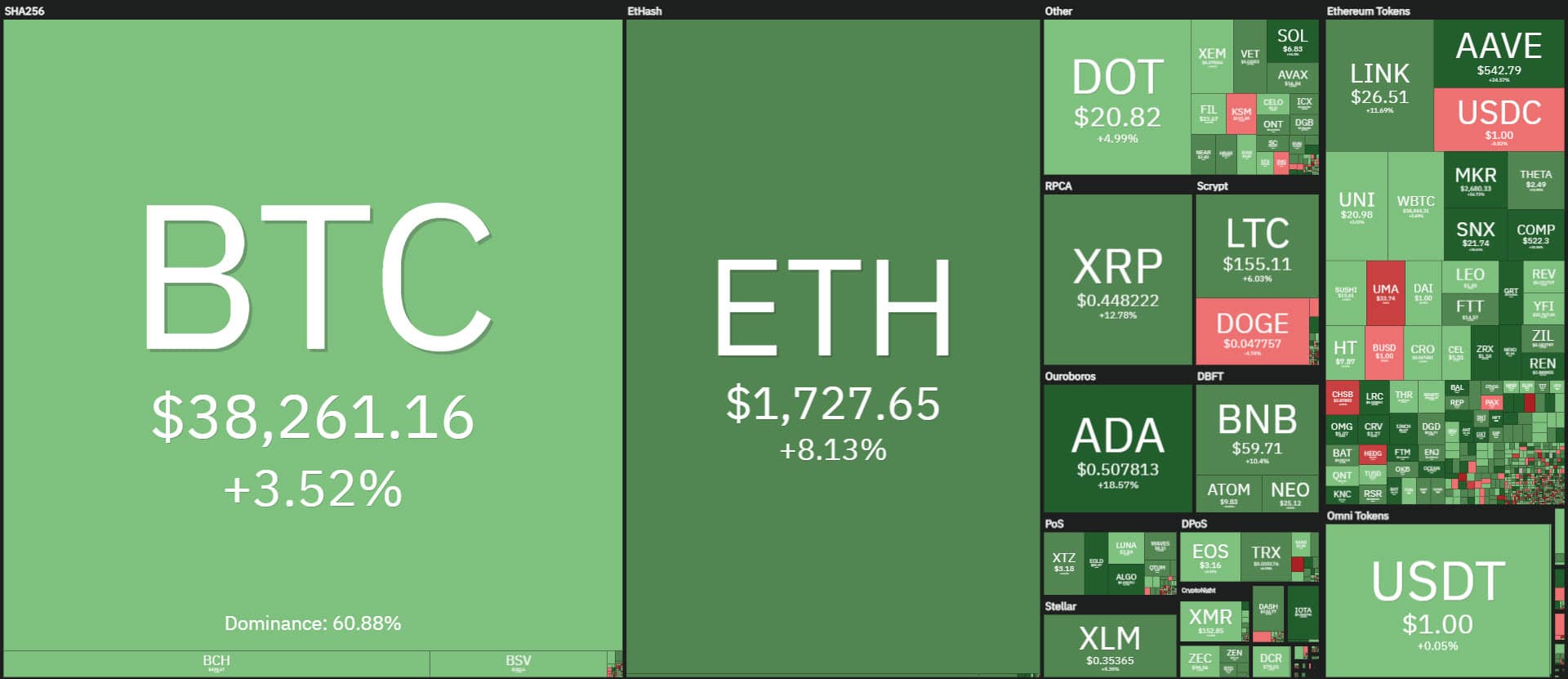

After breaking the absolute all-time highs of January 2018, Ethereum continues to charge forward and set new absolute all-time highs for the 4th consecutive day.

In these hours, ETH prices rise above $1,730 recording one of the best rises of the day, a rise that drags behind all the altcoins.

It has been an explosive week for Ethereum and the altcoin sector. After the early part of the year when Bitcoin emerged and attracted a lot of attention, the month of February has seen the redemption of altcoins, especially Ethereum.

Today, over 85% of the top 100 are above par.

Among the top 10, Cardano (ADA) has performed very well, almost +20% and Ripple (XRP), which after sinking over the last few days following the strong rise that had characterized its prices over the weekend, closed with one of the best weekly rises and a gain of 50%.

XRP, unlike Bitcoin and ETH, is definitely far from the historical records of 2018 when its quotations exceeded $3, 10 times higher than current quotations.

Today’s rises push the total market cap to over $1.170 billion, an all-time record in terms of capitalization. Bitcoin retreats to 60% of the market share, its lowest level in 3 months.

In contrast, Ethereum’s gains saw its market share rise to 17%. XRP remains unchanged at 1.7%, levels from where it has fluctuated since early February.

With today’s rise, XRP once again managed to overtake Polkadot (DOT) and regain 3rd place in the overall ranking.

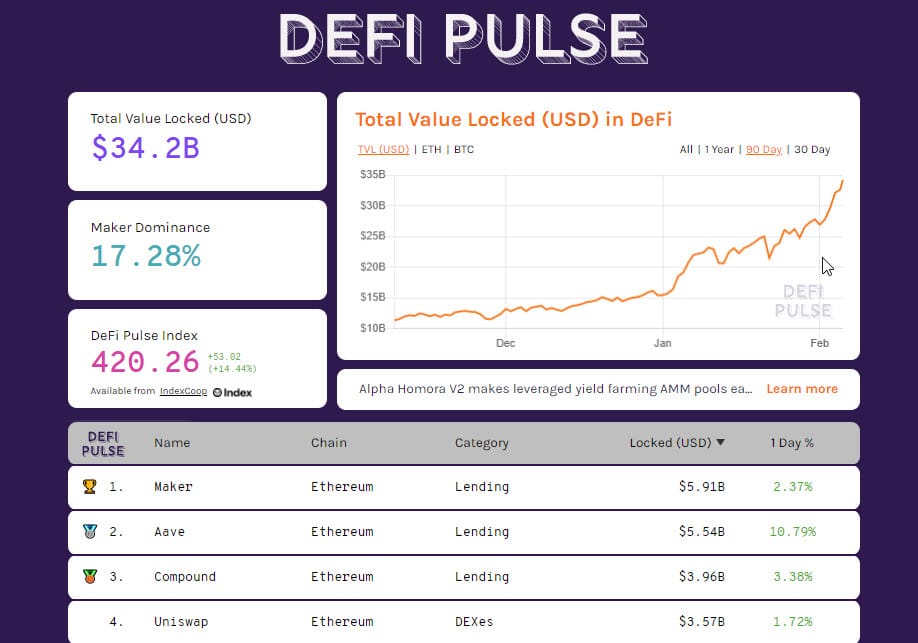

DeFi is also at an all-time high, with its main project, Maker, up more than $34 billion in TVL and close to $6 billion. Strong rise also for Aave‘s TVL, which flies from $4 billion to over $5.5 billion in just a few hours.

These are all-time highs for the platform, which has established itself as one of the leading projects in decentralized finance, particularly for lending and financing. In third place, there is Compound with $3.9 billion.

Uniswap is in fourth place, the first DEX to establish itself as a leader in trading operations with 50% of total cryptocurrency trading.

Summary

Bitcoin (BTC) targets $40,000

Bitcoin is back above $38,000, a threshold that is technically not particularly relevant as the real resistance level is $39,000 which corresponds to 75% of the Fibonacci retracement, taking as reference the highs of early February and the double low of late January. This will be the level to monitor over the weekend.

If the resistance is exceeded accompanied by volumes, the first target will be the psychological area of 40,000 and then the historical record of January 8th, just a step away from 42,000 dollars.

The trend continues to be set to the upside even in the short term. The first warning signal for short-term intraday volatility would only come with prices below $35,000.

Ethereum (ETH), another record high

Ethereum continues to climb into uncharted territory with unprecedented levels above $1,700. At the moment, there are no bearish signals even from an intraday perspective. ETH has ample room for manoeuvre even for bearish speculation up to 1,400 dollars, meaning 300 dollars down from current levels without affecting the short-term uptrend.

There is ample room for manoeuvre also with regard to the medium-term with danger levels decidedly distant, therefore ETH remains at this moment in a phase where there are no dangers even, although it is always better to use caution especially for short-term operations and in a bullish phase such as the current one. ETH has gained over 30% since Monday’s levels.