It is the day before the vote for the 2020 US presidential election and all eyes are on the United States partly in view of the impact that the election result will have on the financial markets.

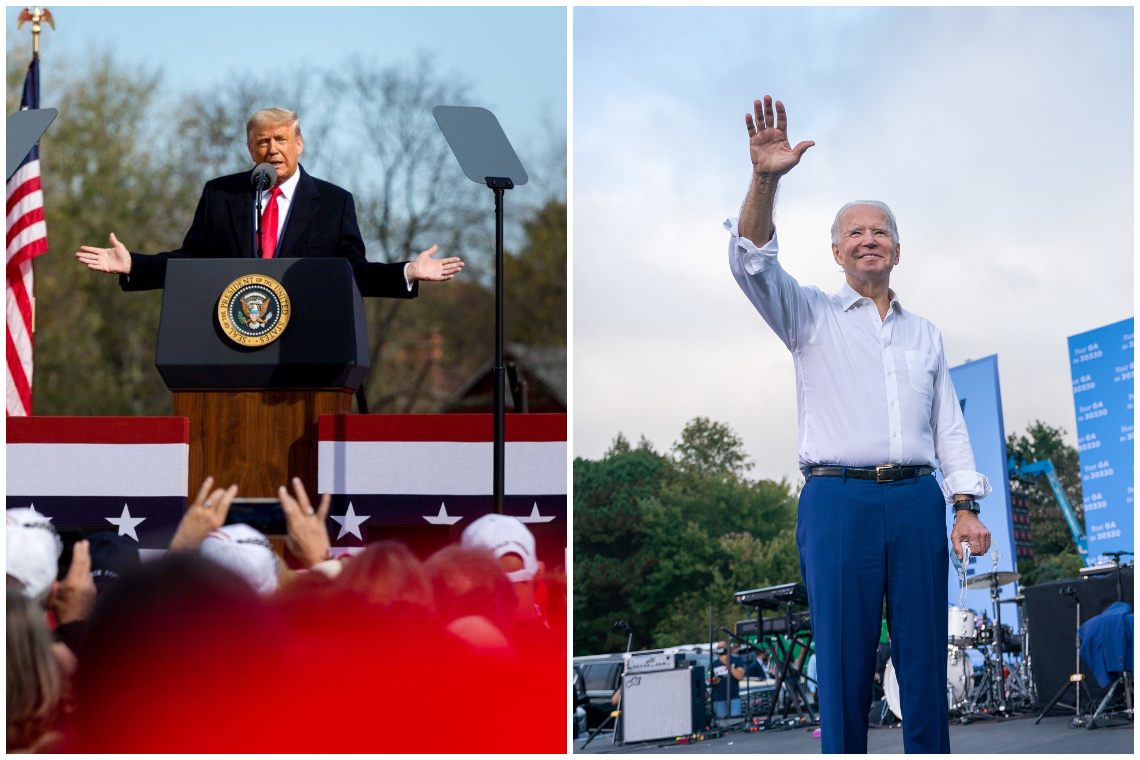

Trump or Biden, who will win?

The polls put Democrat candidate Joe Biden, former vice president at the time of Barack Obama, in the lead. But there is nothing more uncertain than the polls.

What is certain are the statistics. And these say that in most elections an outgoing president has almost always won, with a few exceptions: in 1980 Jimmy Carter was defeated by Ronald Reagan, while George H. W. Bush (senior) had to hand over his second term to Bill Clinton in 1992. But since then every president has been in office for 8 years.

However, as pointed out by JPMorgan, if there is a time when incumbent presidents have failed re-election it is in the case of economic recessions. This is precisely the scenario in which tomorrow’s elections will take place.

The Coronavirus pandemic has plunged the world into the worst economic crisis since the war. In short, the Coronavirus will be the real big constituent of this competition.

US elections, Biden vs Trump: what will happen to the financial markets?

The opinion of US Bank

US Bank issued a report analyzing different post-November 3rd scenarios, for example, pointing out that usually when there is a party change in the White House, markets gain 5%. When the president is re-elected, they earn 6.5%.

It is also important to bear in mind the majority that will come out for the House and Senate. In fact, if there were a fully Republican or fully Democrat President and House and Senate, this would result in short-term volatility for the markets.

Capital.com

In Capital.com‘s opinion, a Biden victory would be good for the S&P 500 index, as the Democrat would already have a set of measures ready to shake up the US economy. If Trump wins, Capital.com is still predicting volatility.

For gold, it would be a success either way. Whether Biden wins or Trump is reconfirmed, it will continue to be bought as a safe haven par excellence and the forecast for its price is positive.

Worst case scenario for the markets

The worst-case scenario would be that of a disputed result. It does not seem a remote possibility since outgoing president Donald Trump has already anticipated that he might not recognize the validity of the vote if his challenger wins.

All analysts agree that in the event of an uncertain outcome, this would result in a period of market turbulence.

In any case, in the coming days, everything will be clearer. Tomorrow is the big day, and probably Wednesday could be the final verdict on who will lead the United States of America for the next 4 years.