Bitcoin has crossed the 20000 dollar mark. After an early part of the day where relative uncertainty prevailed with the top 100 cryptocurrencies divided into 50% positive and 50% below par, the only positive signals came from Bitcoin which managed to breach the threshold of $19,500 after several attempts in recent days that had rejected the crossing of this level and with a price that then headed to 19,800 going to attack the record of $19,950 set on December 1st. The break of $19,955 occurred at 2.45 PM CET.

It’s a break that triggered a rush to cover positions of the daredevils who remained set to the downside and who had entered automatic closures even above the psychological threshold of $20,000 that then ran in the following minutes to touch $20,800.

Bitcoin’s rise, as is usually the case, dragged the rest of the sector with 80% above par.

Bitcoin is among the best of the day with a 6% gain. Ethereum follows with +5%. Ethereum, after uncertainty in the morning, broke the $600 mark in conjunction with Bitcoin’s all-time high at $20,800, testing $630, just a step away from the previous record of the last two and a half years at $635.

Ripple also benefited as it broke through the 44 cents support in the early part of the day, the lowest level since November 23rd, with a bearish movement of over 43% from the top of November 24th ($0.78). The general positive context brings the price of Ripple back above 52 cents, turning around a day that saw it in clear negative territory with losses of 5%. With the rise of these hours, Ripple is now up 4%.

Among the big 20, the only two negative signs are Monero (XMR) which is fluctuating around parity and NEM (XEM) which is around -1%.

The best of the day among the big names is Bitcoin +6%, but if we expand the analysis to the top 100, UMA stands out, +23%, followed by Bancor (BNT) which is close to +20%. Bancor has almost doubled its price in three days.

Crypto market cap and DeFi record

The rise to the top has led the crypto market cap to set new records for total capitalization in 2020 above $594 billion. This is the highest peak that has not been recorded since January 15th, 2018.

The rise consolidates Bitcoin’s dominance over 64% while instead Ethereum maintains the month’s levels at 11.9%. Ripple’s collapse in recent days brings its market share back below 4%, its lowest level in the last month.

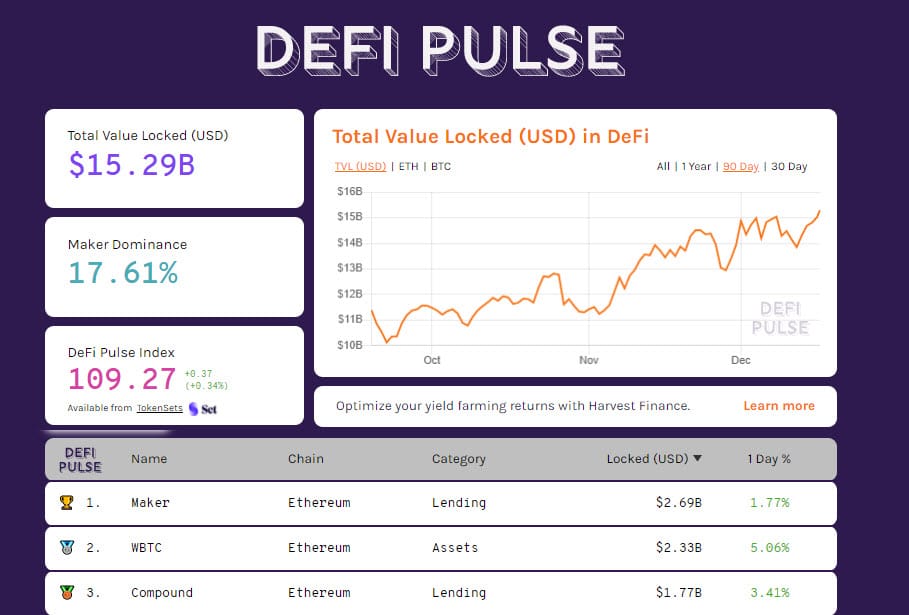

DeFi benefits from this strong bullish movement in Ethereum and Bitcoin. The TVL goes beyond $15.3 billion, an all-time record for DeFi as well.

Maker maintains its leadership with around $2.7 billion, followed by WBTC. Compound is in third place, overtaking Aave with whom it is engaged in a head-to-head battle.

Bitcoin (BTC) at 20000 dollars, this time it’s a record

The break of the previous record high of $19,595 sent prices into an intraday rally that jumped more than 3% in an hour. It’s a leap that if it were to continue and consolidate above $20,000 would mark Bitcoin’s first historic day with it closing above $20,000 for the first time in its history. Bitcoin needs to consolidate the move by the end of the day.

This breakout chases away the bearish clouds that over the weekend had brought Bitcoin back to test the $17,500 mark, with fears of a possible downward movement in the most sensitive phase of the year, as always happens in December.

This time around, it seems that mid-December remains an important date for Bitcoin. The last two years have been crucial bearish dates while December 17th, 2017 had marked a three-year record high. In 2018 and 2019 Bitcoin had set two very important downside records. 2020 continues the tradition that sees mid-December major movements for better or worse.

We will have to wait until the close of the day to see if Bitcoin will close above $20,000 for the first time. It is also important to wait for the evolution of tomorrow to see if there will be confirmation of the break of the psychological threshold at $20,000. At the moment the bearish clouds have cleared and would only come back with the return of prices to $19,500, a threshold that in previous days had rejected every possibility of a bullish attack. It is a break that also occurred with very important volumes that so far in 3/4 of the day exceed the volumes recorded in the last week and that heralds new records for Bitcoin.

This happens because the breaking of the new all-time high is an important signal that usually also attracts a lot of speculation and a lot of movements even with regard to intraday movements.

Today’s rise that pushes to the new record also sweeps away all the discussions that for three years saw indecisions in establishing whether Bitcoin had more or less broken the 20000 dollar record on December 17th, 2017. That price in fact was set on the CME and some spot markets, while for some exchanges such as Bitfinex and Bitstamp, by a few tens of dollars Bitcoin remained at $19,900. This indecision over breaking the $20,000 mark is swept away by today’s move, ending a discussion that has lasted three years.

Ethereum (ETH)

After faltering earlier in the day as it struggled to break the $600 mark, Bitcoin’s record-breaking move has dragged the entire sector behind it. Ethereum is also within striking distance of the December 1st record at $636. For Ethereum, the structure continues to consolidate in the medium and short term.

The only sign of concern would only come with a major break below $550, which coincides with the levels last seen a week ago.

It is necessary for ETH to wait for tomorrow’s developments to see if there is enough juice to establish the record of the last two and a half years above $636.