The day sees the red sign prevail with Bitcoin returning to test the $18,000 support.

This is a trend that is the opposite of yesterday, when the day had started in a negative way and then reversed.

In most cases, even for Bitcoin, Ethereum and Ripple, daily closures were recorded above parity. Today, however, the trend does not seem to be repeating itself.

This weakness was already quite pronounced during the first part of the day and continued in the afternoon, despite the community’s expectation of a pronouncement from ECB President Christine Lagarde, who confirmed the European Central Bank’s PEPP purchasing incentives that support the purchase of bonds from countries that are suffering negative consequences, particularly due to Covid-19.

The confirmation of the European stimulus plan will have an impact on inflation. Lagarde concluded by saying that it will continue also because the closing of the last quarter of 2020 is expected to fall.

This is evidence of the confirmation of what is happening in the economic sphere, and that it will affect central banks and the inflation of the fiat currency, in particular the euro.

Lagarde’s words strengthen the euro/dollar exchange rate with the European currency, which is gaining more than 0.5% on a daily basis and is back to the highs of the last two years above 1.21 euros.

Cryptocurrencies in negative

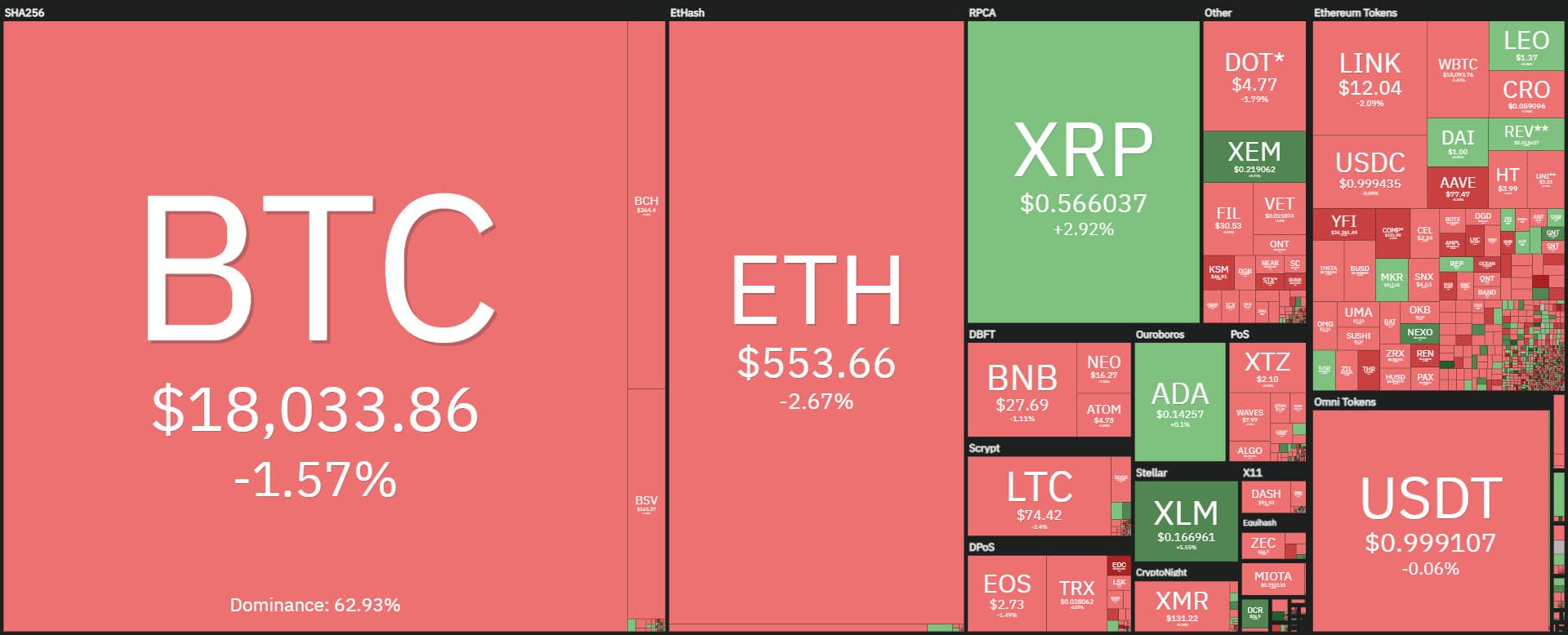

The day is characterized by the negative sign for more than 85% of cryptocurrencies under parity, a feature that is also highlighted on a weekly basis.

Among the first 20 positive balances since last Thursday, only those of Monero (XMR) and Nem (XEM) are able to confirm a positive balance on a weekly basis.

Today, scrolling through the top 20, only Stellar (XLM) and Nem (XEM) are in clear countertrend with increases of over 5% for both. Ripple (XRP) is also in contrast to the trend with an increase of 2.5%.

Bitcoin is weak and in the last few hours, it is back to testing the $18,000 threshold. The loss from the tops at the beginning of December widens, with a drop of 10% resulting in a loss of about $3,000 from the records close to $20,000.

This weighs on the rest of the industry as always. Ethereum is testing the $550, minimum levels since the beginning of December.

Ripple is going against the trend, with a recovery of the 56 cents, after yesterday’s sinking when it tested the 50 cents. This has an impact because these are the last hours in which XRP owners will benefit from the snapshot that between March and June next year will see the airdrop of Spark (FLR) tokens that will reward Ripple owners who will benefit from decentralized finance.

Market cap and DeFi decreasing

The market cap slips again below $535 billion in a context where, despite the difficulty and the 10% drop from the top at the beginning of December, Bitcoin continues to confirm its market share around 63%. Ethereum remains at the levels of the last few days, far from the top levels of mid-September, at 12%. Ripple, on the other hand, gains a few decimals and returns above 4.8% market share.

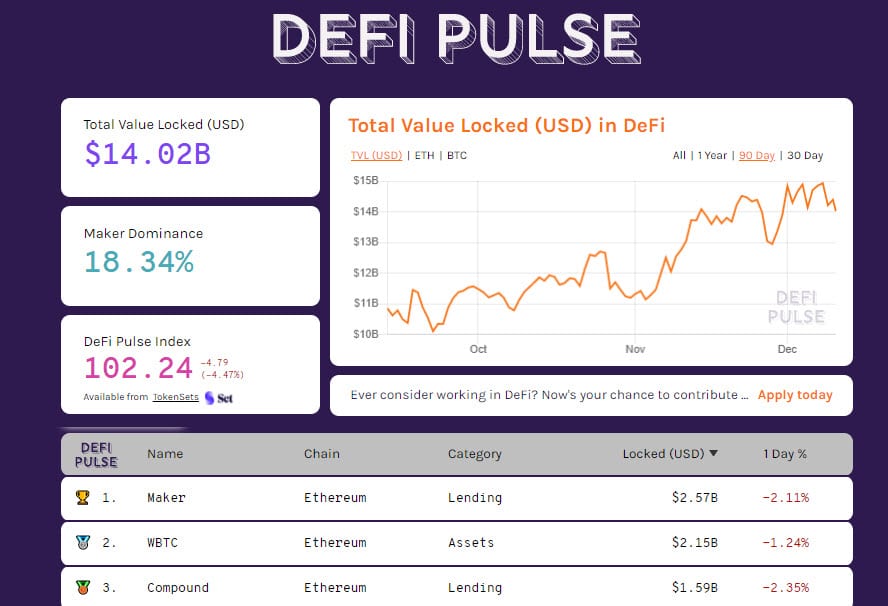

DeFi sees the TVL slide to $14 billion, selling more than 900 million dollars from the top recorded last December 8th. This is not due to the exit from the blocked tokens but depends on the value. In fact, the ETH locked on the decentralized protocol is growing, but Ethereum is losing value and this affects the total value locked. There are still over 162,000 BTC locked on DeFi protocols.

Maker remains Leader followed by WBTC and Compound.

Bitcoin (BTC) testing dynamic support

Dangerously, the price of BTC is testing the first real dynamic support, the bullish trendline that combines the rising lows that have supported the rise since mid-October. The test of the 18,000 in addition to being a psychological area in this context is also a dynamic support.

It is necessary in the next few hours and days to find an area where to return to attract the purchasing volumes. The first clues arrived yesterday but today’s trend seems to cancel what happened yesterday. In a medium-term perspective, the breaking of the $18,000 would be a first static support in an area of 17,500 where protection by operators is growing with an increase of put positions.

Ethereum (ETH)

Ethereum replicates Bitcoin’s performance with a return in the $550 area and a decrease that from the December tops, when it reached over $635, is over 13% loss of value.

Nothing to worry about since the bullish structure of Ethereum at the moment allows a wide margin of movement without affecting the bullish trend of the last three months.

It is always good to monitor slippages below current levels. The first real level of support and alert is in the $490 area, about $60 away from current levels.

As for Bitcoin, it is necessary to observe the trend of the next days where prices will build a base from which to start again.