The day sees volumes on cryptocurrencies that have returned to their highest levels in recent days.

The whole sector is back to showing signs of vitality, following a start to the week benefiting from what happened during the weekend, though without any particular lively signals.

The second part of yesterday saw a return of strength in the sector, which has again shown a new upturn. In particular, Bitcoin is back to over $11,700, which is the highest level since September 2nd, and is dragging the market with it, as is Ethereum, which is seeing the month’s high again at $390.

Summary

Cryptocurrency: the return of volumes

The rises in the last few hours see the return of volumes to over $125 billion traded in the last 24 hours. An increase in trading volumes of more than 35% from yesterday morning’s figures.

Bitcoin, for the first time since October 1st, is trading 1.94 billion dollars.

Even Ethereum is reporting for the first time more than 1.2 billion dollars, breaking the negative series that for 10 days had traded under one billion dollars. A series of this kind has not been recorded since mid-July.

The status of the cryptocurrency market today

Among the best of the day, today stands out Ocean Protocol (OCEAN), up more than 20%, followed by Synthetix Network (SNX), up 10%. Uniswap (UNI) celebrates with a leap that brings the prices back to almost $3.60.

More than 60% of the crypto assets are in positive territory, and in the top 10, they all show green signs. The best is Binance Coin (BNB), +8%. Chainlink (LINK) and Cardano (ADA) are also good, +6%. Chainlink in particular is back just under $12, which is the highest level in the last month, which it hasn’t seen since September 15th.

What makes this day’s rise emerge is that even on a weekly basis the top 20 capitalized return to positive territory with an average weekly earnings of around 10%.

Capitalization goes above $365 billion, which is the highest level since September 2nd. Bitcoin remains above 58% dominance.

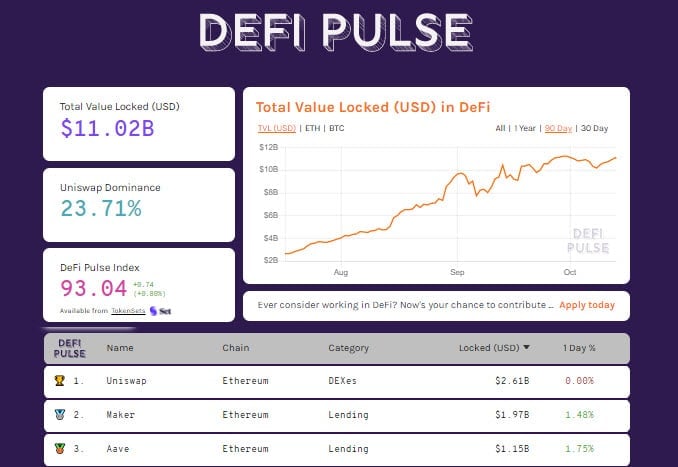

The total value in dollars in decentralized finance is reported above $11 billion, a positive sign that continues to be confirmed by the growth of tokenized bitcoin rising above 146,600 BTC tokenized on the ERC20 protocol.

Uniswap remains the leader in decentralized finance. Today it rises above $2.6 billion as collateral on the protocol, the highest level ever.

Maker is for the first time close to the 2 billion collateral locked on the protocol. Aave remains in 3rd position, with 1.15 billion dollars.

Bitcoin (BTC)

The rise in the last hours of yesterday restores Bitcoin’s confidence as it moves away from the dangerous threshold of $11,200, tested yesterday before attracting purchases and volumes pushing prices to $11,700, the highest level since September 2nd.

It is a positive signal that brings Bitcoin to test the dynamic bullish trendline at the bottom, which until early September supported the upward trend.

Prices are close to testing the resistance of the 11.800 dollars but also the first true barrier protected from the Call options of the operators in derivatives that see in this threshold a crucial level in order to give one eventual turn to Bitcoin that above this level could trigger a further jump due to the coverings of the positions to protect an eventual rise.

Downward, instead, the dangers that see the first level of support at 11,200 dollars, tested yesterday, are getting further and further away. In a medium-long term perspective, the 10,200 dollar holding is more important.

Ethereum (ETH)

The rise of Ethereum, despite bringing the quotations back to test the 395 dollars, does not succeed in breaking the lateral channel that has been caging the oscillations since September 3rd. The part at the top shows resistance in the area 390-395 dollars.

If this resistance were violated with the support of the volumes, that in the last hours do not seem not to lack, the prices would be pushed to the test of the resistance of the 415 dollars, a true watershed area in a long term perspective.

For ETH, it is necessary not to return below the threshold of 335 dollars in the next few days.

After the consolidation within the range that continues to form since the beginning of September in the $320-390 area, an exit from this channel would most likely cause a strong directional movement, with the break-up of the levels of these hours at $390-395.