The month of November 2020 closes beautifully, with the highest monthly closing ever for Bitcoin.

Bitcoin ended the month with a gain of over 45% on a monthly basis. It is a close just under $19,700.

Yesterday afternoon, the sharp rise caused a movement that for some exchanges brought the prices above the historical highs of December 17th, 2017. This is the case for Binance, Bitstamp and Kraken. The other exchanges saw prices stop just a step away from breaking the historical record.

Bitcoin, the records of November 2020 drive the sector

The movement dragged behind the rest of the sector. In particular, Ethereum benefited from this, which, after seeing a prevalence of over $500 in some parts of the weekend, yesterday ETH prices saw prices rise to close to $600, the highs reached last week.

Also for Ethereum November is the month with the best closing since April 2018, even though ETH remains distant from the maximums of January 2018, when it exceeded 1,400 dollars.

It is a moment of glory for the entire cryptocurrency sector, not only for Bitcoin but also for what is happening with the fundamentals, which Bitcoin has confirmed several times in the last month.

Ethereum today passes to phase 2.0, at 12 noon the first genesis block will be validated, a crucial phase that will see the passage in the coming months to the adoption of Proof of Stake, a different system of mining that will see Ethereum break away from the Proof of Work used until now. This too could lead to price fluctuations.

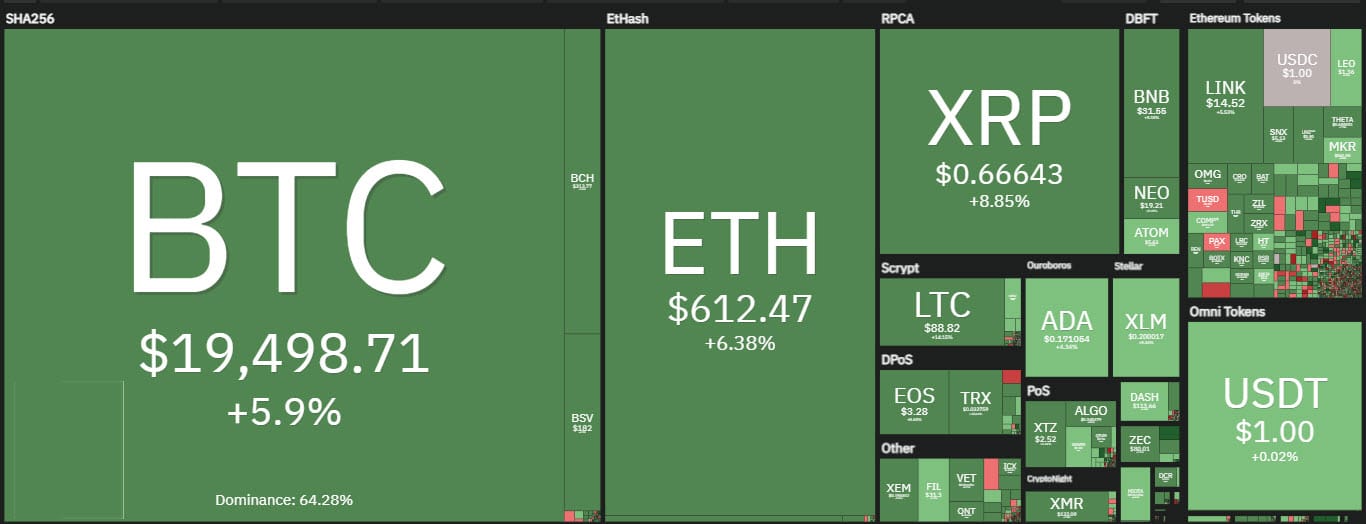

This leads to a very euphoric beginning of December with 99% of the first 100 cryptocurrencies in positive. Today only Hedge Trade (HEDGE) is below par with a full-bodied decline of almost 10%.

The rest of the sector is in positive territory with strong rises for SushiSwap (SUSHI), +27%.

Litecoin (LTC) is one of the big names, earning 13% and exceeding $90, going to attack the record of the last year reached on November 24th. Litecoin’s strong movement sees a recovery of the entire drop accumulated between the 24th and 26th of November, which had rejected the quotations at 65 dollars.

November sets a record also for volumes

The month of November closes with a record not only for prices, but also for the highest trading volumes ever.

Yesterday, with the movements that are taking place, reported an increase in total volumes too. Bitcoin and Ethereum have risen above the trading average of the last few days, while remaining below the average recorded in last week’s euphoric movements.

However, volumes are increasing, and on a daily basis, they are growing by 30%.

Volumes on the derivatives market are also growing again. Yesterday, trading on platforms offering derivatives saw an increase in trading. The CME, the best known platform, traded over $1.27 billion in dollars in a single day. This is less than the OKEx exchange alone, which traded $1.33 billion.

After last week’s downtrend, which coincided with the closing of the monthly futures contract, open interest is once again climbing from a record high on November 25th to $7.3 billion.

Trading on Bitcoin options is also growing again, again at $4.8 billion, following last week’s record high at over $5 billion.

The futures on Ethereum, on the other hand, remain full-bodied and perky, even if lower than the records traded last week. On November 23rd and 26th, Ethereum had the highest trading volume ever, surpassing the peaks of January 2018.

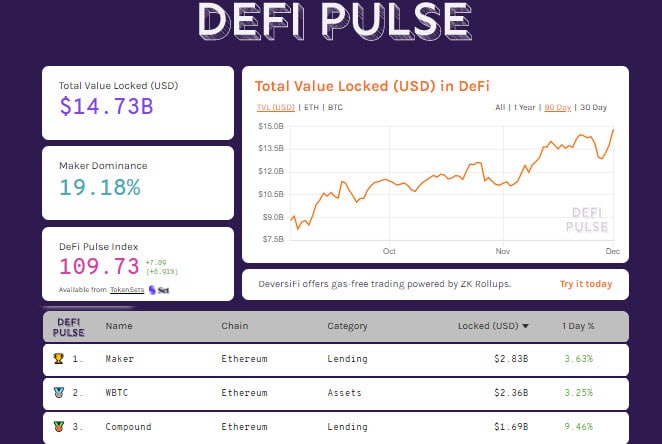

DeFi benefits from this, with TVL updating the absolute historical record with 14.7 billion dollars locked. The Ethereum exiting from decentralized protocols slows down the haemorrhage of the last month. 6.6 million Ethereum remain locked, while tokenized Bitcoin remain above 166,000 units.

Maker rises to over 2.8 billion, the highest peak ever. Maker is confirmed as the leading protocol among decentralized finance projects. WBTC and Compound follow.

Bitcoin (BTC)

Bitcoin now records an increase that confirms the trend initiated by the relative lows of mid-October and that until now has found a critical point at the end of last week when there has been a prevalence of profit-taking after the jump in quotations to $19,300. Profit-taking that was absorbed during the weekend and yesterday, when prices updated to the highs of the last three years.

It is a delicate phase because it will be necessary to have the confirmations that the rise of these hours finds the support from new purchases necessary to validate the movement that has been formed in the last 12 hours. At the moment there are no signs of danger except that the current rise is not supported by real purchases but by short-term covering movements.

There are no signs of danger. The first real alarm signal would come only with a reversal by prices under 17,200 dollars, just above the lows recorded between Thursday and Saturday of last week. A movement below this level could give a signal of weakness in the short and medium-term.

No threatening clouds can be seen in the long term at the moment. The first real sign of danger would only be triggered by a descent below $15,800. A reversal that at this moment would mean a loss of 20%, so there is ample room for movement. In such a bullish and euphoric context it is important to observe the behaviour of prices above $19,000, a level on which Bitcoin has been on for just over a day. It is necessary to confirm the breaking of the $19,000 not only on a technical basis but also as a temporal aspect. With the rise of the last few hours Bitcoin confirms the closure of the previous monthly cycle. The new monthly cycle will close the bi-monthly cycle started from the lows of mid-October.

Ethereum (ETH)

The rise in the last few hours brings Ethereum back to test the $620, a record of the last two years, set on November 24th. For Ethereum, being at a crucial time for the development of the project, it will have to find technical confirmation.

Ethereum has structured a more solid bullish trend, due to a rise that has not seen any particular vertical movements, except that of last week, generated from November 20th, and that has seen the peak with the highs of November 24th, leading prices to rise by more than 30%. It was the most intense movement for Ethereum in such a long period of time.

For Ethereum like for Bitcoin at the moment, it is necessary to establish and consolidate the bullish movement of these hours.

Alert signals would only come with declines to 480 dollars, which coincide with last Thursday’s relative lows.