Today is the second consecutive upward positive day for most crypto assets and Bitcoin’s bounce brings the price back above $15,500.

More than 75% of the crypto assets are in positive territory today. The crypto sector is not affected by the “balloon” effect that the stock indices have experienced, especially those in the United States, which after the announcement on Monday of the Pfizer vaccine, in a few hours have seen a sharp jump up and then a sharp contraction that brought the prices back to the morning values.

The same is not happening in the European markets, which are holding up better and remain at Monday’s values.

The rumours suggest that the vaccine would not be particularly preferential to the United States despite the fact that the company is American and despite the US being the biggest financiers of the vaccine research. This disappointment is adversely affecting the S&P 500 index.

Even gold remains below $1,900. The sharp fall on Monday, which saw a loss of 4% in a single day.

This is the second time there has been a very strong plunge in three months. On August 11th, gold had lost 5.6%. This is the first time gold has seen violent bearish movements in such a short period of time.

Bitcoin, on the other hand, is still halfway through and is not particularly affected by these movements. With the high jump of these hours, it returns above the threshold of 15,500 dollars, close to the highs recorded on Monday with the lunge above 15,900 dollars. The prices of Bitcoin are close to the maximums of the period and are not affected by the tensions.

Ethereum also follows the positive wake and rises by 5% on a daily basis, with prices returning above $465. Together with Nem (XEM), Ethereum is the best rise among the first 30 capitalized.

To find better daily performance it is necessary to scroll further, to the 31st position where there is Uniswap (UNI) which gains 6%. The best of all is a token from the DeFi sector and it is Loopring (LRC) which, after the strong bearish movement of the last 48 hours, now recovers with +40%. Sushiswap (SUSHI) follows with a 10% rise.

The total market cap, thanks to the day’s increases, is up to 450 billion dollars, the highest level not seen since February 2018.

Bitcoin gave up some fraction of its market share returning to 64% after having reached over 65% last week. Ethereum gains market share and returns to 11.5%. XRP remains stable at 2.5% market share, which is the lowest level recorded since September 11th, 2017.

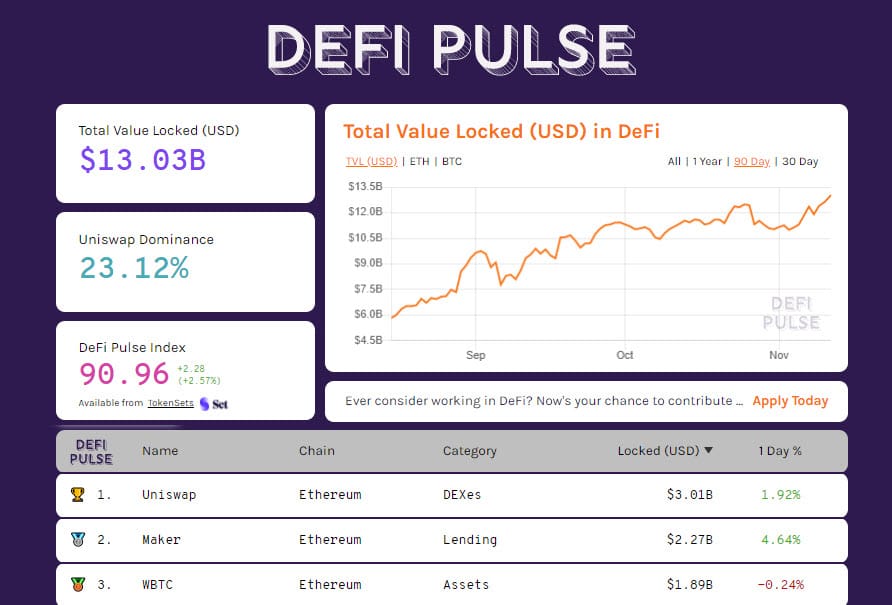

DeFi goes beyond $13 billion TVL for the first time, and marks a new historic day. Much of the credit goes to Uniswap, which for the first time exceeds 3 billion in locked value in dollars. The increase is also due to the price of Ethereum in the last few hours, which has a decisive impact on the total value calculated in dollars.

Bounce for Bitcoin (BTC)

Bitcoin is back over $15,500, giving a signal of a vigorous period supported by volumes, although on a daily basis in the last 7 days it is not at the highest levels.

Yesterday’s volumes for Bitcoin remained above $2.5 billion for the 7th consecutive day. In the past few days, trading was higher, so much so that on Monday it reached over $4 billion.

For Bitcoin, it is important to maintain the healthy condition of the last few hours. Initial dangers would only come with a break below $14,600, levels that Bitcoin has not recorded since last Saturday.

Upwards, a break of $15,900 would open the way to update the latest records just below this level, set on November 6th.

Ethereum (ETH)

The incident of these hours that has seen a problem for the main infrastructure, Infura, which is blocking most of the transactions on the Ethereum network, is not affecting trading. The prices of Ethereum in these last few hours have again revised 465 dollars, the highest level set last Saturday, which had not been recorded since the beginning of September.

The trend of ETH is supported by options derivatives traders. Yesterday a new record was set for open interest in options, above $575 million, the highest level ever.

In the last 24 hours, there has been activity developing in the sale of put options. This is a sign that operators are hypothesizing more of a rise rather than a fall in prices.

It’s necessary for Ether to push decisively beyond $470, to open up space to attack the year’s highs set in September. For ETH there would only be concerns with a major reversal below $365, an area 20% below current levels, so there is ample room for price movement.

Volumes on Ethereum remain solid and for the 7th consecutive day are above one billion dollars.