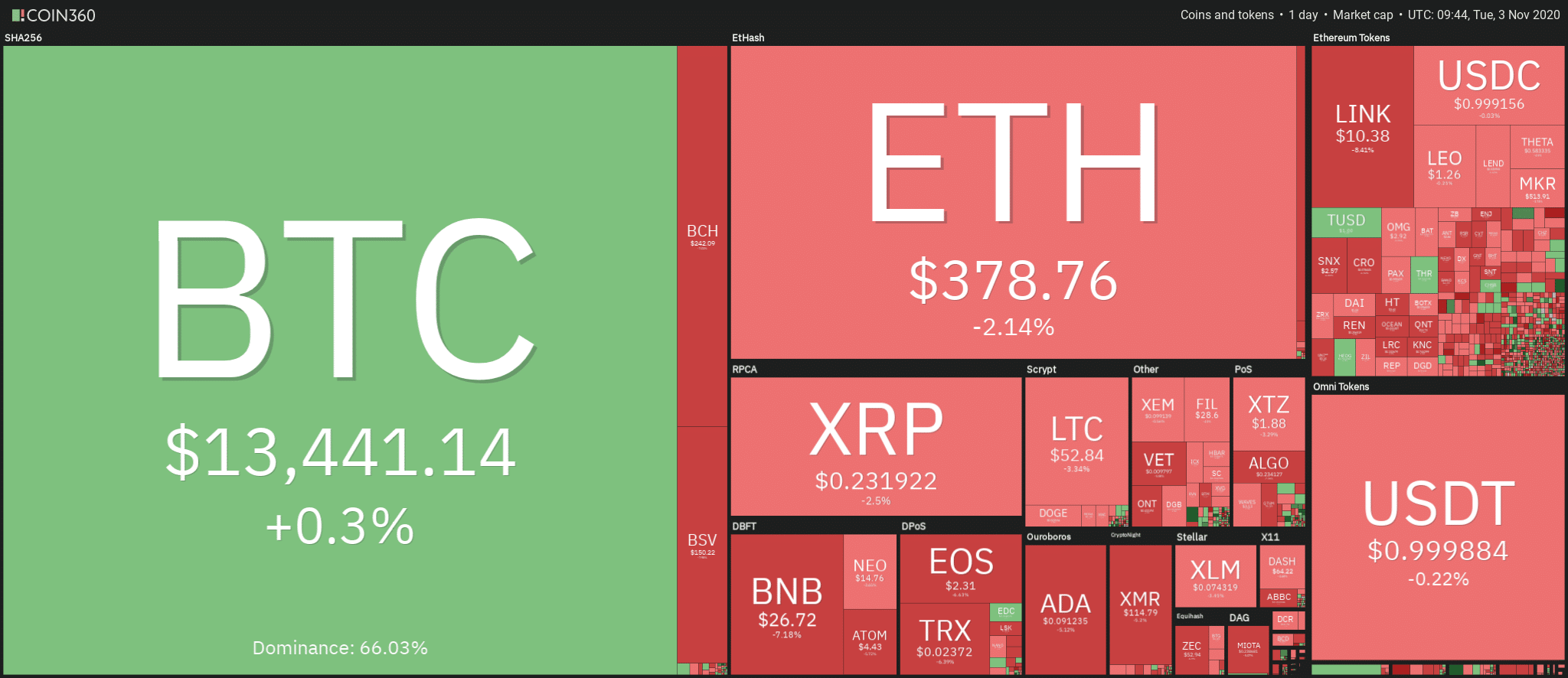

It is a day of suffering for the entire cryptocurrency sector which today sees losses for almost all coins.

Out of the first 100, only a handful fluctuate above parity, and the rest suffer even double-digit declines.

Bitcoin goes against the trend and earns 1.5% over the 24-hour period

After last week’s rises, culminating in the weekend’s tops, profit taking continues to make itself felt, with a clear prevalence of sales that are rejecting prices at mid-term levels.

Cryptocurrencies experiencing losses: Bitcoin’s dominance rises

This is also observed on Bitcoin, which is the only one among the first 30 that on a weekly basis continues to have a positive balance, highlighting how the period is subject to the ups and downs of the crypto queen.

This is also reflected in the dominance. During periods in which sales prevail and operators seek stability for their capital, Bitcoin emerges as the crypto of choice and in the last few hours, this is leading to a further increase in its dominance, which goes beyond 64% of market share, the highest level it had not recorded since the first ten days of July.

This is affecting Ethereum’s dominance, which falls just below 12.2%, while Ripple falls to 2.7%, the lowest level in the last three years.

Total capitalization also falls again below $390 billion, the lowest level since mid-October.

The day sees only a handful of cryptocurrencies above parity in the top 100. Among them is The Midas Touch Gold (TMTG), which is the only one that is clearly against the trend and flies with a 11% gain.

Augur (REP) also stands out among the few uphill ones, earning just over 1%, due to the token that in the last few hours is used for bets made on the US elections, on a dedicated platform.

Among the big ones, the worst of the day is Chainlink (LINK) which loses 11%.

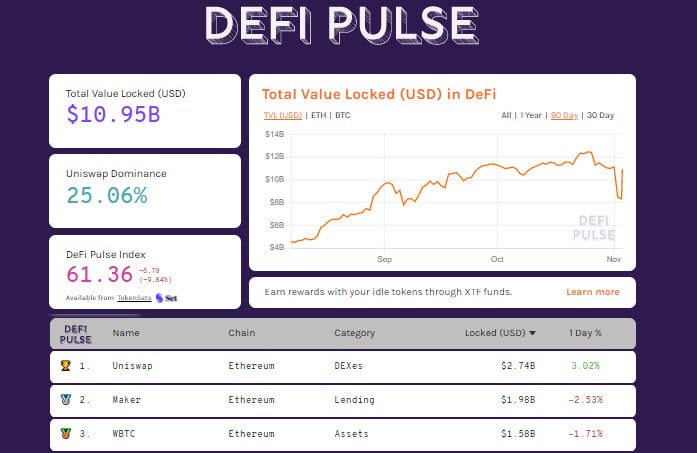

DeFi out of breath

Unlike yesterday, today the bleeding of DeFi tokens is evident. Among the worst is a sharp double-digit decline for tokens in the decentralized finance system. The worst of the day is Reserve Rights (RSR) down by about 20%, followed by Aave, Sushi Swap (SUSHI), Ocean Protocol (OCEAN), Synthetix Network (SNX), Compound (COMP), down more than 15%.

TVL is again falling below the $11 billion threshold. Uniswap, Maker and WBTC remain the first three projects used.

Bitcoin (BTC) at a loss

Despite the descent that began after failing to exceed $14,000 over the weekend and the setback that yesterday saw prices slide to $13,200, the first level of short support, Bitcoin tries to react by reaching $13,500.

This is due to the short bearish positions being covered rather than a real return of the bears.

Purchases remain at the levels of the past few days, above $1.5 billion, but, unlike last week, they arrive at a weak moment with a prevalence of sales and coverings. For Bitcoin, it is necessary to find a support base from which to set up a new rise.

It is necessary to wait for a consolidation base, at the moment identified in the 13,000-13,200 dollar area. These are the levels to be confirmed in the next few hours and days in order not to witness a lunge that has not left clear supports during the ascent of the last two weeks and finds space for any dangerous descents down to area 12,200.

For this reason, it is necessary to wait for the construction of a valid base from which to start again.

Ethereum (ETH)

Ethereum was already struggling in recent days to keep up the bullish pace of Bitcoin. The lack of strength of BTC is reflected in the weakness of ETH in the last week.

Ethereum yesterday, after having failed to hold the $390 support, which has now become resilient again, sees an extension towards the $370 area, the lowest level of the last 15 days.

A further descent leads therefore to the test of the dynamic bullish trendline that passes in these hours a little over the 365-360 dollars, a level to defend in case of a further lengthening downwards in order not to witness a dangerous aggression from speculation with the break of the trendline that has supported the prices since last March, for over 7 months.