion of every form of money unlike anything the developed world has ever seen.”

August 2020: One of the largest business intelligence companies on the planet, MicroStrategy, purchases $250 million in bitcoin for their treasury reserve assets. One month later, the company purchased $175 million more, having a total of $425 million.

Their CEO stated,

“This investment reflects our belief that bitcoin, as the world’s most widely-adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash,”

September 2020: Jack Dorsey’s company, Square, recently purchased $50 million in bitcoin – this equates to roughly 1% of the company’s total assets. Their CFO stated,

“We believe that bitcoin has the potential to be a more ubiquitous currency in the future … As it grows in adoption, we intend to learn and participate in a disciplined way.”

According to Messari Research, the total amount of AUM (assets under management) is estimated to be $104 trillion. This includes endowments, family offices, sovereign wealth, pension and mutual funds.

If the influx of investors shown above continues with just a 1% institutional allocation, this would create a $1 trillion market cap for bitcoin.

Conclusion

There is a very clear trend happening with big names starting to invest in bitcoin, and it’s safe to say that this will only continue. More investors are starting to see the reality of the current economic situation: You can’t create unlimited amounts of money and expect it to hold value.

Bitcoin fixes this, and there is more exciting news to come.

Guest post sponsored by Bitcoin Reserve

https://www.youtube.com/watch?v=VqI2VYGQEU4&feature=youtu.be