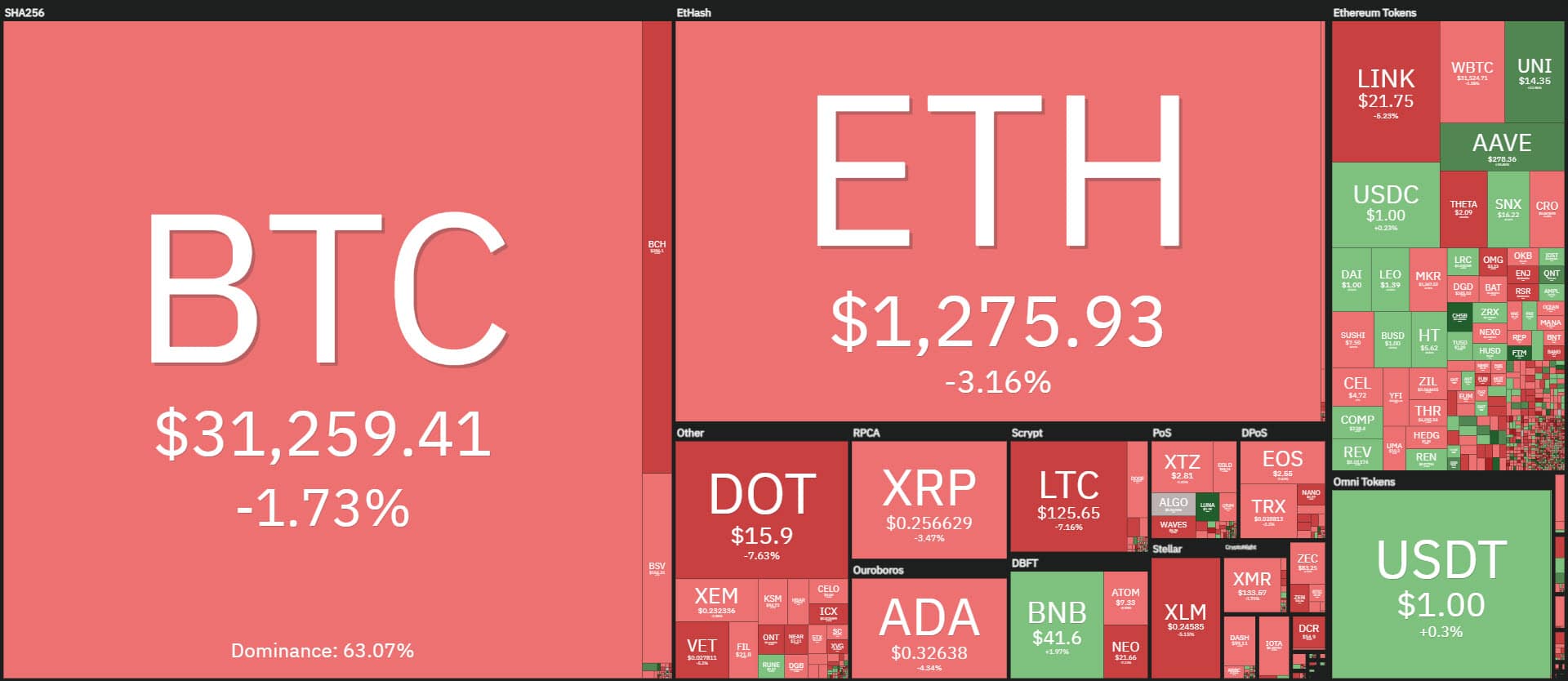

The fourth day of ups and downs, with volumes of Ethereum still outpacing those of Bitcoin. Unlike yesterday, today the red sign prevails with over 70% of cryptocurrencies in negative territory.

Among the big names, Uniswap (UNI) continues to impress today, recording another double-digit rise (+13%). Uniswap’s prices have been at all-time highs since yesterday, attempting to break through the psychological level of $14.5.

Among the big names, the other crypto assets rising are Aave, which is up 5%, and Binance Coin (BNB) which manages to stay just above par.

The day is also particularly euphoric for tokens in the decentralized finance ecosystem. Also on the rise are 0x (ZRX), Compound (COMP), Matic Network (MATIC), Loopring (LRC) and Synthetix (SNX), all up over 3%.

Volumes, the flippening of Ethereum

The day’s red sentiment has affected the market cap, which is back below $925 billion.

Volumes continue to contract. The rare event is the flippening of Ethereum volumes against those of Bitcoin, for the third consecutive day. Total volumes on Ethereum are close to $7 billion, a difference of over $200 million between ETH and BTC. This highlights the study period after the strong rises of recent weeks.

Bitcoin’s dominance gains slightly, back above 63%, with Ethereum consolidating its market share records of the past 30 months, above 16%.

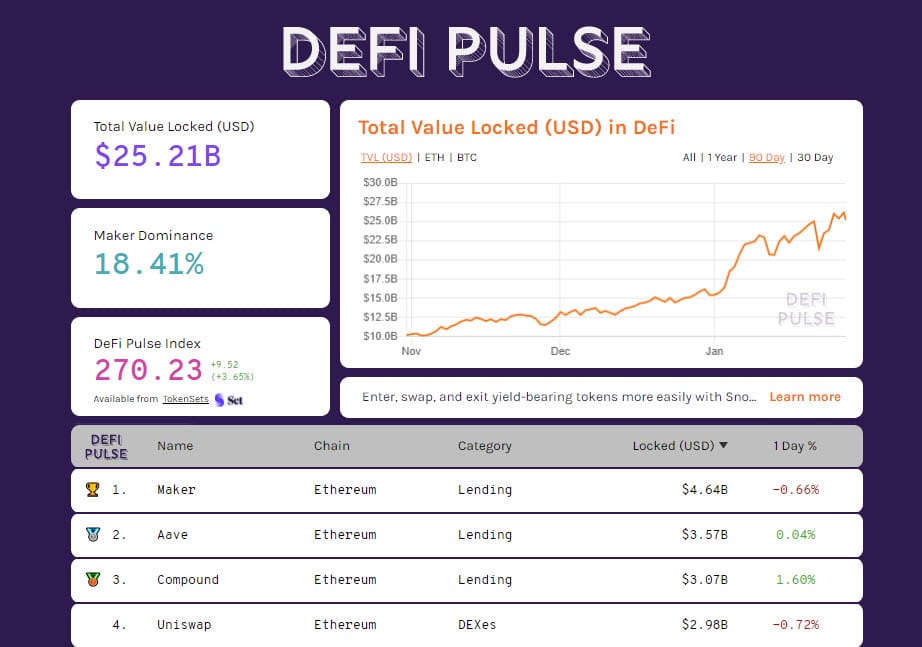

Total value locked on DeFi protocols remains at the highs of recent hours, above $25 billion total. The number of tokenized bitcoin continues to increase and today exceeds the 44,000 BTC mark, the highest level since December 15th.

Maker maintains the lead with over 4.6 billion in dollar value, followed by Aave and Compound.

Bitcoin (BTC)

Bitcoin continues to remain caged in the range that has characterized the fluctuations for about 7 days. After the high volatility of the past few days, traders are relaxing. The same indications remain valid, waiting for the upward or downward break of the side channel.

Ethereum (ETH)

Ethereum, after having reached all-time highs, 48 hours later sees profit-taking continue to prevail, which does not disturb the trend, remaining solidly set to the upside.

Prices are in the 1,300 dollar area. For Ethereum too, the indications already written in the last days remain valid.